Rishi Kapoor sits in front of a large screen projecting a rendering of a proposed Miami Beach co-living project, as he describes his quest to dominate that sector of multifamily real estate, starting in South Florida, and then across the U.S.

But a widening scandal engulfing Kapoor could torpedo those ambitions.

“Development is a tough business,” Kapoor said during a Zoom call with The Real Deal in mid-May, showing the image of his planned project. “Ultimately, we need a lot of things to go right with us, both micro- and macro-economically.”

In recent months, a great deal more has gone wrong than right for Kapoor, CEO of Coral Gables-based Location Ventures. At the start of the year, a group of investors sued him in Miami-Dade Circuit Court, seeking to oust Kapoor as manager of a co-living mixed-use project in Coconut Grove. They allege he made unilateral decisions, such as paying exorbitant six-figure fees to extend maturing loans, without first seeking their approval per an operating agreement.

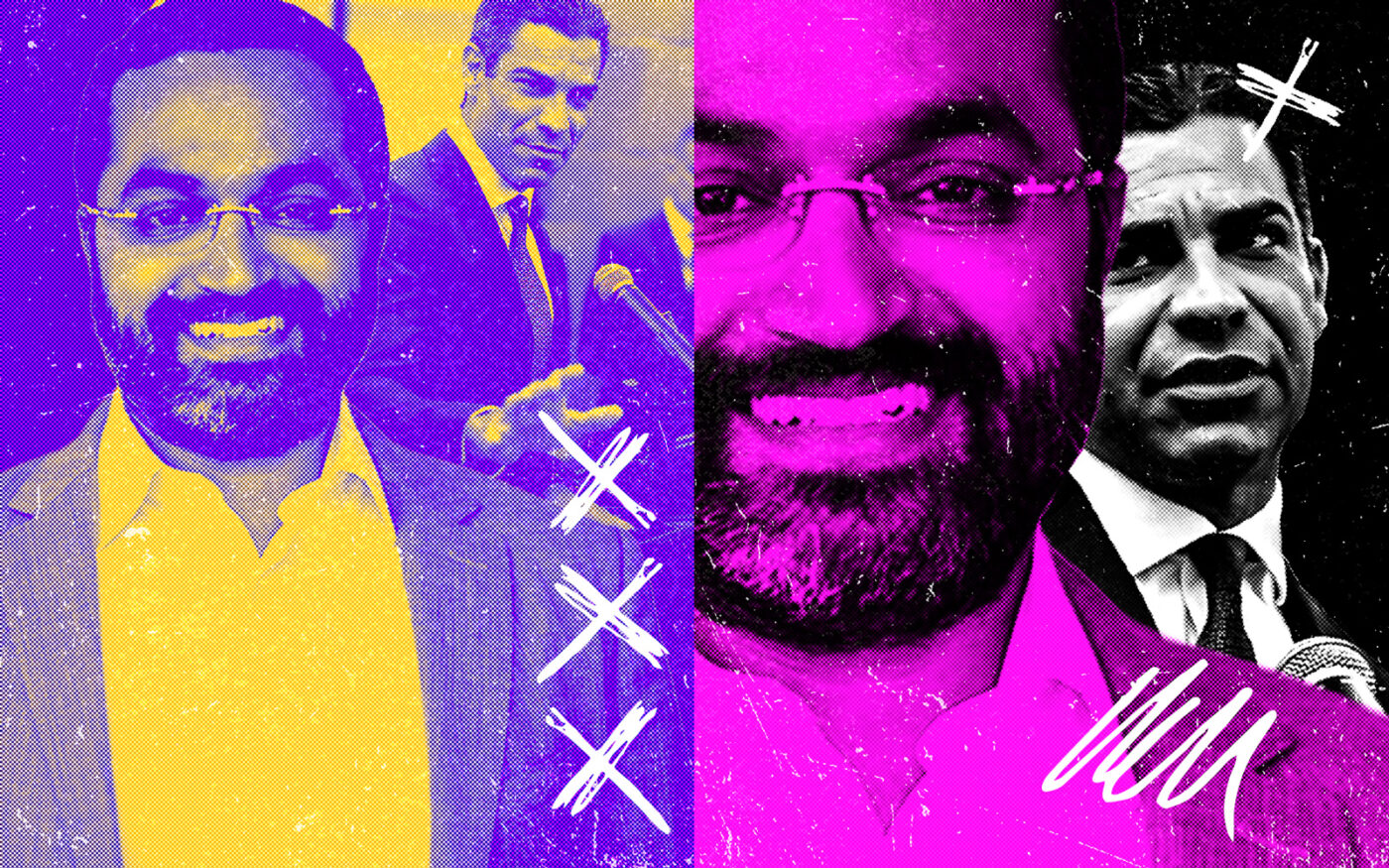

And in May, a separate civil lawsuit filed by Location Ventures’s ex-CFO Greg Brooks made an explosive allegation, and Kapoor confirmed it in his response to the complaint. Through its Urbin subsidiary, Location Ventures has been paying Miami Mayor Francis Suarez $10,000 a month as a private consultant. Suarez, a Republican contemplating a 2024 White House run, did not disclose his Location Ventures side hustle on his annual financial statements as required by Florida law.

The business arrangement sparked a joint criminal investigation by the the ethics commission and state attorney’s office in Miami-Dade County, as well as a separate public corruption probe by the FBI, the Miami Herald reported. The Securities and Exchange Commission is also digging into other allegations that Kapoor misrepresented potential profits to investors and misappropriated funds for personal expenses, among other possible securities violations.

Kapoor declined to comment about the scandal hanging over him, as well as separate, damning claims by three sources who claim to have intimate knowledge about Location Ventures’ investors who want out. The sources spoke on the condition of anonymity out of fear of reprisals from Kapoor.

“It’s all going to implode,” one source said. “From what I’ve heard, Rishi’s panicking. This is a powder keg. And he’s running out of options.”

In an emailed statement on Monday, Location Ventures’ lawyer Brian Goodkind said the company “denies all wrongdoing, and looks forward to the truth coming out through the appropriate channels in due time.”

From marketing guy to developer

