Online lender Social Finance, or SoFi, is the latest SoftBank-backed startup to eye a public offering through a blank-check company.

The San Francisco-based company has held talks with several special purpose acquisition companies about an IPO, reported CNBC. SoFi did not comment.

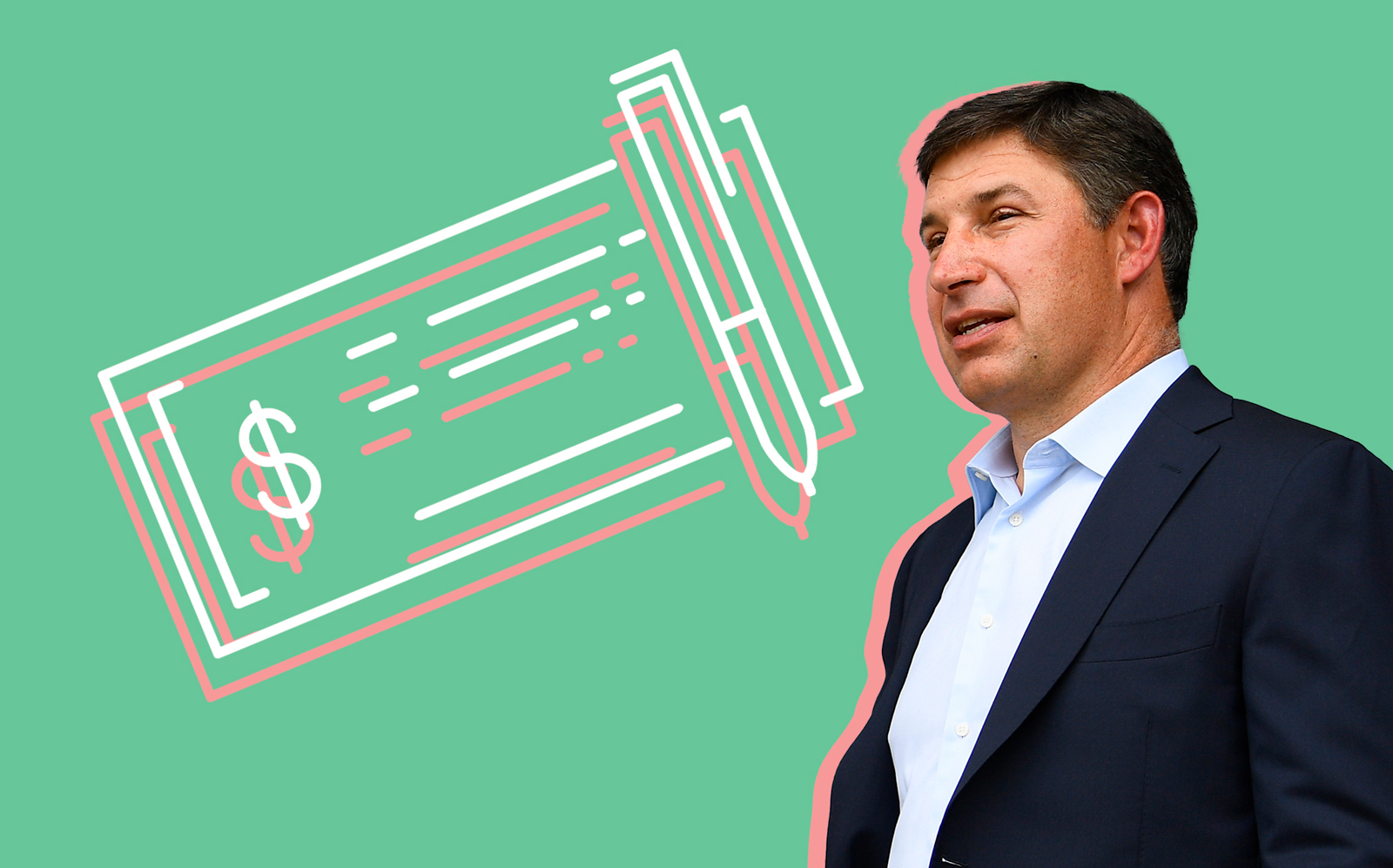

CEO Anthony Noto, a former Goldman Sachs banker, has previously said that going public is a goal. SoftBank’s Masayoshi Son has publicly said he expects several of the Vision Fund’s investments to go public in the next year.

Read more

SoFi appears to be capitalizing on a hot IPO market, fueled in part by special purpose acquisition companies. United Wholesale Mortgage and Finance of America are two lenders going public through SPACs. Some 208 blank-check companies have raised $70 billion so far this year, according to SPAC Research.

Rocket Companies, the parent company of Rocket Mortgage and Quicken Loans, also went public in August. On Wednesday, the stock closed just over $21 pr share, up from its IPO price of $18.

This year, SoftBank-backed insurance startup Lemonade went public, as did Beike Zhaofang, a Chinese real estate platform. iBuyer Opendoor and View, a smart-glass maker, are planning SPAC IPOs. Compass recently hired bankers ahead of a potential IPO next year.

Founded in 2011, SoFi found a niche after the 2008 financial crisis when many banks pulled back on consumer lending. It has raised $3 billion from investors including SoftBank, which provided $1 billion in 2015.

The company was most recently valued at $4.3 billion, after raising $500 million from the private equity firm Silver Lake in 2017. Last year, it raised $500 million at the same valuation from the Qatar Investment Authority.

[CNBC] — E.B. Solomont