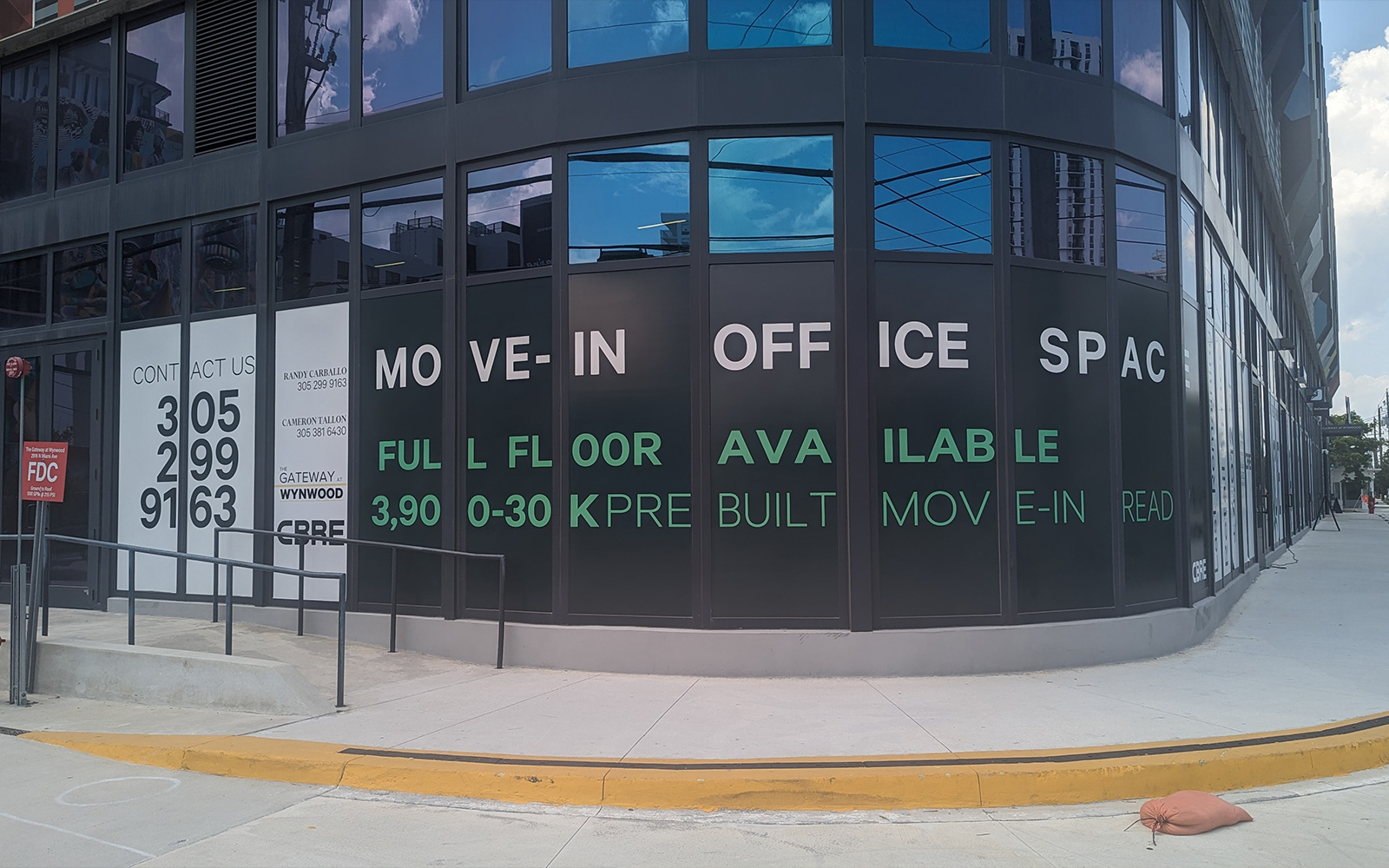

New York-based R&B Realty wrapped a large vinyl sign around the ground-floor windows of Gateway at Wynwood recently. The advertisement is meant to draw the attention of prospective tenants to the 13-story mixed-use building’s 3,500 square feet to 30,000 square feet spaces that are available for lease. Some suites are move-in ready, and an entire floor is available, the sign blares in giant white block letters.

What’s happened to Gateway at Wynwood could be a harbinger of distress in Wynwood’s nascent office submarket, some commercial real estate experts say. Tanking tech firms, the collapse of Silicon Valley Bank last year, rising interest rates and corporate tenants’ preference for other established office submarkets in Miami slowed leasing in Wynwood, which could lead to trouble for landlords that own the few office buildings in the neighborhood.

R&B is already feeling the sting. Gateway at Wynwood is facing foreclosure, after R&B allegedly defaulted on a $101 million debt, according to a lawsuit filed in March by lender Wilmington Trust NA, as trustee for Boise, Idaho-based A10 Capital. At the same time, roughly 59,000 square feet, including the entire 12th floor, remain available for lease at Gateway at Wynwood, an online brochure shows.

Aron Rosenberg, R&B’s CEO did not respond to phone messages and emails requesting comment.

“The Gateway at Wynwood foreclosure is certainly a wake up call that there is some difficulty emerging in that submarket,” Jason Comer, a real estate law partner in the Miami office of Sidley Austin, told The Real Deal. “We have certainly seen more softening in Wynwood, compared to Brickell and downtown Miami.”

