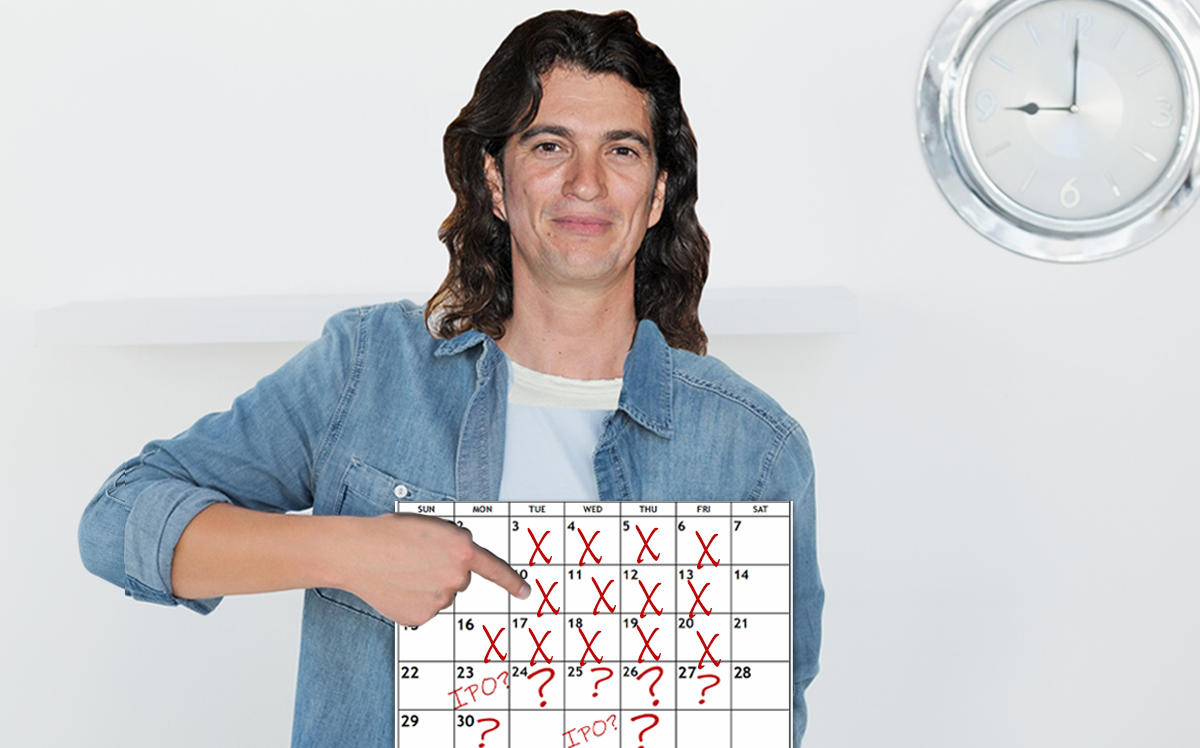

WeWork’s parent company is reportedly planning to postpone its initial public offering following weeks of scrutiny over the co-working firm’s valuation and corporate structure.

Sources told the Wall Street Journal that the IPO roadshow would be put on hold until at least mid-October, following the Jewish High Holidays, despite earlier reports that WeWork’s IPO roadshow would kick off as early as this week.

WeWork’s co-founder and CEO Adam Neumann has been under significant pressure since the company’s IPO prospectus was filed in August. The filing revealed $47 billion in U.S. landlord commitments over 15 years and just $4 billion in committed revenue, as well as huge personal loans issued by the company to Neumann and other executives.

The company faced further criticism over revelations that its board was entirely male, and that Neumann was paid $5.9 million to sell the rights of the word “We” to WeWork. Nuemann later returned the payment and appointed a female board member.

Last week, Neumann reduced the power of his voting rights to 10 votes per share from 20. And although he still has voting control, the board can now remove him as CEO. The change in corporate governance last week also limited Neumann’s ability to sell stock in the three years that followed the IPO.

WeWork planned to raise at least $3 billion in its IPO on the Nasdaq Stock Exchange, but rumors swirled last week that limited investor appetite could see a valuation fall below $20 billion.

WeWork’s largest outside investor, SoftBank, has also urged the company to postpone the offering, pointing to the cool response from investors.

WeWork lost $1.61 billion last year, with revenue totaling about $1.82 billion.

[WSJ] — Sylvia Varnham O’Regan