Developers have increasingly tailored their condo projects toward investors, and a new report shows how strong that trend is: More than half South Florida’s planned condo development pipeline is for short-term rental-friendly buildings.

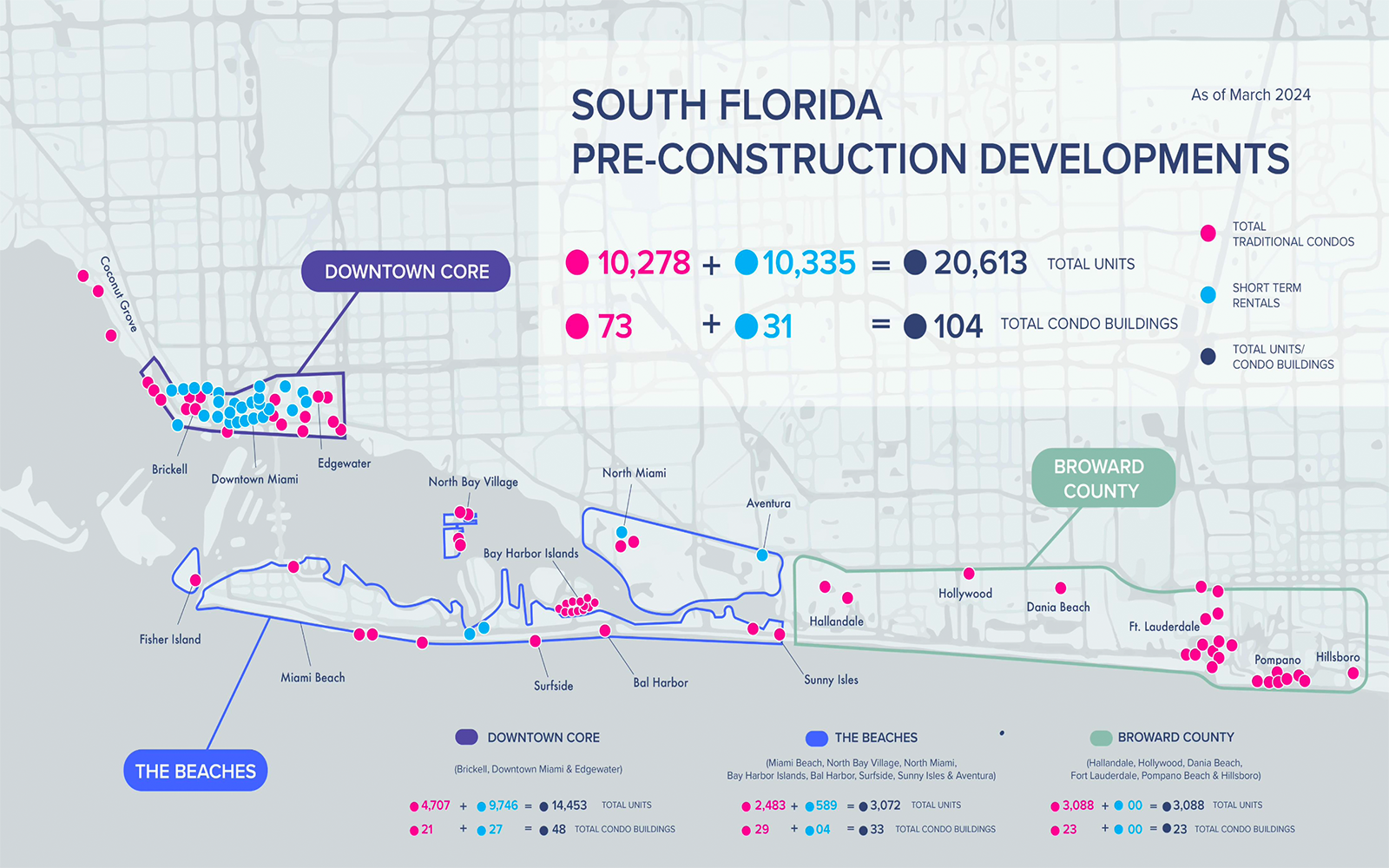

Of 20,613 condos in the works from Miami’s Coconut Grove to Hillsboro Beach in Broward County, 10,335 units in 31 buildings allow buyers to rent out their units with few to no restrictions, according to ISG World’s first quarter report. Traditional condos, meaning those geared toward end-users who will be living in the units or renting them out on an annual basis, represent just under half of the pipeline with 10,278 units spread across 73 buildings.

The trend of short-term rental-friendly condo developments has boomed in South Florida in recent years. Some multifamily projects are even being converted to such buildings due to continued demand from buyers, many of whom are foreign investors. Developer Henry Pino recently secured a $68 million construction loan for River District 14, a short-term rental-friendly condo project that was originally planned as apartments.

The ISG World report, authored by Craig Studnicky’s Aventura-based brokerage, tracks new developments east of I-95.

It also shines a light on the age of existing inventory — the vast majority of resale units on the market as of March 31 are 30 years or older. Coupling that with what Studnicky considers a low supply of new traditional units could create a challenging situation for the housing market, he said.

Of the 18,704 resale condo listings on the Multiple Listing Service in Miami-Dade, Broward and Palm Beach counties, 15,759 listings are for units that are 30 years and older. About 6,700 are in Miami-Dade County, 4,900 in Broward and roughly 4,200 in Palm Beach County.

Just 2,133 of those listings are for units that are between 10 and 30 years old. And only 812 are listings of condos less than 10 years old.

By the end of this year, older condo buildings will have to start complying with new condo safety regulations. Florida lawmakers passed the new rules following the Surfside condo collapse in 2021, which killed 98 people when the oceanfront Champlain Towers South collapsed overnight.

The law eliminated condo associations’ ability to waive the financial reserve requirement — forcing many properties to play catchup. Associations must fully fund their reserve requirements in their annual budgets beginning Dec. 31 of this year. It also creates deadlines for milestone inspections for buildings that are 30 years or older, or 25 years old if they are coastal communities.

The added cost of shoring up these buildings’ finances and physical structures will make it more expensive to own units or buy condos in these communities, putting more pressure on the housing market. Though prices have risen dramatically for both single-family homes and condos since the pandemic, many families can now only afford to buy condos.

Studnicky believes South Florida is running “dangerously short” of housing.

Read more

Construction has not gone vertical for most of the new planned projects so far this cycle. Forty-four developments with almost 6,500 units are still in the preconstruction or groundbreaking phases. Construction is vertical on just a dozen projects with nearly 2,600 units, according to the report.

Developers are still grappling with elevated costs of construction, land, debt, insurance and more, which have contributed to delays with construction starts across property types. But condo developers have continued to launch projects and reach notable sales milestones.

“We still have huge demand, unprecedented demand from all four corners of the world,” Studnicky said. “What we don’t have enough of is the traditional condos.”