What was once scarcely used as a source of development financing now has a waiting list. Condominium projects, and more recently hotels and even restaurants, are increasingly turning to EB-5 investors to fund their construction and business expansion.

“It’s very difficult to get financing,” said Roger Bernstein, an immigration attorney who heads the EB-5 For Florida Regional Center. He said the tight lending environment is motivating developers and entrepreneurs to explore alternative financing like EB-5. The visa program grants permanent U.S. residency to investors and their immediate family members if they create at least 10 domestic jobs and invest a minimum of $500,000 in U.S. real estate projects.

The popular program was recently extended through December, putting off further federal action until after the presidential election. But critics say that scant oversight of regional centers has led to rampant fraud. Even many program supporters say more regulations are necessary to prevent fraud and to create measures for transparency and accountability. The program’s repeated last-minute extensions have also taken a toll on the investor pool, experts said.

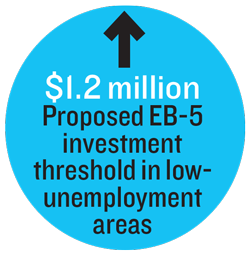

Congressional proposals for reform measures are already on the table. Virginia Congressman Bob Goodlatte, a Republican who chairs the House Judiciary Committee, sponsored a recent bill to raise the minimum individual investment required for EB-5 visas to $800,000 in areas with high unemployment, and to $1.2 million in areas with low unemployment. Goodlatte has argued that the bill should include some retroactivity, because otherwise the EB-5 application backlog would deter reforms from taking effect.

Many real estate pros say the proposed bill would severely restrict the program’s use for new real estate development. In particular, any retroactive element that would require investors to cough up more money to qualify for green cards would “cause a huge disruption of the market,” Bernstein said.

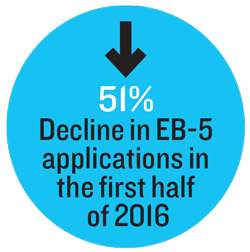

The proposal comes at a time when national demand for the visas is declining for the first time in years. Only 2,361 foreign investors applied for the visas in the first half of 2016, nearly 51 percent lower than in the first half of 2015, according to the U.S. Citizenship and Immigration Services website.

South Florida developers, meanwhile, are taking advantage of the EB-5 money spigot while it’s still running at full force.

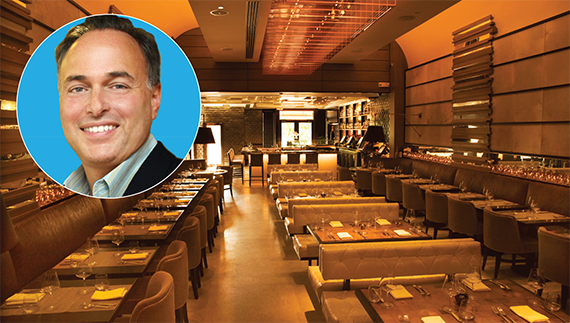

Meat Market, a South Florida restaurant group, has used EB-5 investments to help fi nance expansion. It has received a lot of backing from Latin Americans. Inset: David Tornek, the restaurant’s co-owner.

New directions

The definition of an attractive EB-5 project is morphing. For example, EB-5 For Florida Regional Center is working with local restaurant groups such as Meat Market and Tap 42 to raise capital for their expansion plans, a relatively new trend in South Florida.

From the business owners’ perspective, EB-5 funding is often cheaper than a loan from a commercial bank or a private equity fund. Because restaurants are so labor-intensive, Bernstein said many of those working with his center generated three times the jobs they needed to obtain in EB-5 financing.

Bernstein’s regional center is in the process of raising a goal of $10 million for Tap 42, a restaurant group with locations in Fort Lauderdale, Boca Raton and Coral Gables. The restaurant is in the midst of building a Midtown Miami location and also has plans for outposts in South Beach, Aventura and West Palm Beach.

Credit: The Real Deal South Florida

Meat Market’s flagship steakhouse is on Miami Beach’s Lincoln Road, with another location in Palm Beach and plans for more in Tampa, Orlando and Fort Lauderdale. The Palm Beach Meat Market opened in 2014, and was partially funded by EB-5 investors, who are on track to recoup their investments by the fifth year, said David Tornek, Meat Market’s co-owner.

The group has received a lot of backing from Latin Americans, particularly Venezuelans, and Tornek said he feels beholden to his investors. “The restaurant industry in general has a bad reputation from the standpoint of a high failure rate,” he said, adding that he wants to counteract that.

Hotels have also become popular EB-5 investments in South Florida. Those that have tapped the EB-5 market range from a cluster of new properties near the Miami International Airport to the landmarked 1925 Langford Hotel in Miami’s downtown.

A number of condo developers are also still seeking EB-5 investors. The Highlands, a planned 60-unit North Miami Beach condo project, received EB-5 approval earlier this year. In addition to funding construction, investors can also purchase units as investments, with unit prices ranging from $360,000 up to $500,000 for a penthouse.

The Highlands, a planned North Miami Beach condominium, is seeking EB-5 capital.

Credit: The Real Deal South Florida

Blue Road, the Bay Harbor Islands-based developer behind the Highlands, travels to find foreign investors, along with consultant Arturo Venti, the CEO of Become American Investor, a Fort Lauderdale-based company that works with developers to find them EB-5 investors.About 32 percent, or $7 million, of the Highlands’ total project cost is slated to come from EB-5 investment, with a further 22 percent coming from preconstruction condo sales and the remaining 46 percent from a mix of developer equity and construction financing.

EB-5 money will also help finance the much larger Paramount Miami Worldcenter project, a planned 83-story, 513-unit condo tower in Miami’s downtown. Developers have slated up to $75 million to be raised from EB-5 investors, with much of that anticipated to come from Chinese investors, according to Ronald Fieldstone, an attorney with Arnstein & Lehr who is working on the project.

Chinese nationals currently make up the bulk of EB-5 participants, but many South American investors have heard of the program, although they might not know it by name.

Credit: The Real Deal South Florida

“When we started in South America, we didn’t even use the term EB-5. We used to go to the market by saying, ‘Get your green card by investment,’ ” Venti said. But he said there’s been a gradual shift, and for many EB-5 investors, “it’s not just about the green card.” He said that more of them are out to get a good deal, and view the immigration element as an added bonus.

Other large development projects in South Florida are tapping the EB-5 market, although it will logically represent a relatively smaller portion of their financing.

At the Panorama Tower, only 6 percent of the $800 million estimated project cost is expected to be funded with EB-5 capital, which works out to about $48 million. The project’s developer, Tibor Hollo’s Florida East Coast Realty, secured a $340 million construction loan in the spring of 2015, and the project is on track to open in late 2017.

Once completed, the 83-story, mixed-use tower will become the tallest residential high-rise on the eastern seaboard south of New York.

Bernstein said that as time goes by, he expects more real estate ventures to seek out EB-5 investors.

“Now that the secret’s out,” he said. “I think you’re going to see a lot more.”