BDT & MSD Partners is making big equity gains thanks to a $1 billion refinancing of Boca Raton Resort & Club.

Citi Real Estate Funding provided the two-year, floating-rate interest only loan, which replaces a previous $900 million debt secured by the 1,047-key luxury hotel and private club at 501 East Camino Real in Boca Raton, according to a Fitch Ratings report. Of the additional $100 million, $166,000 will be placed in reserves, $35.4 million will pay closing costs and New York-based BDT & MSD will receive $64.4 million in return equity.

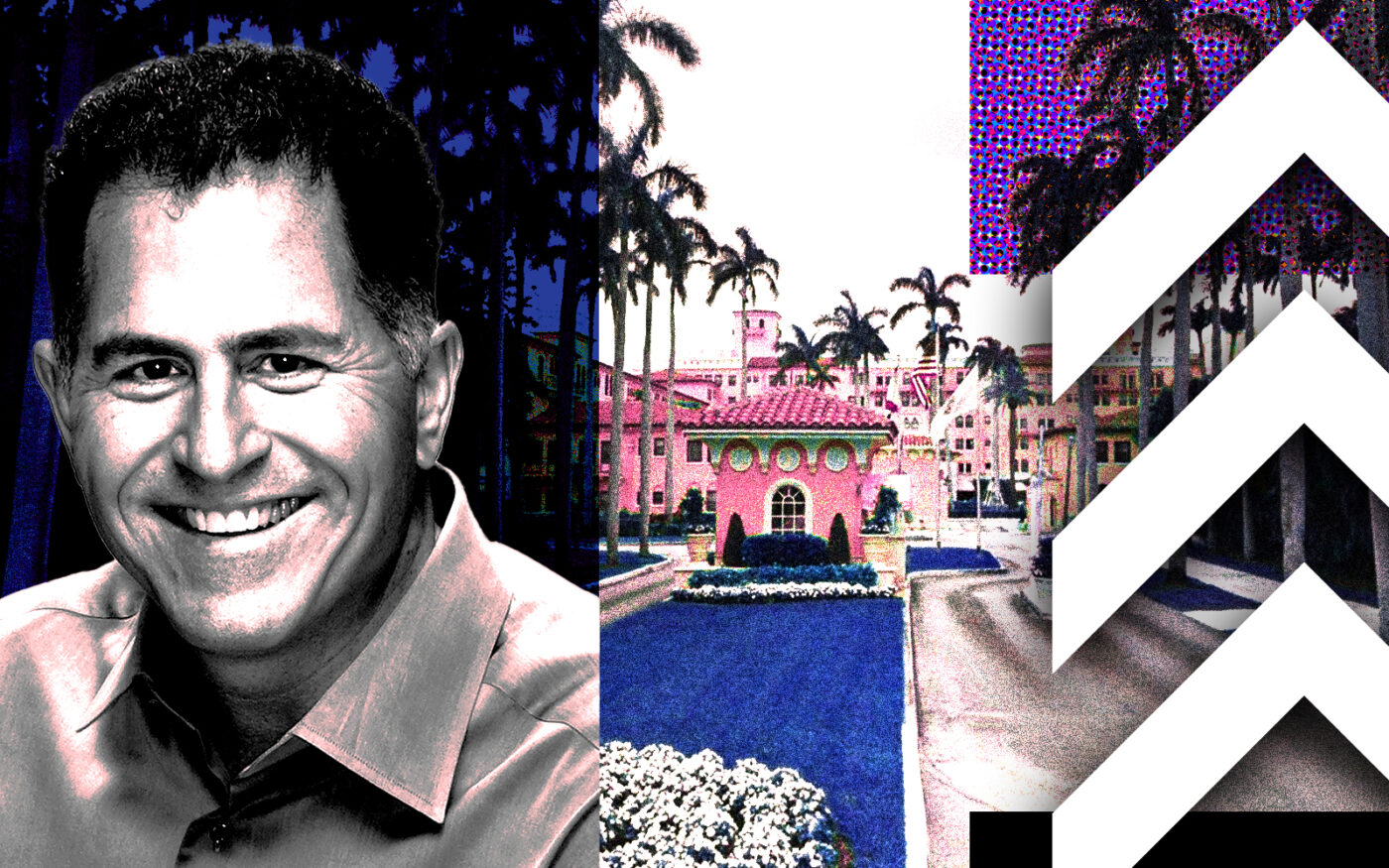

Led by co-CEOs Byron Trott and Gregg Lemkau, BDT & MSD is a merchant bank formed last year through a merger between Trott’s BDT & Company and MSD Partners, the private investment arm of Dell Technologies founder Michael Dell. In 2019, MSD paid $875 million to Blackstone for Boca Raton Resort & Club, records show.

Between 2021 and 2023, MSD invested $75 million in renovating Boca Raton Resort & Club, resulting in a net cash flow increase of 56 percent to $95.8 million through the first five months of this year compared to $61.4 million during the 12 months of 2019, the Fitch report states. The property’s revenue per room also jumped by 51 percent to $307 per room in May of this year compared to $203 per room during the same period in 2019.

During the 12 months ending in May, Boca Raton Resort & Private Club derived $123 million in revenues from club membership sales and monthly dues, as well as golf, tennis, marina, beach concessions and retail income, the Fitch report states. Revenues are expected to increase following a $102 million renovation of the property’s beach club slated for completion by the end of this year.

The refinancing of Boca Raton Resort & Private Club is the largest so far this year, surpassing the $575 million in two loans obtained by Trinity Real Estate Investments and Credit Suisse Asset Management in May for the Diplomat Beach Resort in Hollywood. The joint venture owns the 1,000-room luxury oceanfront hotel.

Trinity and Credit Suisse obtained a $452 million first-lien mortgage from Citi Real Estate Funding and German American Capital Corp., while TD Miami Beach Mezz LLC and PPIB Credit Investments III Inc. provided a $123 million mezzanine loan.

The joint venture used the loan proceeds, as well as $48.3 million in equity, to pay off a previous mortgage and fund reserves.