A line of eager real estate agents, architects, attorneys and industry insiders snaked out the double doors at the Pérez Art Museum Miami on a balmy Friday night in May.

In a scene reminiscent of the launch parties of 2014 and 2015, about 800 guests made their way through the museum and up to the crowded third-floor terrace of the museum that bears the name of Miami’s biggest condo developer, Related Group founder Jorge Pérez.

The event? Okan Development Group, a Turkish development firm making its debut in the Miami market, was launching its Okan Tower, a $300 million, 70-story hotel and condo project planned for Miami’s Arts & Entertainment District.

Not everyone on the long line made it inside, but the soiree — which included a Turkish jazz band and speeches from billionaire developer Bekir Okan, Miami Mayor Francis Suarez and One Sotheby’s International Realty President Daniel de la Vega — showed how hungry the real estate community was for a brand-new project, one that was free of the baggage of previous site plans, delayed timelines or lackluster sales.

Kasim Badak, CEO of Okan Development Group, acknowledged there is a clear slowdown in Miami’s condo market, but said he believes Okan Tower will be timed perfectly for the next cycle.

“The project will take about 40 to 45 months to build. By then, we will be in a great position to have a new project in the market,” Badak said. If Okan breaks ground in the fourth quarter of this year, it would be delivered at some point in 2022, in time for what insiders say could be the start of the next cycle.

“The project will take about 40 to 45 months to build. By then, we will be in a great position to have a new project in the market,” Badak said. If Okan breaks ground in the fourth quarter of this year, it would be delivered at some point in 2022, in time for what insiders say could be the start of the next cycle.

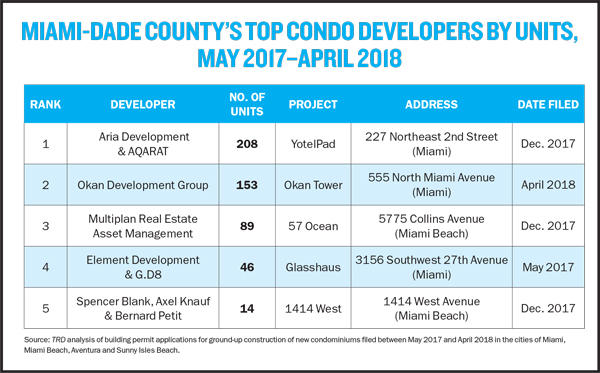

Okan is one of only a handful of developers to submit new permit applications for ground-up condo construction in Miami, Miami Beach, Aventura and Sunny Isles Beach over the past 12 months. The Real Deal analyzed applications filed in those cities between May 2017 and April 2018 and found that the developers forging ahead on condo projects included Aria Development, which ranked first, Okan Development Group which came in second, and third-place firm Multiplan Real Estate Asset Management, led by Brazilian billionaire José Isaac Peres.

The developers who’ve built some of the biggest Miami condo projects of this cycle — Related, JDS Development Group, Swire Properties and others — are keeping mum about future condo projects, focusing instead on selling out their current buildings and ramping up multifamily, mixed-use and other types of projects.

Swire, for example, recently hired ISG to take over the remaining sales at Brickell City Centre’s Reach and Rise condos, and it won’t release a timeline or details about phase two until it sells out those 198 remaining units, said Maile Aguila, Swire’s senior vice president of residential sales. Aguila doesn’t expect a sellout for another year and a half or two years — sometime between the end of 2019 and the beginning of 2020.

Others are proceeding boldly. Aria Development, for example, is working with Kuwait real estate company AQARAT to build YotelPad Miami, a 31-story tower planned for 227 Northeast Second Street in downtown Miami. Aria developer David Arditi joked that his firm likes to be different.

“Perhaps we’re a little contrarian in terms of market timing,” he said.

But with YotelPad, Arditi and AQARAT are targeting a much lower price point than many developers sitting on unsold inventory, Arditi pointed out.

