UPDATED, May 11, 2023, 10 a.m.: The developer of a massive mixed-use community in Sunrise is seeking an equity partner to move the long-planned 4 million-square-foot project forward.

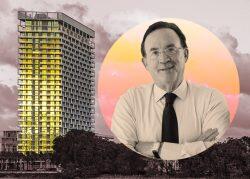

Joseph Kavana’s Metropica Development tapped Avison Young and Karson & Co. to find and structure a joint venture partnership for the roughly 48-acre site at 1800 Northwest 136th Street, according to a press release. Kavana said the project will require more than $250 million in equity.

“We’re seeking to put together the equity necessary to speed it up,” he said.

The entire 65-acre development has been in the works for at least a decade. The property is sandwiched between the Florida Everglades and Sawgrass Mills mall in western Broward County. Kavana has been acquiring land for the assemblage since the early 1990s. His firm secured approval for Metropica in 2014.

The project, which has been referred to as a “city within a city” could include up to 2,500 residential units, 240 hotel rooms, 480,000 square feet of retail space and 650,000 square feet of offices.

The city of Sunrise recently approved the Metropica Community Development District, which will allow it to secure up to $65 million in bonds to fund infrastructure improvements and services for a 50-acre portion of the site, according to the developer.

Kavana has completed one tower: the 263-unit Metropica One condo building in 2020. It is not included in this listing.

A team led by Avison Young’s Michael Fay and David Duckworth, and Arden Karson of Karson & Co. are leading the equity investor search.

Duckworth said the developer is open to “re-looking at the site plan and building something that is going to fit well in today’s economy.”

Kavana said he is considering building apartment towers due to strong demand for high-end rentals in the area.

Metropica Development is also flexible in structuring a new arrangement, Fay added.

The brokers highlighted the influx of out-of-state investors and developers that purchased sites in South Florida over the past two years. Fay is also leading the team brokering the $1.2 billion sale of Genting Group’s downtown Miami assemblage to a group led by David Martin and his firm, Terra.

“The time is now to focus on South Florida to bring in some new capital and bring this project to fruition,” Karson said of the Metropica site. “This type of land doesn’t exist anymore.”

The site is in a Community Development District, which acts as a quasi-governmental agency that funds and maintains infrastructure projects within large-scale developments. Developers across the state have formed CDDs since the early 2000s.

In 2021, Kavana closed on a $30 million condo inventory loan from New York-based Madison Realty Capital for the first tower and the second planned condo building.

Condo buyers and construction firms have sued Metropica Development over the years, regarding alleged delays and unpaid work, court records show.

Other South Florida projects have brought on new partners to move their developments forward, especially as the cost of construction, insurance, materials and land continue to rise.

Earlier this year, Jorge Pérez’s Related Group joined the development team of the planned Bahia Mar project in Fort Lauderdale. The $1 billion-plus redevelopment of the property at 801 Seabreeze Boulevard has been in the works since 2014.

Read more