Real estate brokerages in South Florida are facing tumultuous times.

The industry is changing: Companies are being bought and sold, stocks of publicly traded firms like Realogy are falling, and disruptors such as Zillow Offers and other iBuying firms that bypass the agent are entering the market. “There are just seismic shifts that create uncertainty,” said Beth Butler, Compass’ director of new development in the Southeast. “And [agents think,] ‘Maybe I need to move. Should I look at other things?’”

With sales in a slump, the top brokerages in the region are playing offense, whether they’re adding ancillary services for customers as a way to enhance profitability, or growing by acquiring smaller firms or agent groups or luring high-profile agents by boosting incentives.

“We’re playing a game of musical chairs,” said Phil Gutman, president of Brown Harris Stevens Miami. “We’re at a difficult time. The market is just doing so-so, and when the market is doing so-so, the agents start to look around because their first inclination is that their brokerage is the issue, instead of market conditions.”

In fact, competition between brokerages for the best talent is tougher than ever before, said Gutman and others, including Butler. Compass, which has raised $1.5 billion in capital, is largely viewed as among the most aggressive in luring agents since it launched in South Florida four years ago. It now has 800 agents in nine offices across four counties after doubling its agent numbers in just the past year.

“I don’t remember this kind of environment existing at this level in the 30 years I have been doing this,” Butler said. “It really has become an environment where top agents can shop their offers and come up with whatever suits them best.”

