So much for an early thaw.

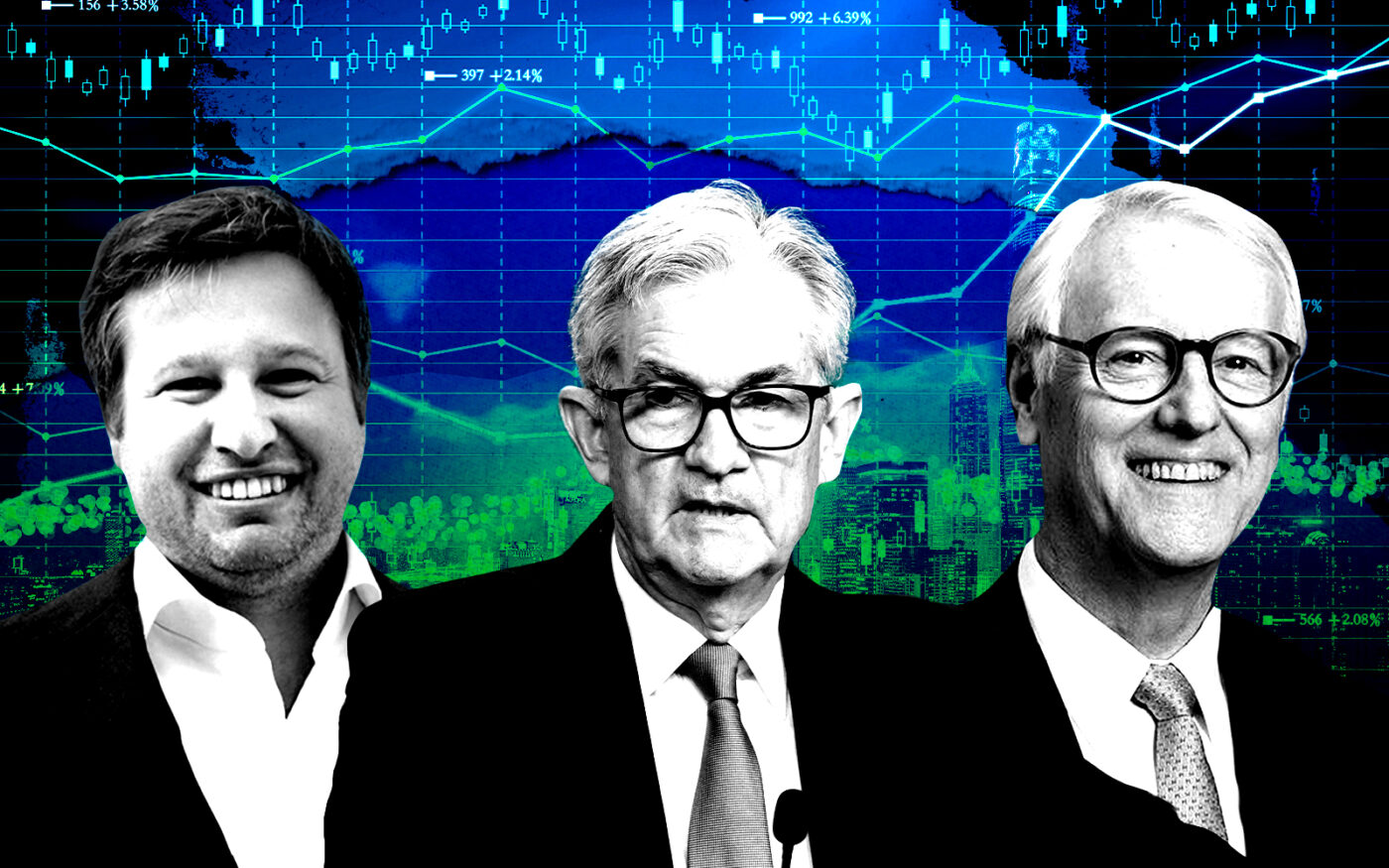

Interest rates are headed up, possibly at a faster rate and in higher amounts than previously expected, Federal Reserve Chairman Jerome Powell signaled Tuesday.

Comments by the policymaker left open the possibility of a 0.5 percent increase in the federal funds rate later this month. Such an increase — double what was previously expected — would affect broad swaths of the economy, including driving up borrowing rates for homebuyers and commercial real estate investors.

“The Fed is killing us,” said Steven James, CEO of Berkshire Hathaway HomeServices New York Properties. James had hoped for low-six or even sub-six percent mortgage rates going into the springtime selling season. “Clearly that is not going to happen,” he said. As of last week, the average 30-year fixed mortgage rate was 6.65 percent, according to Freddie Mac.

James was not the only real estate professional to take the news with consternation.

“It’s going to be rocky for a while,” said Greg Heym, chief economist at Brown Harris Stevens.

“People shouldn’t worry about a 7 percent mortgage,” Heym added, noting that current rates are similar to those at the peak of the housing bubble in 2007. “But 8 percent is a different story.”

Higher rates will hit first time buyers the hardest, said James, because competing with all-cash buyers will be nearly impossible. But they won’t be the only ones affected.

Lower transaction volumes, resulting from higher home prices due to higher borrowing rates, will hurt “all industry participants,” said Brown Harris Stevens agent Ari Harkov. “Not just brokers but lenders, attorneys, movers, furniture companies, contractors, painters, stagers and everyone who participates in the home buying and selling process.”

Sellers working with a more limited pool of potential buyers have also lost a key alternative as rents have begun to slip across the country.

“It used to be a no-brainer to rent your home instead of selling,” said Heym. “That’s no longer the case.”

In commercial real estate, last year’s rate hikes coincided with a steep decline in investment sales that has major brokerages joining their residential counterparts in aggressively cutting costs. For commercial landlords, a much more challenging financing environment could lead to a wave of distress as billions of dollars in loans secured by commercial properties come due this year.

More expensive to buy and borrow also means more expensive to build.

“For developers, higher borrowing rates will add, and have already added, pressure to make the numbers on deals work,” said Andrew Steiker-Epstein, a former Compass and Corcoran agent who now heads sales at developer Charney Companies. “Additionally, lenders may be more reluctant to take on more leverage resulting in more out of pocket capital for developers.”

Residential brokerages will need strong relationships with mortgage brokers, James said, in order to help buyers find financing and calm those faced with perplexing instruments such as financing contingency agreements, which require buyers to forfeit a deposit if they cannot secure a loan.

Low levels of housing inventory, due to decades of underbuilding, may prove the industry’s saving grace by propping up prices. But the threat of runaway inflation — a specter from the 1980s — remains more bitter than the medicine to cure it.

“Higher rates are bad for real estate,” said James, “but probably good for the economy.”