This year’s office investment sales in South Florida were squarely in line with market trends.

The biggest deal was in Miami’s booming Brickell Financial District, while properties in the suburbs traded at a discount amid an elevated interest rate environment.

In the leasing frenzy of the past four years, Brickell was a top choice among out-of-state companies expanding or moving to South Florida, and investors dropped hefty sums for Brickell towers.

This year, the biggest sale was for $443 million in Brickell, marking the third year in a row the financial district hosted the top South Florida office deal. Last year, Monarch Alternative Capital and Tourmaline Capital Partners paid $250 million for the 801 Brickell tower. In 2022, billionaire hedge funder Ken Griffin dropped $286.5 million for the 1221 Brickell tower.

Suburban offices have proved a bargain. Three sales this year in each of Boca Raton, Coral Gables and Doral were a discount off the properties’ previous purchase prices.

The Federal Reserve imposed its third benchmark interest rate cut this month, after 11 aggressive hikes in 2022 and last year. But rates remain elevated. Landlords also are battered by skyrocketing insurance, increases in other expenses and questions over the office market’s long-term resilience amid remote work.

Here are South Florida’s top 10 office sales of 2024:

1. Brickell lands the top deal –– again

Billionaire hedge funder Paul Singer’s Elliott Investment Management and a partner dropped $443 million for the 701 Brickell tower.

West Palm Beach-based Elliott and Boca Raton-based Morning Calm Management bought the 33-story building at 701 Brickell Avenue in October. New York-based Nuveen Real Estate, a subsidiary of the Teachers Insurance and Annuity Association of America, was the seller.

The tower was more than 90 percent occupied at the time of the deal. It was completed 1986 on a 3.8-acre bayfront site, records show.

Elliott, an investment management firm founded in 1977, had about $69.7 billion in assets as of June, according to its website.

Over the past year, it increased its South Florida investment through a joint venture with Adi Chugh. Their Tyko Capital provided a $565 million permanent loan on the 830 Brickell office tower and a $527 million construction loan for the St. Regis Residences, Miami, condo project in Brickell.

2. Miami-Dade County drops $182M for new government offices

Miami-Dade County dropped $182 million for an office complex in the Fontainebleau neighborhood that will house various county departments.

New York-based Bushburg, led by Joseph Hoffman, sold the 26-acre property at 9250 West Flagler Street in an unincorporated area of the county in September. The complex consists of a six-story building and a one-story building completed in the 1970s, according to property records.

It will be renamed West Dade Government Center and house county information technology, water and sewer, regulatory and economic resources, and solid waste departments. The county plans a $74 million renovation.

3. Adam Neumann’s Flow, Israeli firm buy Aventura complex

Adam Neumann’s Flow and Israeli firm Canada Global paid $116.2 million for the Aventura Corporate Center, according to a Canada Global filing to the Tel Aviv Stock Exchange in November.

New York-based Stonecutter Capital Management sold the property consisting of 258,000 square feet of offices in three buildings on an 8.7-acre site at 20801, 20803 and 20807 Biscayne Boulevard in Aventura. The complex was 92 percent leased at the time of the deal, Canada Global’s stock exchange filing says.

Publicly traded Canada Global is majority owned by Assaf Tuchmair and Barak Rosen.