Kapoor was reluctant to meet face-to-face when TRD initially approached him for an interview a month before Brooks’ lawsuit was filed. He refused three requests for an in-person meeting, and he wouldn’t answer questions about the allegations made against him in court documents tied to the suit filed early this year.

He agreed to a video interview, but Kapoor would only answer questions about why he jumped into real estate development, and his firm’s focus on building co-living projects in South Florida.

“We currently have developed and sold just over $300 million worth of properties,” Kapoor said during that May 16 Zoom call. “Pipeline-wise, we have another couple hundred million [dollars] worth of [projects] going through entitlements. For what the future holds, the market and God will dictate it.”

In 2016, Kapoor launched Location Ventures after a brief career marketing real estate projects, Kapoor said. “I wanted to get into the business of creating my own product,” he said. “Working for a number of developers, it gave me great insight.”

Location Ventures started off developing a couple of single-family homes, and in 2017, Kapoor set his sights on Orduna Court, a 24-unit condominium in Coral Gables across the street from the University of Miami. Location Ventures bought the property for $7.9 million, and converted the five-story building into a co-living project with fully furnished long-term rentals and extended stays targeted to college students.

Last year, Location Ventures sold Orduna Court for $14.7 million.

In the eight years since its inception, Location Ventures has ramped up its development pipeline. Between 2018 and last year, the firm paid nearly $100 million combined for five development sites in Coral Gables, Miami’s Coconut Grove and Miami Beach. Four of those sites are being developed into Urbin-branded co-living projects.

In Fort Lauderdale, Location Ventures is developing two proposed hotel projects that will be branded under Marriott’s Edition flag.

As Location Ventures sought zoning approvals for its co-living projects, the firm forged business and political relationships with local elected officials that have raised eyebrows.

In addition to giving Miami Mayor Suarez a side job, Location Ventures is also paying $12,410 a month for an empty space inside a Coral Gables retail building owned by that city’s mayor, Vince Lago. The firm has also donated $19,000 to Lago’s campaign and a political action committee supporting the Coral Gables elected official since 2021, campaign finance records show.

Recently, Location Ventures donated $50,000 to a political group supporting ex-Miami Beach commissioner Michael Góngora’s run for mayor in that city’s November election, according to a campaign finance report.

