Porch.com gave an early Christmas present to its investors: The home-services startup will start trading on Nasdaq on Dec. 24 after its merger with a blank-check company was finalized.

The deal with Proptech Acquisition Corp. closed Wednesday, after shareholders approved the transaction at a special meeting held virtually on Dec. 21. After the vote, shares of the special-purpose acquisition company closed at $12.68, up 25 percent from July when the Porch deal was announced. At the time, the deal gave the startup an enterprise value of $523 million.

In a statement, Porch said it will receive $322 million in gross proceeds from the IPO. The deal includes a $150 million investment led by Wellington Management.

Steve Cohen’s Point72 Asset Management also invested in the company this month and now holds a 6.4 percent stake, regulatory filings show.

Read more

Founded in 2011, Porch provides software to home-services companies in exchange for data on their customers. Itthen sells other home services to those customers. To date, the Seattle-based startup has raised $120 million from investors including Valor Equity Partners, Lowe’s Cos., Founders Fund and Battery Ventures.

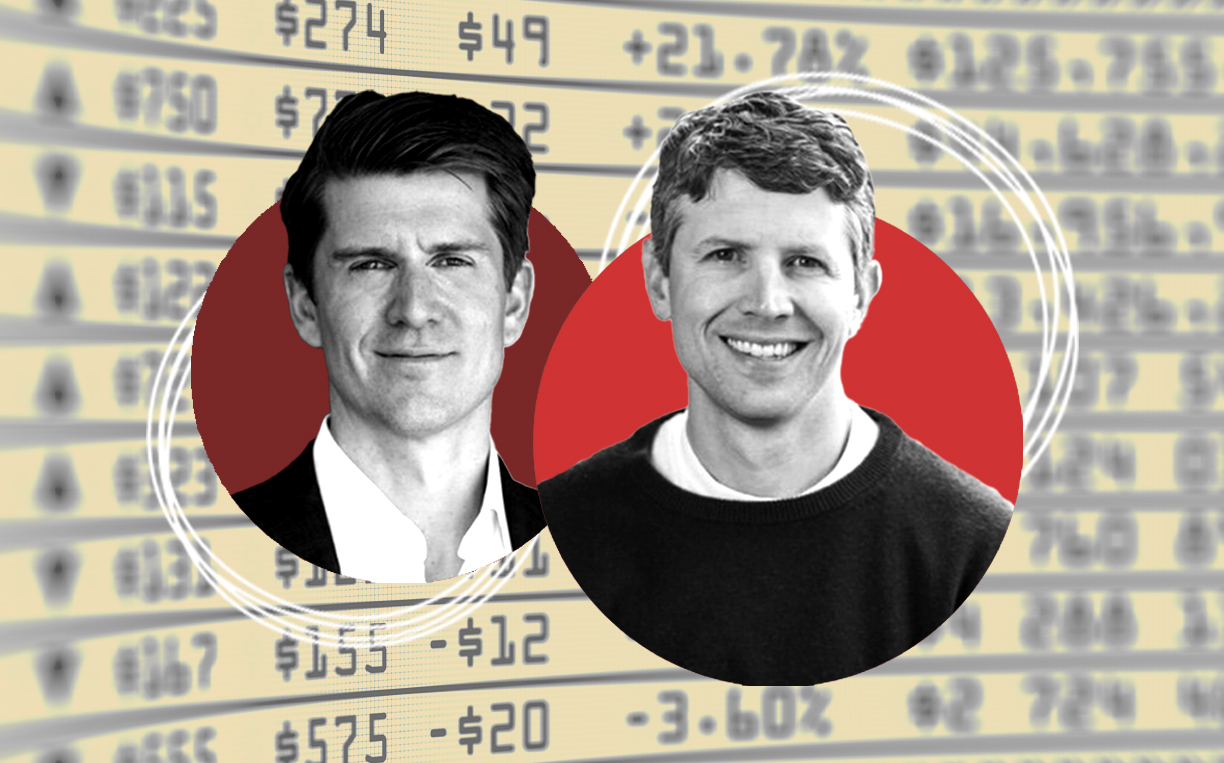

PropTech Acquisition Corp. was formed last year by Abu Dhabi Investment Authority veterans Thomas Hennessey and Joseph Beck. During an investor presentation in July, Hennessey said the SPAC evaluated 300 companies before striking a deal to take Porch public.

A subsequent IPO filing, however, shed light on Porch’s shaky finances.

A report by independent accountants cited recurring losses and raised “substantial doubt” about Porch’s ability to stay in business. The company had $3.8 million in cash as of June 30. It lost $49.9 million in 2018 and $103.3 million in 2019, and projected a $34 million loss in 2020.

Still, CEO Matt Ehrlichman defended the company’s finances in an interview with The Real Deal in October, noting that the SPAC merger would give Porch $200 million in cash and no debt.

“It gives us a significant war chest, which we can use to play offense,” he said. He said Porch became profitable in June with $7 million in EBITDA by holding research and development expenses flat. By growing its core business, Porch hopes to generate up to $500 million in annual revenue in five to seven years.

To get approval for the merger, Ehrlichman struck a deal with Valor, which agreed to approve the transaction in exchange for $9.5 million in shares, according to the IPO filing. Post-IPO, if Valor’s stake is valued at less than $44.2 million, Ehrlichman will make up the difference. He will also pay Valor $4 million in cash.

Ahead of its IPO, Porch also beefed up its C-suite, adding Matt Cullen, a former Expedia executive, as general counsel. It also hired Joshua Steffan, former COO of Home Bay, a home-buying platform, to lead Porch’s home inspection and real estate vertical.

SPAC deals made a huge comeback in 2020, as investors scrambled to capitalize on a strong market for tech stocks. With a week left in the year, SPAC Insider counted 247 SPAC IPOs in 2020, up from 59 in 2019.

One was Opendoor, the SoftBank-backed instant home-buyer, which began trading Monday after merging with Chamath Palihapitiya’s blank-check firm. Opendoor’s valuation tripled to $18 billion after the deal closed.