The building, a $150 million development, will have 208 condos and 250 Yotel “cabins,” or small hotel rooms. Sales launched about two months ago, with prices starting in the $300,000s, Arditi said. Condos range in size from about 417 square feet to 708 square feet.

“We saw an opportunity in the market that we felt was not being adequately addressed for branded residential product,” Arditi said.

YotelPad, which is 70 percent owned by the Al-Bahar family — the controlling shareholders of AQARAT — will manage the property. Aria and AQARAT are working to secure a construction loan for about half of the project cost, which comes to about $75 million. They’ll break ground in the fourth quarter of this year and complete the project in approximately two years.

Sales skipped the reservation phase and went straight to contracts, Arditi said. He declined to state how many units are under contract, but said he’s “very pleased” with the number. Buyers so far are from South America, Europe and China, as well as from the U.S., he said.

“I would not have launched this project if it required selling million-dollar branded residences right now,” he added.

Located just north of downtown Miami, Okan Tower will also be targeting non-luxury buyers, with units there starting at $318,500. In addition to a 294-room Hilton Hotel & Resorts-branded property, the tower will feature office space and a restaurant and bar on the 66th floor.

Badak of Okan said that the company launched sales in Istanbul in May, and has secured about 45 reservations from buyers in Turkey and in the U.S. Okan is self-financing the $300 million project.

Although it’s rare, there are some developers who will be putting more luxury condos on the market.

Although it’s rare, there are some developers who will be putting more luxury condos on the market.

Multiplan Real Estate Asset Management is demolishing the Marlborough House property in Miami Beach, where it will build 5775 Collins Avenue, a boutique luxury condo building.

The Brazilian developer is building an on-site sales center. Marcelo Kingston of Multiplan declined to provide specific numbers, but said the 17-story, 89-unit project will be priced similarly to Eighty Seven Park, the Four Seasons Residences at the Surf Club and L’Atelier. Units in those properties generally range in price from at least $1.6 to $31 million.

The approval process wasn’t an easy one for Multiplan, which faced a delay from the city of Miami Beach, thereby pushing the project’s timeline back. But sales won’t dictate when the building gets completed, Kingston said.

“The [December] approval was a major trigger” for the project to move forward, he said. Now, the development team, which includes Arquitectonica, is pushing toward what they see as the next most optimal time to launch: Art Basel this December, the unofficial kickoff to Miami’s selling season.

And after launching last fall, Element Development plans to break ground on the first phase of Glasshaus in the Grove in June, then launch sales for phase two by the end of this year. The developer ranked fourth in TRD’s analysis of the biggest condo project developers of the past 12 months.

Element, led by Javier Lluch, has sold about half of the units in the first phase, a 23-unit condo development at 3161 Center Street. Element is building the project with G.D8, and Fortune International Group is handling sales and marketing.

“Sales are doing very well. We’re selling at about a third of the price of our competitors,” Lluch said. Prices at Glasshaus start at $595,000.

Meanwhile, sales have not yet launched for 1414 West Avenue in Miami Beach. The development group, tied to Spencer Blank of Boca Raton firm Redcliff Builders and Belgian investors Axel Knauf and Bernard Petit, secured design approvals from the city of Miami Beach in October 2017.

UrvanX, a Miami-based architecture firm, is designing the five-story, 14-unit boutique condo building. The previous owner of the site won approvals for the building in 2015, but it didn’t obtain building permits within the allotted time frame. Units at 1414 West Avenue will range from 672-square-foot one-bedrooms to 1,315-square-foot two-bedrooms.

The development site is about two blocks north of Monad Terrace, a luxury condo building that JDS Development Group and partners are building. At Monad, units are under contract for more than $1,800 a foot, developer Michael Stern said.

JDS, one of Miami’s largest condo developers in terms of number of units this cycle, has sites across South Florida, including some along the Miami River.

Stern declined to comment on future condo plans, but said that while he’s always watching the market, he’s careful not be too cautious: “If you overreact to the specifics of the cycles in Florida, you can get [caught] with bad timing.”