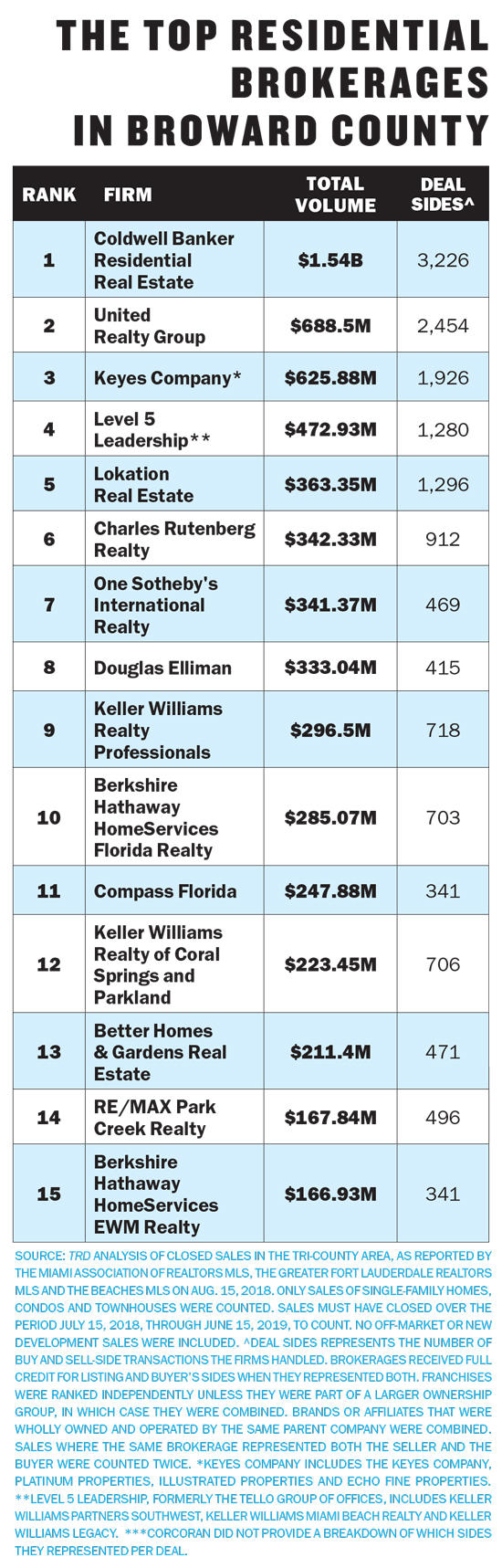

Indeed, top producers can catapult a firm’s sales volume. The Real Deal’s latest brokerage ranking analyzed the top residential brokerages in Miami-Dade, Broward and Palm Beach counties, based on closed sales from July 15, 2018, through June 15, 2019. TRD obtained the data from multiple sources and confirmed the sales totals with the brokerages themselves. The findings showed that in Miami-Dade, One Sotheby’s International Realty took the lead spot with $1.46 billion in volume. In Broward, Coldwell Banker Residential Real Estate led the list with $1.54 billion in volume, and in Palm Beach County, it was the Keyes Company with $1.76 billion in volume.

Recruiting top agents is a key to growth. “People go into the market and grow aggressively quickly, because you have to hope to make it up in volume — that is the only way to compete in South Florida,” Butler said.

To get top agents, without a doubt, money talks.

In South Florida, agents with strong production may get a range of incentives from brokerages, including upfront cash incentives, big marketing budgets, cash to offset lost commissions from changing companies, a free assistant or a year-paid assistant, office space and/or a guaranteed number of referrals, Butler said. The overall compensation package also includes high splits, which brokerages say can range from 80 to 90 percent for the agent.

It all points to a highly competitive industry, brokers say.

“Big players are pouring a significant amount of money to grow, and grow not necessarily profitably,” said Edgardo Defortuna, founder, president and CEO of Fortune International Group.

“That creates a very significant pressure on both agents and companies,” he added. “Agent splits are at a high 80 to 90 percent for top agents, and some companies are also willing to pay a signing bonus.”

“That creates a very significant pressure on both agents and companies,” he added. “Agent splits are at a high 80 to 90 percent for top agents, and some companies are also willing to pay a signing bonus.”

Indeed, recruiting can cause friction, and Gutman calls some firms’ recruiting methods “questionable.” Some have tried to recruit some of his agents, “claiming we were for sale. We are not for sale,” he said. “Most of us that have been here in the real estate industry for the past decade have a mutual respect and don’t actively poach each other’s agents … Recent firms that have infiltrated the market don’t show the same respect.”

The huge splits are a short-sighted incentive, according to the president of One Sotheby’s International Realty, Daniel de la Vega.

“Once some of these companies start to realize that they cannot be profitable giving away the house the way they do, they have to adjust to reality,” he said. “We all have desk costs, fixed costs, and a brokerage firm simply cannot operate at a 90 percent split structure. It’s not possible unless some of these companies start changing their split structures and offering ancillary services.”

Buying up the boutiques

While representatives from Compass say they aim to have a 20 percent market share in the region by the end of next year, other firms, too, are looking to show off their market muscle with more robust headcounts. For many, that means acquiring smaller brokerages and broker teams. One Sotheby’s International Realty, for example, is planning to make three acquisitions in the next two months, according to de la Vega.

“They are companies that have like-minded agents that specialize in luxury,” he said, declining to disclose the firms. With the acquisitions, One Sotheby’s will go from about 900 agents to close to 1,000, he said. That’s in sync with its strategy to expand into new markets, boost its digital presence and improve its market share on the general side of the business as well as in new development, de la Vega said.

Similarly, firms can grow by “fold-ins,” or incorporating teams from other firms. The Keyes Company, for example, recently brought over the Coloney Group’s 30-person team in Fort Lauderdale, said Mike Pappas, Keyes’ president and CEO. The team left Related ISG International Realty.

Fortune International Group recently brought on 10 agents from a small, independent firm, which had covered Aventura and Sunny Isles Beach. They closed their office and joined Fortune, Defortuna said, declining to name the firm.

Douglas Elliman, which now counts 1,200 agents in 22 offices in Florida, brought on David Siddons and his five-agent team from EWM Realty International in July. That same month, Elliman picked up the four-agent Cassis Burke Collection team from Brown Harris Stevens Miami. In 2014, Elliman had $300 million in sales and 100 agents; it now has 12 times the number of agents and is on track to close $5 billion in sales, including new development, this year, said Jay Parker, CEO of the Florida brokerage.