More vacancies than other submarkets

Wynwood has a higher vacancy rate compared to six other Miami-Dade County office submarkets, including Brickell, Coral Gables, downtown Miami and Miami Beach, a first quarter report by Colliers shows. Of 2.1 million square feet of total office space in Wynwood, 14.4 percent is vacant. For Class A space like Gateway at Wynwood, the vacancy rate jumps to 23.5 percent, according to Colliers.

Colliers’ report lines up with data from CoStar, which shows the Wynwood submarket with a vacancy rate of 14 percent. Currently, Wynwood has 760,000 square feet of available office space, CoStar data shows. About half of the available square footage, including a 12-story, 250,000-square-foot office building that is part of the Wynwood Plaza project at 95 Northwest 29th Street, is under construction and has yet to be leased up, said CoStar’s Juan Arias.

“Available space in the [Wynwood] submarket has doubled since 2019, largely due to new construction,” Arias told TRD. “Still, new office space in the submarket commands asking rents of over $70 a square foot, which is in line with average asking rents in Brickell, but below new construction in Brickell.”

For instance, the asking rate at OKO Group’s 830 Brickell office tower project that is nearing completion is $200 a square foot, making new office buildings in Wynwood a “more affordable and attractive option for occupiers looking for high-end space,” Arias said.

However, Brickell and downtown Miami are experiencing more demand than Wynwood for Class A office space from corporate and institutional tenants, said attorney Comer.

“Wynwood is more for a niche-type tenant looking for a walkable neighborhood with a lot of vibrant arts offerings,” Comer said. “And there’s been a shift in appetite in what those types of tenants in Wynwood are looking for. They want shorter-term leases.”

Steven Wernick, a real estate law partner in the Miami office of Day Pitney, said Wynwood is still going through growing pains that make it harder for some office tenants to commit long term to the neighborhood. Wernick has been active in Wynwood’s revitalization and represents local and national developers in the district.

“There is a lot of construction going on, and you have streets and sidewalks getting closed off as improvements are made,” Wernick said. “In other submarkets, you have buildings in mature neighborhoods that are fully built out. Some tenants want to be in places where they can move in quickly.”

Wynwood office leasing also took a hit in the past year as tech and cryptocurrency firms backed off previous plans to expand or relocate to Miami.

“I think that is a component of it,” he said. “We are seeing a lot of companies reevaluating the spaces they need.”

Tech firms short-circuit Wynwood’s lease-up

In one case, a tech tenant didn’t bother with moving into its new Wynwood digs. Amyris, a biotechnology company based in Emeryville, California, allegedly defaulted on a lease to occupy an entire three-story building at 2724 and 2734 Northwest First Avenue, according to a civil lawsuit filed in Miami-Dade Circuit Court last year.

The landlord, San Francisco-based real estate investment firm Brick & Timber, alleged that Amyris failed to build out the interiors and did not maintain the building, called The Onyx, as required by a 10-year lease agreement the biotech firm signed in 2022, the lawsuit states. The same month Amyris signed the lease, Brick & Timber bought the property for $9 million.

The lawsuit was stayed in August when Amyris filed for bankruptcy. Since then, Brick & Timber has yet to find a replacement tenant for The Onyx and put the building up for sale with an asking price of $21 million at the beginning of this year. Brick & Timber slashed the asking price to $15 million in March.

Brick & Timber partner Jesse Feldman said despite Amyris bailing out of The Onyx, he believes that Wynwood’s office submarket is on stable footing.

“The Onyx is a perfect single tenant building,” Feldman said. “Many of the tenants that would lease the building would also be qualified to, and interested in, purchasing it. So, we decided to offer it for both lease and sale.”

Feldman told TRD that Brick & Timber’s other two mixed-use buildings, Cube Wynwd and The Annex Wynwood, are fully leased. Feldman’s firm paid a combined $111 million for both Wynwood properties in 2022.

Venture capital firms Founders Fund and Atomic are among the tenants that still occupy full floors at Annex Wynwood, after signing leases in 2021.

“Wynwood is the best market for startups poised for exponential growth,” Feldman said. “[The neighborhood] is a true arena for technology companies. Wynwood has significant and dense new workforce housing and Miami’s best food and beverage options.”

Brick & Timber understands that investing in Wynwood requires a longview approach, as the neighborhood is still in the midst of a development boom that is adding thousands of apartments, condo units and hotel rooms, Feldman said.

“Wynwood is a nascent office market,” he said. “None of these buildings were here five years ago, and most of them are newer than that. The interesting thing is what has been accomplished in leasing here, less so what is still available.”

Feldman expects the office submarket to stabilize over time. “While 100,000 or 200,000 square feet of vacancy is meaningful today, over the course of the next decade that number will seem trivial — the neighborhood will continue to absorb and grow,” he said.

And the concentration of venture capital firms in his two buildings will likely attract tech companies that are not only seeking funding, but also intellectual knowledge to help them grow, Feldman added.

“Miami has been a rocket ship, but no market was immune to the end of the zero interest rate policy era,” Feldman said. “It caused a market-wide slowdown, as tenants measured their burn rates. As we sit at the dawn of a new economic cycle, and companies are finding comfort again, leasing momentum is accelerating across the market.”