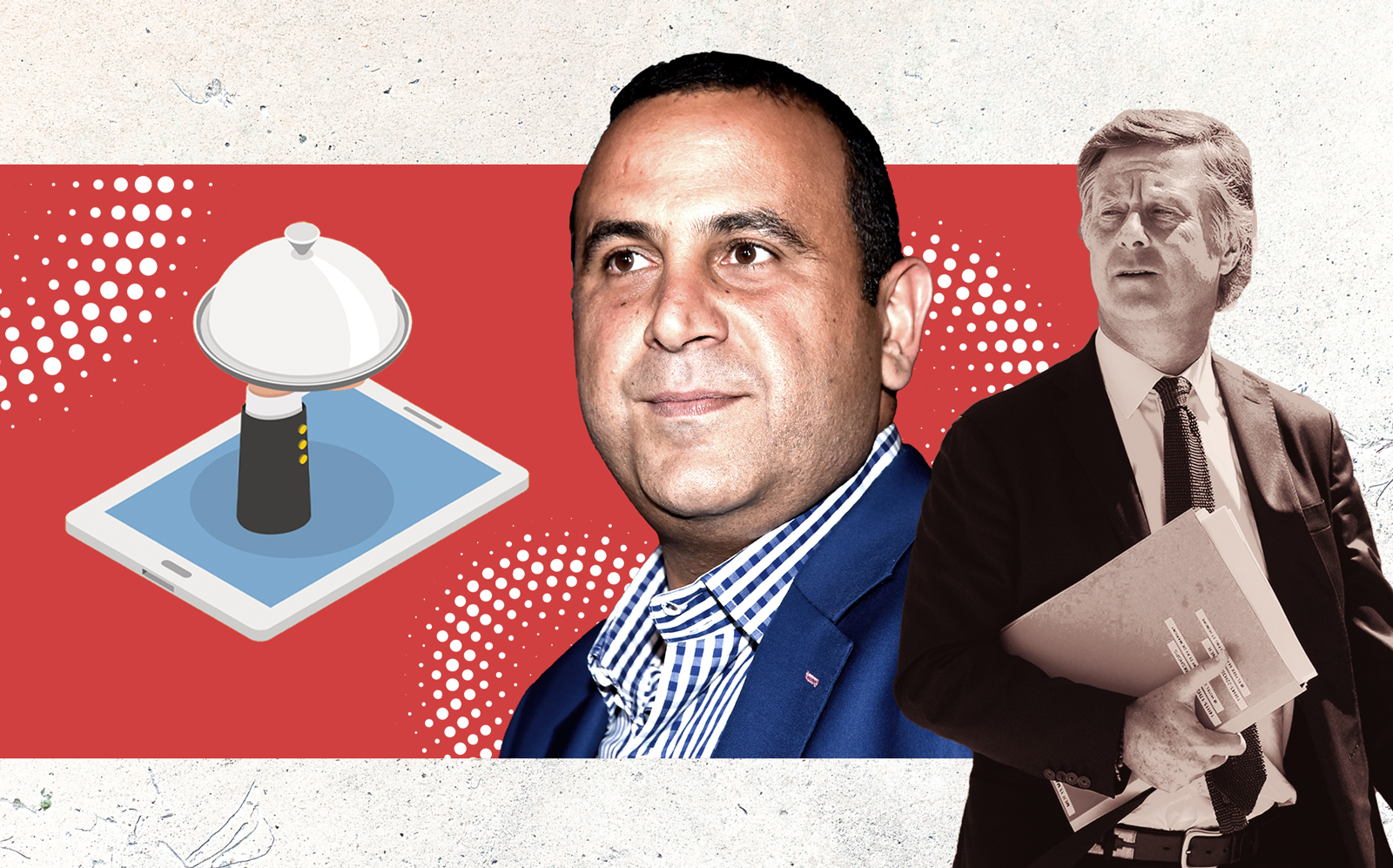

UPDATED, Nov. 24, 4:56 p.m.: As a rising star of the Los Angeles club scene in the early aughts, Sam Nazarian helped create the hotel-as-party-spot with properties like his SLS in Beverly Hills and Miami. He teamed up with A-list designers like Philippe Starck and took the mantle of boutique-hotel impresario from Ian Schrager when he bought the Studio 54 co-founder’s Morgan Hotels group in 2016.

Now, Nazarian is cashing out of his hotels business to focus on the latest trend: ghost kitchens and digital restaurant brands.

Nazarian on Tuesday closed a deal to sell his remaining 50-percent stake in SBE Entertainment’s hotel brands to the French hospitality company Accor, he told The Real Deal. At the same time, Nazarian said he was increasing his ownership of SBE’s restaurant and virtual kitchens business. The cash-and-asset-swap deal values all the different lines of business at $850 million.

The hospitality mogul is moving out of hotels at a time when the pandemic has slammed the lodging industry, and as digital kitchens are proving to be a lucrative area of growth.

Accor, which bought half of SBE in 2018, had planned to purchase Nazarian’s remaining 50-percent stake in the hotel operating business in 2022. But SBE, which includes brands such as the Mondrian, SLS, Hyde and Delano hotels, expanded quicker over the past two years than the sides had originally expected so they decided to speed up the acquisition.

“The business has grown at a pace much faster than anticipated. We basically doubled the pipeline,” Nazarian said.

Through the transaction, Accor bought the operating companies for luxury hotel brands as well as the majority of SBE’s restaurants and nightlife brands, which include clubs like the Mediterranean eatery Cleo and Italian steakhouse Carna by Dario Cecchini. Accor is retiring SBE’s corporate debt, and the deal values the company at $650 million. Accor also plans to launch its own lifestyle platform.

Accor CEO Sébastien Bazin said in a statement that the transaction will accelerate growth with a “leaner management structure.” The company is Europe’s largest hotel operator.

In a separate deal, SBE sold the real estate for the Hudson Hotel in Manhattan and the Delano Hotel in South Beach Greenwich, Connecticut-based Eldridge, for an undisclosed amount. The deal was announced Tuesday.

For his part, Nazarian is taking full ownership of SBE’s food and beverage business and increasing his stake in C3 — the platform that owns eateries like Umami Burger and Sam’s Crispy Chicken. The company, which includes mall owner Simon Property Group as an investor, is on track to open 200 digital kitchens by the end of the year. The transaction with Accor values those businesses at $200 million.

Nazarian will stay on as an adviser to Bazin for the next three years, at which point he’ll say goodbye to the line of business that evolved out of his time in the early 2000s when he quickly gained a reputation as Los Angeles’ nightclub king.

He expanded into hotels with the SLS Beverly Hills in 2009. Around 2015, he flirted with the idea of taking the company public through talks to acquire the publicly traded Morgans Hotel Group, the influential company founded in the 1980s by nightclub impresarios Schrager and Steve Rubell. The negotiations culminated in 2016 with SBE taking Morgans private in a deal valuing the company at $805 million. It gave SBE 22 hotels with 7,000 rooms.

Nazarian is now focusing on his digital kitchen business. He recently opened a culinary incubator at Manhattan West.