“We’re always looking to expand into the markets that fit our strategy of being in all the markets our clients want to be in,” Parker said. “So we’re looking at the west coast [of Florida], pockets on the east coast [of the state] — considering areas north of Jupiter, looking at Aventura and the Sunny Isles market.”

Coldwell Banker, for its part, has added such high-profile agents as Denise Rubin in Aventura, who joined Aug. 30 from Berkshire Hathaway HomeServices Florida Realty; and Judy Zeder, Nathan Zeder and Kara Zeder Rosen, who left EWM Realty International in March to join the Jills at Coldwell Banker, creating the Jills Zeder Group. Coldwell Banker has also signed leases for more space at its Miami Beach office and at an office in West Delray Beach in addition to recently expanding its Boca Raton office, said Nancy Klock Corey, regional vice president for Southeast Florida. Her region now includes 16 offices and 1,600 agents.

For a brokerage to compete today, branding is also paramount, experts say.

Though EWM Realty International sold to Berkshire Hathaway HomeServices in 2003, it was only this past June that it changed its name to Berkshire Hathaway HomeServices EWM Realty. The firm currently has 10 offices and about 800 agents in South Florida. President Ron Shuffield said the move allows the firm to better compete with large brokerages.

“While we have been part of the Berkshire Hathaway family for the past 16 years, EWM elected to enhance our brand by enlarging the font size of our name,” Shuffield said. “What that has done for us is give us immediate recognition of being aligned with major brokerages in New York and California and other places in the world, so when people see the Berkshire Hathaway name, they see that this is the same company I am seeing in these other markets.”

Coldwell Banker, too, promotes its vast presence across markets to attract buyers. “Whether they are coming from this country or outside, they see Coldwell Banker and they trust that name. They have seen it before,” Corey said.

Everything but the kitchen sink

Brokers are also trying to become one-stop shops to fatten their bottom lines. Offering clients a full-service home services operation loaded with ancillary products is increasingly considered a winning competitive strategy among local brokerages.

One Sotheby’s is in the process of creating an insurance company that will offer property and casualty coverage by the end of the year, de la Vega said.

“We’re trying to be as vertically integrated as we can be,” he said. “It’s the way brokerages are going to survive in the future, in my opinion.”

Berkshire Hathaway already offers mortgages as well as title and property insurance, Shuffield said. Keyes offers mortgages, insurance and property management and will soon offer “post-closing” services like cable, internet, phone and security hook-ups and home improvement services for the seller through a partner, Pappas said.

Similarly, Compass has launched Compass Concierge, which fronts the cost of home repairs for sellers.

Taking care of agents by providing marketing support, social media and public relations support, as well as direct campaigns and linking agents to New York, are also important, said Gutman, whose firm has 187 agents in Miami-Dade and 100 in Palm Beach County.

At Coldwell Banker, agents are coached on sales skills and time management. The firm provides customer relationship and database management, and even offers top agents wealth management counseling services.

“Retention is as important if not more important than recruiting. If you do so much to bring them in, you want them to stay,” Butler said. “The environment that you cultivate and the culture that you create is what makes people stay. Someone can be offering them more money, but if they feel that this is the place they belong, it’s the glue that keeps people there.”

Amid changing dynamics, aside from attracting and retaining top talent, the advent of iBuying and the specter of shrinking profitability are also expected to remain concerns in the industry.

“The challenge of profitability is shared — everybody has this concern,” Butler said. “For every dollar of commission, if you are keeping 15 or 16 cents, and you’re paying all the expenses, and rents are rising, and you have sales managers and staff, you have to grow fast to have the volume to sustain that. But you also have to identify other sources of income to supplement the brokerage income.”