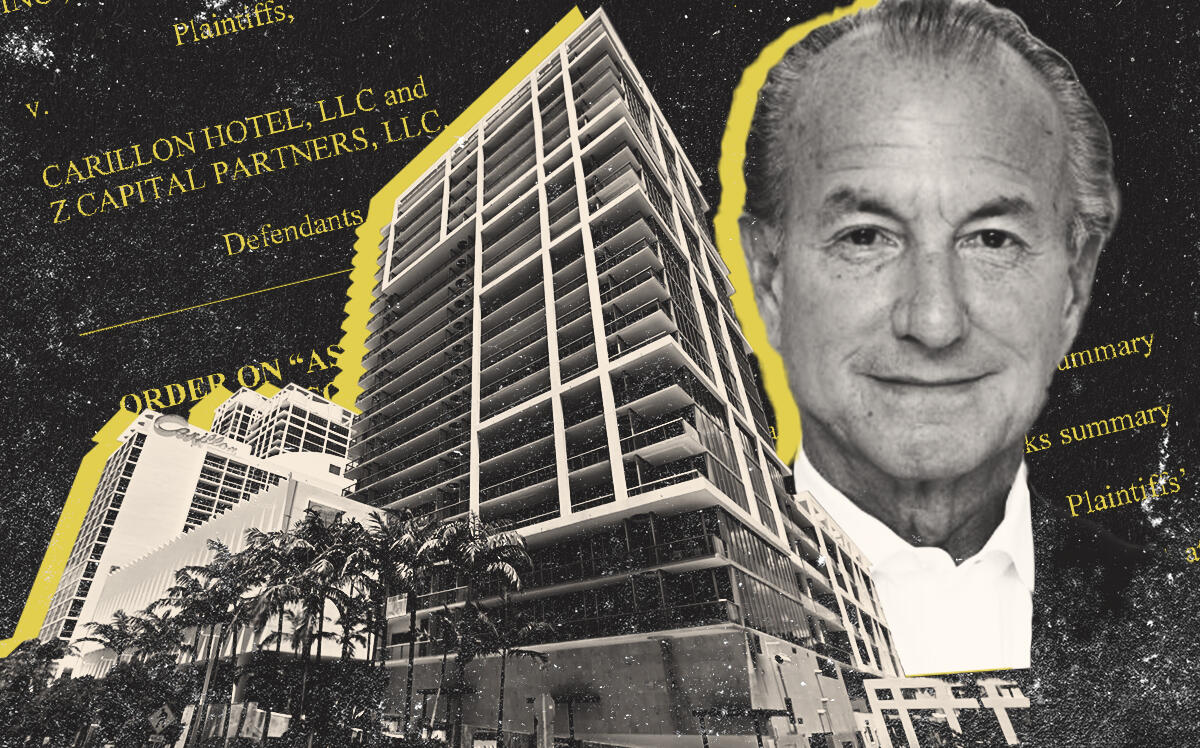

Z Capital Group is poised to lose significant power at the Carillon Miami Wellness Resort.

Miami-Dade Circuit Judge Michael Hanzman on Monday ordered that the portion of the Carillon master declaration that vests authority in Z Capital over common areas is invalid and illegal.

The oceanfront Carillon, at 6801 Collins Avenue in Miami Beach, consists of the North, Central and South towers, each with its own condo association. Together the complex has 580 units. James Zenni Jr.’s New York-based Z Capital owns, maintains, levies assessments for and otherwise controls the rest of the development, including the spa, pools, restaurant and roughly 70 condo-hotel units in the Central Tower.

The latest ruling surrounds Z Capital’s ownership and control over those areas, such as the hallways, elevators, heating, ventilation and air conditioning, roofs, and all other common areas — essentially everything except the condo units.

This level of control of common areas is an “overreach” that allows Z Capital to have power over the portions of the property that under the Florida Condominium Act should be collectively controlled by the condo owners, Hanzman wrote in his order.

“Unit owners … have no say in how the condominium they reside in will be operated. They cannot vote to replace or refurbish the exteriors of their buildings, the lobbies of their buildings, the components that provide utilities to their buildings, or any other facilities outside the four corners of their units,” Hanzman wrote. “The condominium owners are … nothing other than long-term hotel guests.”

Unit owners don’t even have a say in the amount of budget reserves for the common areas, which the Champlain Towers South collapse in 2021 in Surfside showed is an imperative part of running a condo, the judge added in his order.

The associations first sued Z Capital’s affiliates in 2016 over various issues. In court filings against Z Capital’s control over common areas, the associations argued that the master declaration goes against the Florida Condominium Act. The Carillon governing structure instead “distorts the condominium democracy into a dictatorship of unlimited control by” a private commercial entity, according to the associations’ court filings.

Attorneys for the associations hailed the most recent outcome as opening the door to other condominiums to fight unfair control by private entities.

“The order is evidently correct and addresses issues that I think have implications for lots of associations around the state of Florida,” said Eugene Stearns, who represented the North Tower.

“With Judge Hanzman’s decision today, we can finally begin the process of fixing the broken, unlawful structure and ensure that it fully complies with Florida Condominium law,” added Stevan Pardo, an attorney for the Central Tower.

Brian Dervishi, an attorney for Z Capital’s affiliate, cautioned that this wasn’t a complete victory for the associations, as they sought to invalidate the entire master declaration.

“The judge’s ruling is very careful and limited,” he said. “We are still reviewing it and making a determination of our options.”

The Carillon’s governing structure actually is common throughout Florida and nationwide, and the Florida Condominium Act doesn’t even apply to these types of condo structures, Dervishi said.

Z Capital didn’t devise the governing structure in the master declaration, but inherited it when the firm bought the Carillon out of bankruptcy in 2015. The property at the time was called Canyon Ranch Miami Beach. The original developer recharacterized what are “common elements” as “shared facilities” and hammered out the master declaration in a way that gave the private entity that owns a portion of the development, and not the unit owners, “perpetual control over the entire shared campus,” Hanzman wrote.

Z Capital argued that the associations are precluded from claiming the master declaration is illegal, because they did not raise such a claim when the property was purchased out of bankruptcy.

But Hanzman shot down this notion. The associations were not obligated to warn Z Capital that the master declaration might not be legal. In fact, Z Capital’s affiliates “walked into this ‘hornet’s nest’ with eyes wide open,” especially considering it had sophisticated attorneys for the purchase, the judge wrote.

“If it turned out that Florida law did not permit them to lawfully own some of the rights they claimed to have purchased, then so be it,” Hanzman said in his order.

The decision, though a landmark one in the case, hardly is the first or the last in the Carillon litigation that now is in its seventh year.

In the coming weeks, Hanzman is expected to rule on two more claims by the association. They are on whether the associations, with a vote by 75 percent of unit owners, can cancel spa fees; and if the associations can purchase pools at the North Tower for market value, according to Stearns.

Z Capital also has won portions of the litigation. In November, Hanzman sided with Z Capital and shot down the associations’ push for $450 million in damages due to an alleged “diminution in value” of the property, records show. The associations had claimed that Z Capital breached previous agreements that it would run the property as a top-notch resort by achieving a Forbes 5-star or AAA 5 diamond rating, a flagship hotel brand, and a level of service that equals that at Acqualina Resort & Residences in Sunny Isles Beach and other high-end condos in South Florida.

In December, a jury slapped Z Capital with a $16.3 million verdict for overcharging assessments, including inflating dues for the spa, hotel and electricity.

Earlier last year, Z Capital lost its push to levy a $7.7 million assessment on unit owners to recoup its costs for the case. Z Capital is appealing the order.