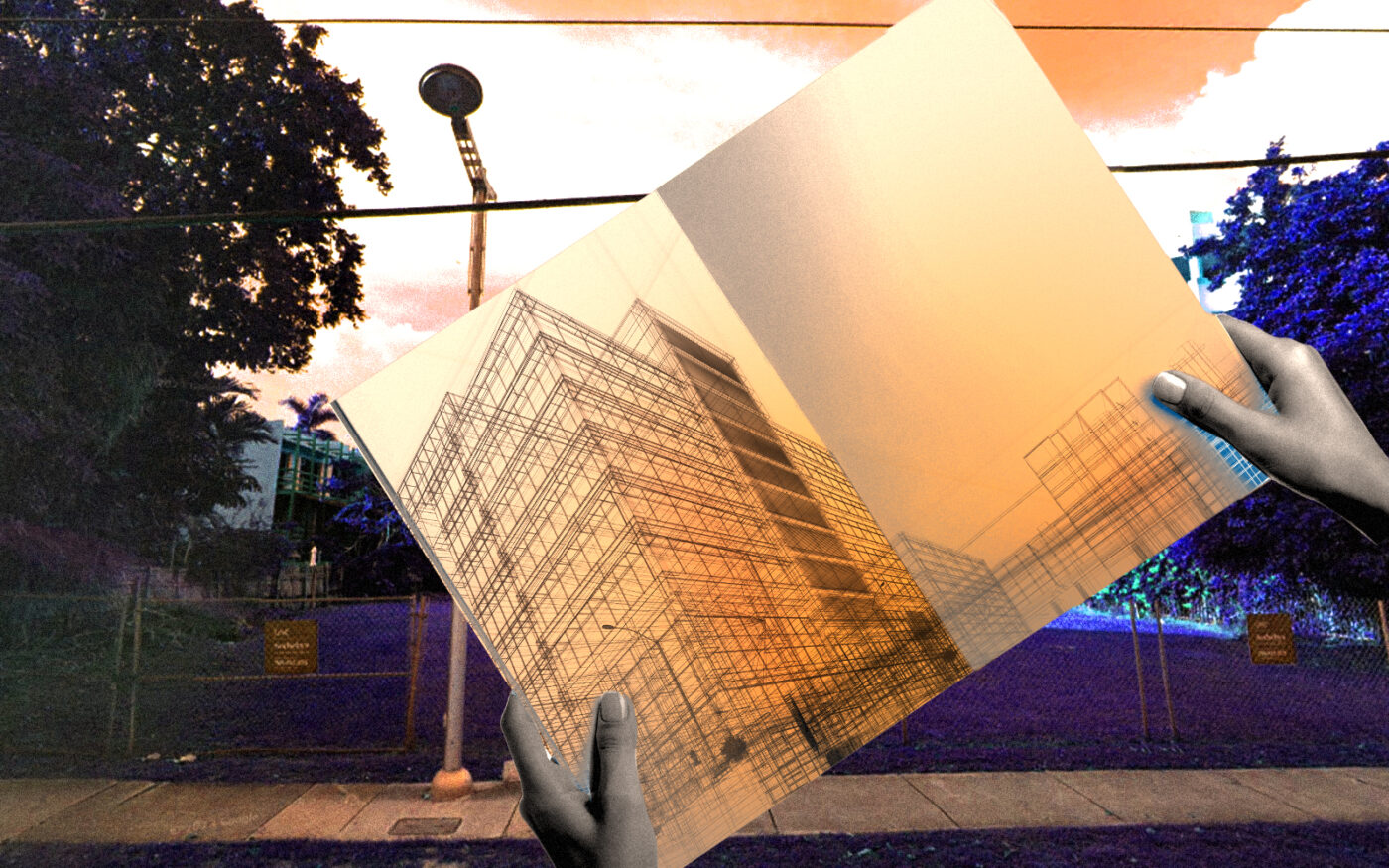

In its second purchase in Miami’s Brickell neighborhood, a Mexican development firm scooped up a development site with plans for a high-end condominium project.

Menesse International paid $6 million for 0.4 acres at 1870 Brickell Avenue, according to a company news release. Records show the Carlos Saenz family trust sold the property, which is largely considered the last grass lot along Brickell Avenue.

Manny Chamizo III of One Sotheby’s International Realty brokered the deal.

The planned condo project is a bet on Brickell’s growth as both an office hub and a residential neighborhood for new-to-market companies’ well-heeled executives. The development would have roughly 16 units that start at roughly $3 million, according to media reports.

The purchase, which pencils out to $15 million per acre, comes as land prices in Miami’s urban core have taken a nosedive that started late last year. After development site prices skyrocketed in 2021 and most of last year, they calmed to $19.3 million per acre in the fourth quarter, down 65 percent from the second quarter, according to Colliers.

Menesse International also has proposed a 39-story, 400-unit apartment tower at 143 Southwest Ninth Street in the Brickell area.

The firm is a joint venture led by Mexican firms Menesse Condos and Investee, which so far have focused on developing in Latin America. Menesse Condos, founded and led by Mariano Borges, has projects that include high-end apartment buildings in the resort town of Playa del Carmen and in Tulum. Both are along the Caribbean coast. Investee, founded and led by Alejandro Díaz, has projects in Mexico City and Riviera Maya.

Borges leads the Menesse International partnership, with Diaz serving as CFO. The pair have worked together on past projects as well. Their local partner is Miami-based Lucid Investment Group, which is also a brokerage and general contractor. Andrew Rasken is managing director of Lucid.

Brickell has hosted much of the office leasing frenzy by out-of-state financial firms that zeroed in on South Florida over the past two years and a half. In one of the most notable relocations, billionaire Ken Griffin is moving his hedge fund Citadel and financial services firm Citadel Securities’ headquarters from Chicago to Brickell.

Others opening offices in the neighborhood include law firm Kirkland & Ellis and global financial services firm Rothschild & Co. They both leased at 830 Brickell, the 55-story office tower being developed by Vlad Doronin’s OKO Group and Jonathan Goldstein’s Cain International. The building is expected to be completed this year.

Others betting on Brickell as a residential market include the Pérez family’s Related Group, which plans a three-tower project that will include a 75-story Baccarat-branded condo, a 44-story apartment tower and a hotel. In January, Related scored a $164 million construction loan for the rental building set to rise at 77 Southeast Fifth Street.

Last month, archeologists discovered artifacts, and human and animal remains on the development site dating back 7,000 years, marking one of the most significant excavations near the Miami River. It’s not clear how the findings will impact Related’s construction timeline.