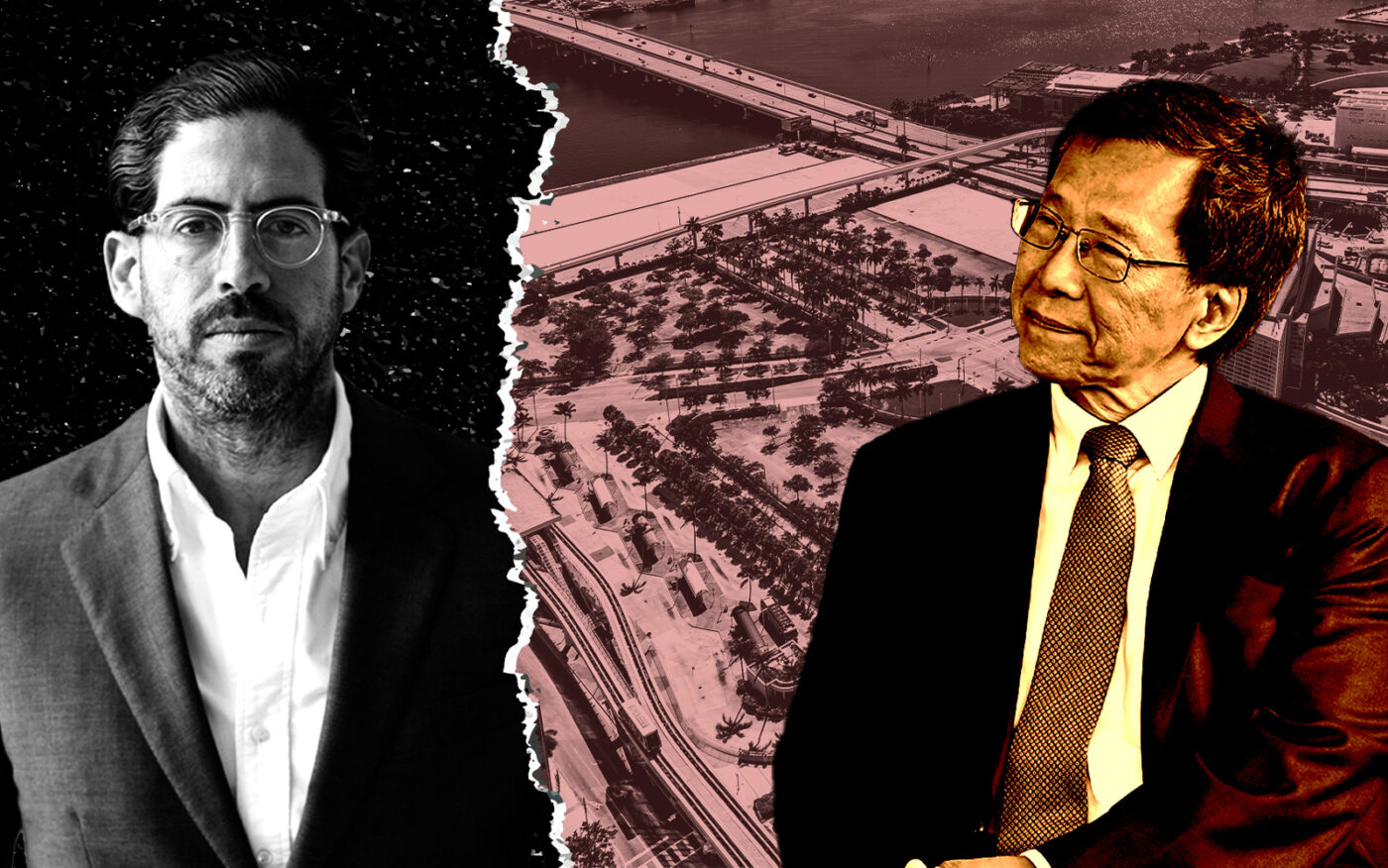

Developer David Martin’s record $1.2 billion purchase of Genting Group’s downtown Miami assemblage was called off, The Real Deal has learned.

Martin and his firm, Terra, led Smart City Miami, an investment group that was in contract to acquire the 15.5-acre assemblage in downtown Miami’s Arts & Entertainment District. The property is north of the Kaseya Arena, and near the Adrienne Arsht Center for the Performing Arts.

The deal was set to mark the priciest urban land sale in Florida and one of the most expensive in the country. News of Terra entering into contract in late April provided rocket fuel for the market at an uncertain time, brokers and attorneys said. It created momentum for other deals, and boosted investor confidence in the local market.

Genting will likely renegotiate with one of the four other bidders that offered more than $1 billion for the assemblage, but the capital markets remain challenging and a new buyer may have difficulty lining up financing for such a massive deal. Commercial sales have plunged and lenders continue to pull back due to rising rates and ripple effects of the bank collapses earlier this year.

The land, at 1431 North Bayshore Drive, hit the market in November with an Avison Young team led by Michael Fay and John Crotty. Both brokers were also involved in another high-profile land sale: the site of the Surfside condo collapse, which traded a year ago for $120 million.

The Terra-led Smart City sought an extension and amendments to the terms of the deal for the Genting assemblage, according to a joint statement from Smart City and Genting.

Smart City said it “elected to end its current bid” but remained interested in the site, suggesting it may bid on it again.

Genting, the Kuala Lumpur, Malaysia-based gambling operator plans to keep the Hilton Miami Downtown hotel and Omni Center north of the properties. The site it was selling to Terra’s SmartCity represents more than half of Genting’s holdings in the area.

It included the Miami Herald’s former 14.6-acre waterfront headquarters, which Genting acquired for $236 million in 2011, at the time a record for Miami-Dade County land sales. The Herald building was torn down in 2015 and the site has been leased out for events that include the Art Miami and Context fairs.

Terra has remained active in South Florida, where it has dozens of new projects. The firm is also in contract to purchase Castle Beach Club, an aging condo building in Miami Beach for $500 million. Related Group and 13th Floor Investments had planned to buy out the owners for the same amount, but pulled out of the deal in October.

Read more