The head of Deutsche Bank’s investment-banking arm is stepping down in what appears to be the beginning of a major shakeup at the embattled German bank.

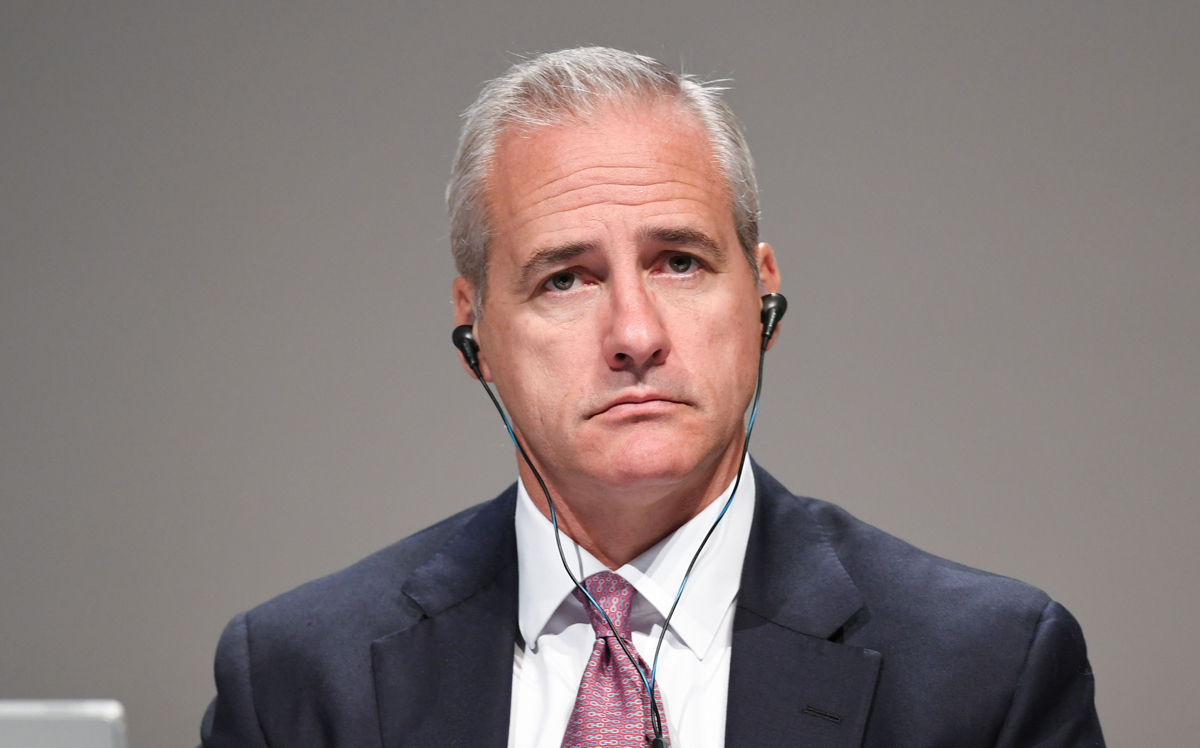

Deutsche Bank announced in a statement Friday that Garth Ritchie will leave the bank at the end of the month, Bloomberg reported.

Ritchie, 51, took over as head of the investment-banking division last year, but during that time he was the subject of criticism. He and another Deutsche board member, chief regulatory officer Sylvie Matherat, got the lowest approval vote at Deutsche Bank’s annual general meeting. German prosecutors had also named Ritchie as one of many suspects in an alleged tax fraud scheme.

The New York Times reported in March that Deutsche used Trump Organization projects to build its investment-banking business. The bank is now the subject of two congressional investigations and the New York attorney general for loans issued to the Trump Organization.

Deutsche chairman Paul Achleitner said in a statement released Friday that Ritchie helped “Deutsche Bank to weather an extremely challenging period and we wish him all the best for the future.”

Deutsche Bank CEO Christian Sewing will take over as head of the investment-banking group, according to a bank statement, which added that further leadership changes will “follow in due course.”

The bank is considering laying off as many as 20,000 workers and shuttering entire divisions on Wall Street, the Wall Street Journal reported last week.

Deutsche was the top commercial real estate lender in New York City from October 2016 through September 2017, according to a ranking by The Real Deal. The bank lent $8.84 billion on Big Apple property and construction projects during that time. Wells Fargo, the city’s second-largest lender, issued $7.94 billion in loans during that time. [Bloomberg] — Rich Bockmann