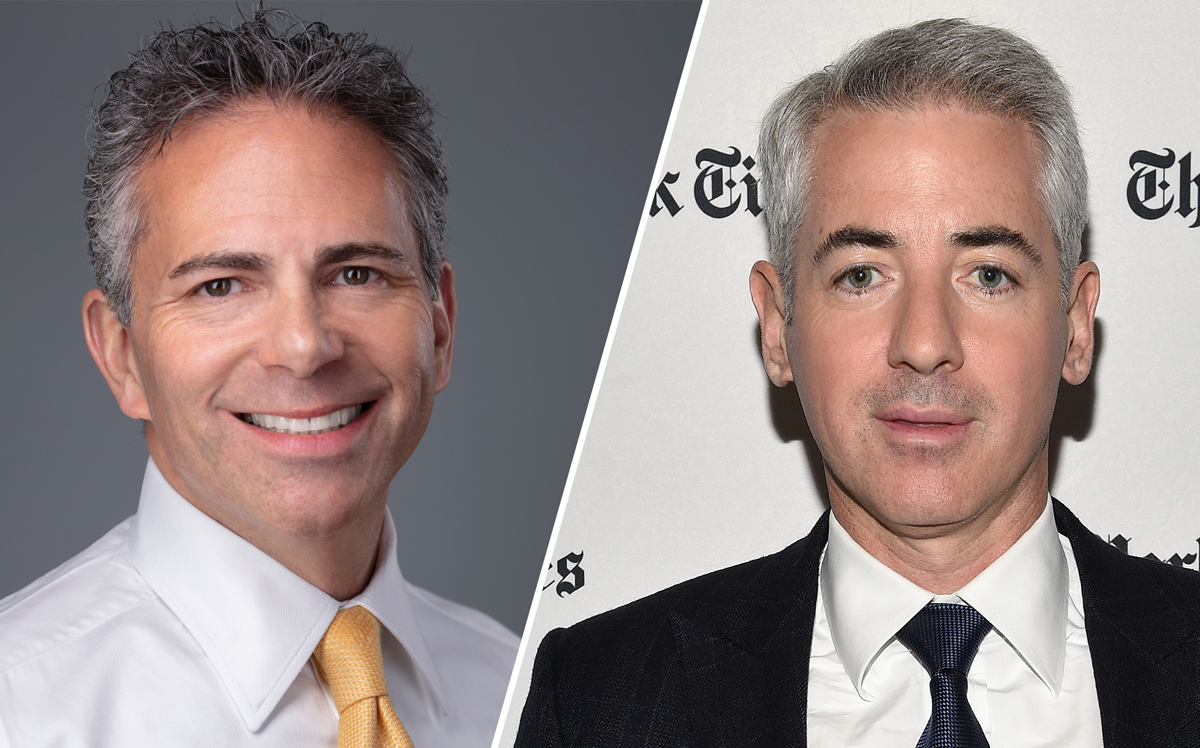

Development firm Howard Hughes Corporation is exploring a possible sale as its struggle to close a “significant gap” between its share price and it net asset value, CEO David Weinreb said, according to Reuters.

The Dallas-based firm has hired Centerview Partners to also consider other options, which include creating a spinoff or joint venture group, recapitalizing, or selling the company entirely, Reuters reported. The review is expected to be complete by the end of summer. Howard Hughes was formed as a spinoff of the former General Growth Properties in 2010.

Shares of the company jumped 35 percent when news broke that it was mulling a sale. The company, whose chairman is activist investor Bill Ackman, had seen its stock fall in recent years from a high in 2014.

The firm is dealing with backlash over a parking lot it purchased in New York City, which may be contaminated. Howard Hughes had clashed with residents there before over a discarded proposal to build a 50-story hotel and condominium on the waterfront, and changing plans for a parklike roof.

The company is also working on massive projects throughout the country. In Chicago, the firm teamed up with Riverside Investment & Development in leasing out a 1.4-million-square-foot office tower. It is also working on the 60-acre Ward Village development in Honolulu that calls for 4,500 residential units and 1 million square feet of commercial space.

Howard Hughes was also involved in two of the largest development site sales in New York in 2018. [Reuters] — Gregory Cornfield