South Florida real estate continued to dominate headlines in 2022.

The pandemic-charged housing market frenzy slowed dramatically as a result of soaring mortgage rates, inflation and other economic pressures. After nearly two years of nonstop sales and rent hikes, renters and buyers were pushed to their limits, and the housing crisis worsened with affordability reaching record lows.

Billionaire hedge fund manager Ken Griffin seemingly couldn’t get enough of Miami. Griffin and his companies, Citadel and Citadel Securities, announced moving the firms’ headquarters to Miami from Chicago. Griffin spent hundreds of millions of dollars on residential and commercial real estate, setting records in the process.

The commercial market boomed. Despite a recent slowdown in office sales (and recession fears across the country), law firms, financial institutions and other companies continued to expand or relocate to South Florida, leading office asking rents to reach record highs. Hotel sales picked up, and hotel properties reported top daily rates and occupancy levels. The industrial market remained strong, with diminishing vacancies.

Developers zeroed in on the multifamily market, creating a massive pipeline of apartment projects throughout the tri-county region.

A month after the Surfside condo collapse marked its one year anniversary, the site’s sole bidder, Dubai developer Damac Properties, acquired the property. The collapse litigation came to a close after attorneys secured a $1 billion-plus settlement. Developers continued to target older condo buildings to tear down for development sites, as these properties faced even higher costs associated with maintenance, repairs and insurance.

Celebrities kept buying and selling pricey homes — including LeBron James, the family of Jeff Bezos, and actor Christian Slater. Countless divorces, lawsuits, and fraud indictments were filed. Among the wildest: Five people were charged with running a massive fraud that allegedly stole more than $1 million from South Florida’s largest homeowners association, the Hammocks.

South Florida housing market overheats

Bidding wars and lines around the block at open houses became the norm in the beginning of the year. Buyers offered sellers incentives in their efforts to secure a home in South Florida. Home prices, on the rise for years, continued to grow in the tri-county area throughout the year, despite the opposite occurring in other parts of the country.

But once the summer hit, the Fed’s repeated interest rate hikes, volatility in the stock market and more uncertainty put a damper on the market, especially compared to the frenzy experienced in 2021. In the latter half of this year, residential deal volume slowed way down, and price reductions became the norm. Apartment rent growth decelerated its pace.

Still, Miami became the most unaffordable housing market in the country. Miami-Dade County Mayor Daniella Levine Cava declared a housing crisis in April, allowing for federal rental assistance to be distributed. (Last week, Levine Cava expanded the Emergency Rental Assistance Program to include residents earning up to 140 percent of the area median income.)

Ken Griffin takeover

Billionaire hedge fund manager Ken Griffin for years had set the stage for his relocation, buying up an entire neighborhood in Palm Beach. But he ramped up his spending this year, before and after announcing he was relocating Citadel and Citadel Securities. On the commercial front, he acquired office buildings, as well as a bayfront site, in Brickell, where Sterling Bay will build an office tower. Citadel also leased space at 830 Brickell, the under-construction office tower attracting a number of well-heeled tenants. (Vlad Doronin’s OKO Group and Jonathan Goldstein’s Cain International are developing the building.)

On top of the Palm Beach properties, Griffin bought homes in Miami Beach, Coral Gables and Miami. The last deal, for Adrienne Arsht’s former estate, set a record for single-family home sales in Miami-Dade County. Citadel executives also began house hunting, driving up prices even more in some areas.

Office becomes the darling

Developers lasered in on offices this year, pitching projects in Miami Beach, Miami, West Palm Beach and other parts of the region. Billionaire Related Companies founder Steve Ross teamed up with Swire Properties to plan a 1,000-plus-foot office tower at Miami’s Brickell City Centre. This followed Ross becoming the biggest office landlord in West Palm Beach, where he has projects in the pipeline.

In Miami Beach, voters rejected developers’ plans for a pair of office projects off Lincoln Road on city-owned land.

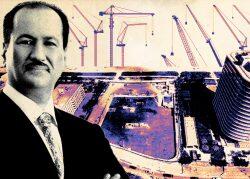

Developer juggernauts Related Group and Related Companies split

Miami-based Related Group, led by Jorge Pérez, and New York-Related Companies, led by Ross, split. The details of their partnership were somewhat murky, but both firms generally stayed out of each other’s territories (except for properties they worked on together) until this year. Sources said the change is in part because of the hot market in South Florida, and partly because Ross’ stake in Related Group had been diminishing in size over the years.

Both companies have continued to launch new projects and new partnerships in South Florida in 2022.

Read more of The Real Deal South Floridau2019s biggest stories