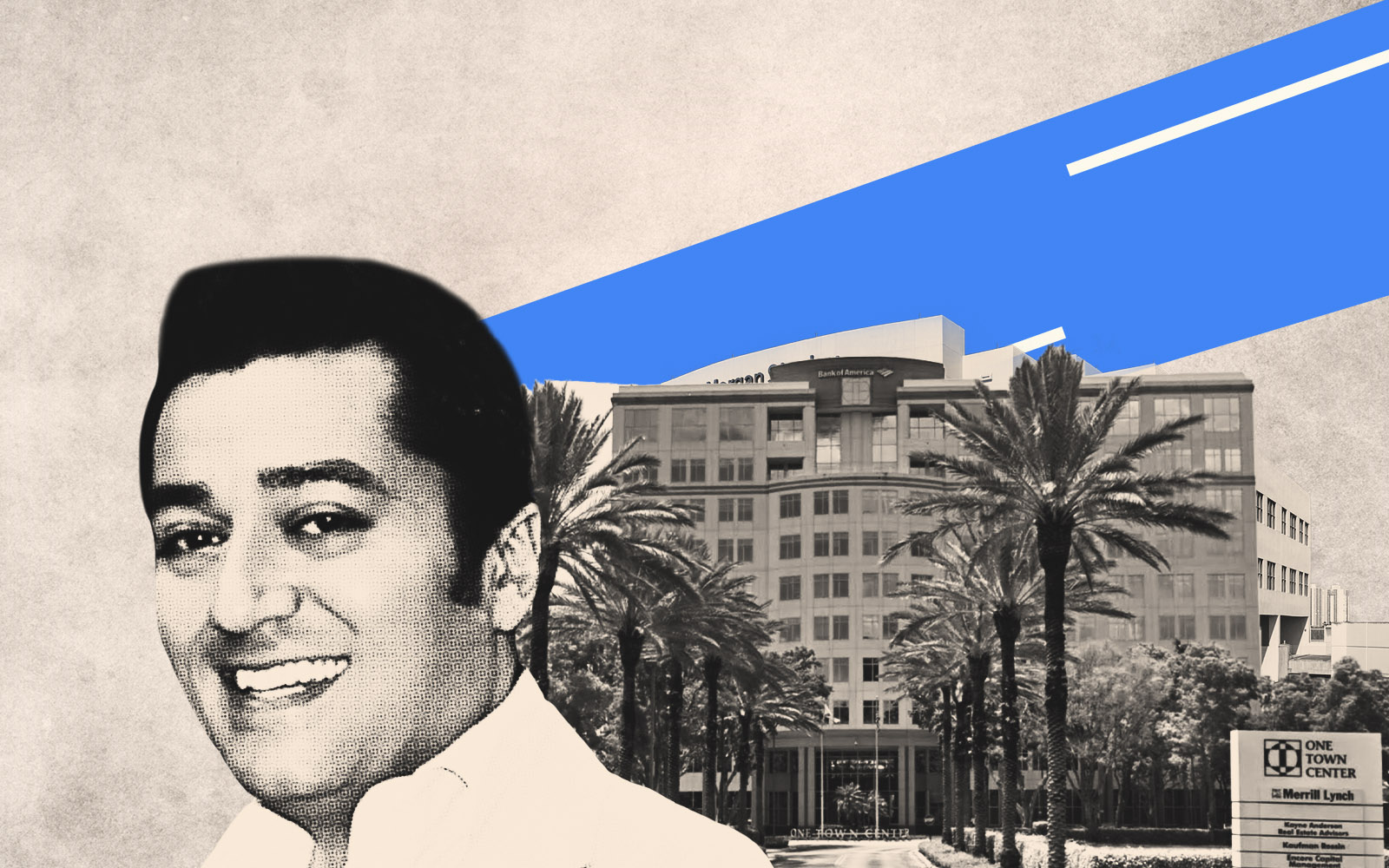

4. Gatsby Enterprises buys Boca Raton offices at a discount

Gatsby Enterprises paid $82 million for the 10-story One Town Center building at 1 Town Center Road in Boca Raton.

Singapore-based Prime US REIT sold the building and an adjacent garage in July for a 17.6 percent discount from its purchase price in 2021, records show.

New York-based Gatsby is led by Nader Ohebshalom and Babak Ebrahimzadeh. Its Florida arm is Gatsby FL.

5. Colonnade Properties scoops up Coral Gables complex at a discount

Colonnade Properties bought the five-building Douglas Entrance campus in Coral Gables for $76 million in March.

Miami-based Banyan Street Capital and Los Angeles-based Oaktree Capital Management sold the 6.2-acre property at 800 Douglas Douglas Road. The deal marked a 25 percent discount from the price the sellers had paid in 2014.

New York-based Colonnade is led by President Joseph Sambuco.

6. Embattled Charles Cohen loses Dania Beach property to lender

Fortress Investment Group bought the Design Center of the Americas in Dania Beach through a $76 million credit bid in a Uniform Commercial Code foreclosure last month.

The trade came after a monthslong legal battle following New York-based Fortress’ $548 million foreclosure filing in April on a slew of Cohen Brothers Realty’s properties nationwide, including a movie theater chain. New York-based Cohen Brothers is led by Charles Cohen.

The Design Center of the Americas is a roughly 800,000-square-foot office center with retail showrooms at 1855 Griffin Road.

Fortress is led by co-CEOs Drew McKnight and Joshua Pack.

7. C-III Capital buys Doral offices at a discount

C-III Capital Partners bought One Park Square at Doral in September for $71 million, marking a 26 percent discount from its sale price seven years ago.

The Los Angeles County Employees Retirement Association sold the complex consisting of an 11-story building and a three-story building on a 3-acre site at 3470 Northwest 82nd Avenue in Doral. The retirement fund administrator and manager had paid $96.1 million in 2017 for the campus, which was completed in 2009, records show.

Irving, Texas-based C-III Capital is led by CEO Andrew Farkas.

8. Shipping company picks Miami for its North America HQ

MSC Group, an international shipping and cruise company, paid $67 million in September for its North America headquarters in Miami’s Overtown neighborhood.

Geneva, Switzerland-based MSC bought a 131,000-plus-square-foot office condo on the seventh floor at 249 Northwest Sixth Street, at Michael Swerdlow’s newly completed Block 55 mixed-use project. Swerdlow’s eponymous Coconut Grove-based firm, Reston, Virginia-based SJM Partners and Miami-based affordable housing developer Alben Duffie were the sellers.

Block 55 consists of 578 senior affordable housing apartments, 175,000 square feet of retail and a 1,000-space parking garage.

9. Black Lion buys South Beach building at a discount

Robert Rivani’s Black Lion bought The Lincoln in South Beach in April for $62.5 million, marking a 42.8 percent discount from its sale price eight years ago.

Miami-based Black Lion bought the ground lease for the six-story building at 1691 Michigan Avenue in Miami Beach, consisting of 43,200 square feet of ground-floor retail and 118,700 square feet of offices. New York-based Clarion Partners was the seller. It had paid $109.2 million for the ground lease in 2016, records show.

The city of Miami Beach is the landowner.

10. Prologis drops $55M for telecommunications firm’s HQ in Miami-Dade

San Francisco-based Prologis paid $54.5 million in August for a Verizon subsidiary’s headquarters near Doral, with plans to redevelop it as a logistics center.

TracFone Wireless, which provides wireless communications, sold the 144,000-square-foot, one-story building at 9700 Northwest 112th Avenue in an unincorporated area of Miami-Dade County.

Prologis, a real estate investment trust, is led by CEO Hamid Moghadam.

Source: The Real Deal’s analysis of data as provided by Colliers and CBRE, as well as of publicly available records.