Lawsuits reveal red flags

In the lawsuit filed in January in Miami-Dade Circuit Court, three entities representing four minority investors in the Coconut Grove project sued Kapoor and his Urbin subsidiary. In the still pending lawsuit, the investors want a judge to remove Kapoor as manager of the development entity after they discovered that he allegedly violated a litany of terms in their operating agreement.

The agreement requires that all major decisions, such as borrowing money and generating loans, require at least 70 percent approval of the development entity’s shareholders, the lawsuit states.

For instance, the investors allege that Kapoor, without their consent, authorized Urbin to pay $262,000 in fees to a lender to extend the maturity date on a $4 million loan, and that he also took out a second mortgage for $16 million.

In a May 17 emailed statement, Kapoor said he could not discuss pending litigation, but he denied any wrongdoing. “We look forward to resolving the matter,” he said. “However, one can see the project is moving forward.”

Even more damaging allegations emerged in Brooks’ lawsuit filed against Location Ventures in Miami-Dade Circuit Court in May. The complaint alleges Kapoor paid himself roughly $3 million in unauthorized project management fees between 2021 and last year. He allegedly did so without seeking approval from Location Ventures’ board of directors and shareholders who invested in the firm’s projects.

Kapoor also allegedly used funds from a loan tied to the Coconut Grove project to “facilitate payments that he owed to another investor that he had agreed to cash out,” the complaint states. Again, he allegedly made this decision without seeking approval from the project’s investors.

Other allegedly unauthorized expenditures include Kapoor using company and project funds to buy himself a McLaren sports car, purchase a $5.9 million Cocoplum waterfront home in 2021, and pay $10,000 per month for a private chef to cater parties on his yacht, Brooks’ lawsuit states.

In a court response to Brooks’ lawsuit, Location Ventures disputed the allegations against Kapoor. As far as fees he collected, Location Ventures’ governing documents do not require Kapoor to obtain approval from the board of directors and project investors, the response states.

The response also denies that Kapoor misused loan funds to pay off the unnamed investor, and states that he paid for the McLaren and his house with his personal funds. The private chef only provided catering services when the yacht was used to entertain Location Ventures’ investors and business partners, the response states.

In a May 18 phone interview, Location Ventures’ attorney Goodkind said Brooks, who was terminated from Location Ventures, made unfounded allegations to ratchet up the pressure on his client. “He was grossly mistaken,” Goodkind said. “His version of the facts is not accurate.”

Investors jump ship

According to the three sources familiar with Location Ventures, the unnamed investor in Brooks’ still pending lawsuit is an entity managed by real estate investors Alex Kleyner and Diana Ulis.

Last year, the married couple paid $11.2 million for a Wynwood commercial building, and in 2021 bought two adjacent waterfront houses in Miami Beach’s Sunset Island for a combined $44.4 million, records show. Kleyner is a partner with New York-based investment firm ABK Capital, and CEO of National Debt Relief, also based in New York.

The three sources claim Kleyner and Ulis invested $45 million in Location Ventures. Before he was fired earlier this year, Brooks allegedly provided Kleyner and Ulis with information about Kapoor’s alleged improprieties, the individuals said. The couple obtained bank account information and financial records from Location Ventures that were reviewed by an accountant Kleyner and Ulis hired, the individuals allege. The accountant’s review allegedly confirmed Brooks’ information.

“When they confronted Rishi, he didn’t have an explanation other than he felt entitled to the fees because of the work he was putting in,” one of the sources said. “They offered him two choices. Either he would let them implement new controls, or he would have to buy them out. He chose the latter rather than fix anything.”

Location Ventures allegedly entered into an agreement to pay back Kleyner and Ulis with monthly payments, the sources said. They also claimed that at least two other investors, including Clement Zanzuri, principal of a Miami-based stone finishing company, are also seeking buyouts from Location Ventures.

Kleyner, Ulis and Zanzuri did not respond to requests for comment.

After the mid-May Zoom call, Kapoor has not responded to follow-up questions from TRD. In his emailed statement on Monday, Location Ventures lawyer Goodkind denied the claims made by the three sources.

“These appear to be manipulated and twisted allegations provided by someone clearly trying to hurt Rishi Kapoor, Location Ventures and its investors, in a sustained and coordinated media campaign,” Goodkind said.