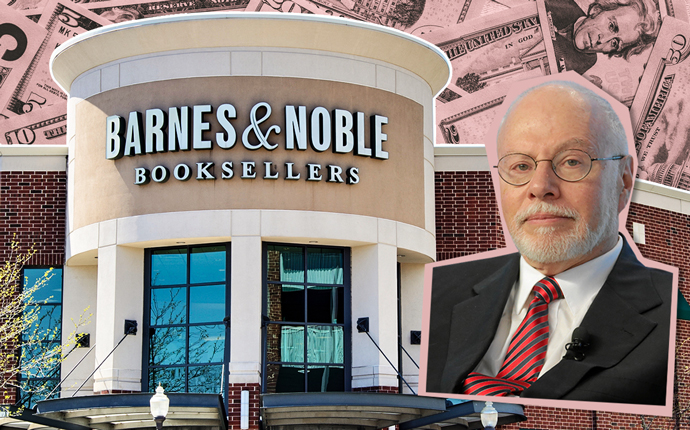

Struggling bookseller Barnes & Noble has agreed to sell to hedge fund Elliott Management Corp. for $475 million in cash, following a Thursday auction for the company.

Paul Singer’s distressed debt hedge fund was the top bidder at the auction. The deal is valued at around $683 million, including the assumption of debt, according to the Wall Street Journal. The future of the bookseller’s 627 U.S. stores remains murky.

Elliott will pay $6.50 per share for all shares of the company. Barnes & Noble stock shot up 30 percent to $5.96 after the Journal reported a deal was imminent. The company’s stock hit a low of $4.32 yesterday afternoon before any reports of a deal surfaced.

Barnes & Noble has lost $1 billion in market value over the last five years, according to CNBC. As of last year, Amazon — which started as strictly an online bookseller — accounts for nearly half of all new book sales.

But Barnes & Noble’s struggles are part of a larger retail softening brought on by shifting consumer trends toward e-commerce. From January to April this year, U.S. retailers had already closed 6,000 stores nationwide, more than the total closures throughout 2018.

Some retailers have significantly shrunk footprints nationwide. Last month, clothing retailer Dressbarn closed all of its 650 stores around the country.

Sales, though, have breathed new life into some struggling retailers. Sears shuttered hundreds of stores over the last few years, but its February purchase saved over 400 Sears and Kmart locations, and now more are opening.

Like many other major retailers, Barnes & Noble has tried to reinvent itself to meet consumer demands. Last fall, the bookseller opened a concept store in Chicago that’s more a café and gathering space than a traditional bookstore. [WSJ] — Dennis Lynch