With a blockbuster regulatory filing this month, WeWork raised more questions about its impending IPO than it answered. Perhaps no stakeholders read the filing more closely than its own landlords.

“There were certain things in that report I would rather have not seen,” Rory Greenberg, a Miami landlord who owns a building entirely occupied by WeWork, said of certain expenditures and loans detailed in the filing, though he would not specify. “Obviously, I’m sure a lot of it can be explained.”

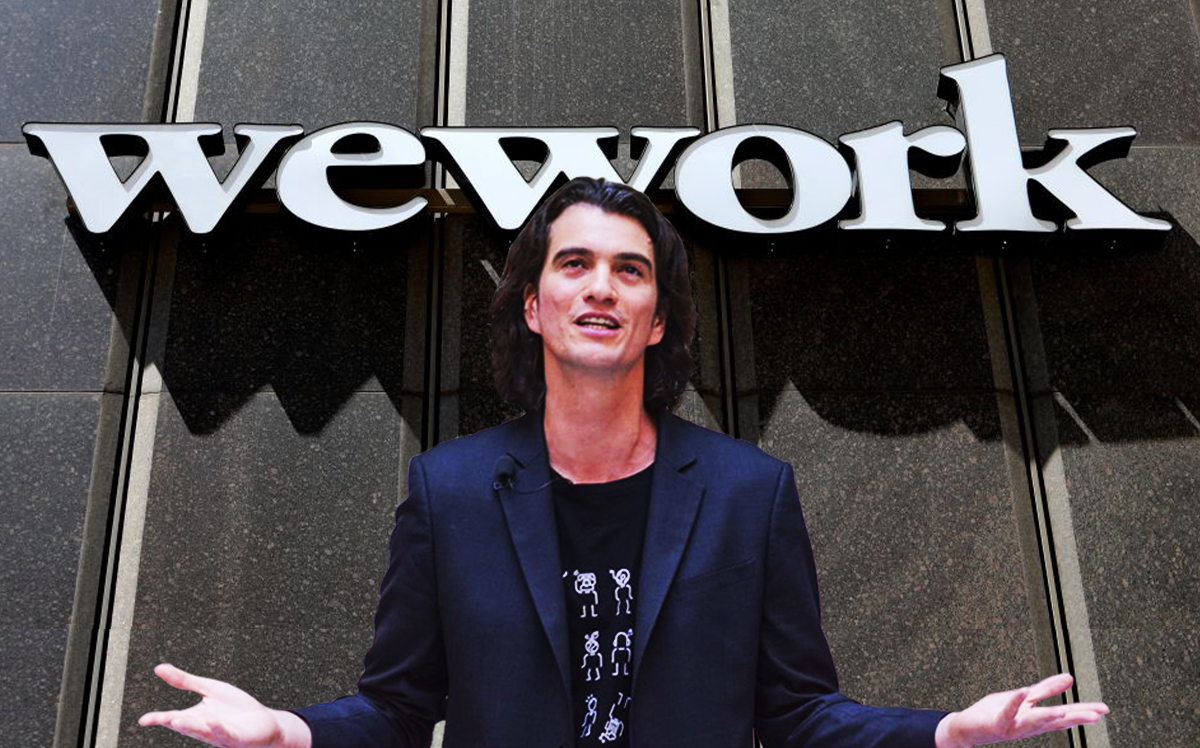

The debate over WeWork’s financial viability has reached a fever pitch, and few have more at stake than the landlords of its 200-plus locations in the U.S. The company received wide criticism for some of its business practices, the scale of its outstanding lease commitments and lack of corporate governance, which led to eye-popping loans to its CEO Adam Neumann and other executives. After the regulatory filing dropped, one Manhattan landlord even sued the company to get out of its lease.

According to its most recent U.S Securities and Exchange Commission filing, known as an S-1, WeWork has committed $47 billion to U.S. landlords over the next 15 years, and plans to raise as much as $6 billion in debt when its IPO launches. (It currently has $2.5 billion in cash, and has acknowledged that it sees no pathway to profitability in the foreseeable future.) WeWork declined to comment for this story.

The Real Deal spoke to multiple landlords across the country to hear first-hand what they think about the S-1.

One institutional landlord, who owns a Manhattan building partially occupied by WeWork, said they are unconcerned by the risk factor attached to the startup, because they took added precautions when signing the lease. One measure involved reducing its tenant improvements — an investment by the landlord to build out a rental space, which is often repaid by rent — and instead asked WeWork to build out its own space.

“They were risky as a startup, and now they’re risky as they chase their IPO,” said the landlord, who requested anonymity because WeWork is a tenant.

The landlord bristled at WeWork’s push to attract enterprise companies, which now make up 40 percent of its members. “They have this enterprise division, and you’ll be chasing a 60,000-square-foot tenant or bigger, [against] WeWork,” the landlord said. “That’s the big difference now.”

But some building owners see considerable upside to WeWork’s IPO. Another New York-based institutional landlord, who is currently negotiating a lease with WeWork in Manhattan and did not wish to be identified, said that an IPO could prove a better deal for landlords because it will provide “better collateral from WeWork than the current state that they are in.”

A Los Angeles landlord, who has multiple WeWork locations, said “there are definitely aspects of WeWork’s business that concerns me.” For example, the landlord said, in a downturn buildings that are underperforming will be more likely to close. About 30 percent of WeWork’s locations are mature, which means occupied for longer than 24 months, according to its S-1 filing.

The LA-based landlord, who has kept WeWork occupancy low, said those with high occupancy rates in their buildings should be more concerned in the event WeWork would downsize.

“I would be concerned for sure if you had a WeWork location that is doing so-so,” the landlord said. “Those are the ones that in a downturn they are going to close.”

A prior analysis by TRD, which focused on WeWork’s New York locations, found that the co-working startup wholly occupies five buildings in the city, and at least 18 buildings have more than 50 percent occupancy.

Major lenders, for their part, are tied to more properties than any one landlord. Bank of America currently has debt tied up in 16 buildings, according to an analysis by real estate data company Reonomy and TRD. It is followed closely by MetLife, Wells Fargo and Citibank.

Wells Fargo, which has provided loans to 12 buildings, said that as a general rule, it will not provide loans to a building that is more than 20 percent occupied by co-working companies.

“We have tried to limit our exposure to co-working and non-credit tenants,” said Mark Myers, Wells Fargo’s head of commercial real estate.

Greenberg, the Miami landlord who is a part-owner of the Security Building, a 96,000-square-foot building where WeWork is the sole tenant, said that he was comfortable signing the lease because WeWork agreed to make its own tenant improvements. He added: “I love the business model.”

He is in discussions with WeWork to lease another building, but said he would not consider the company to entirely fill a location again. Instead, he said he would consider the company as an anchor tenant.

“Not to say anything about the tenant,” he said. “I think it’s just my personal tolerance for risk.”