Real estate developers gleefully took advantage of the crypto craze, as newly minted cryptomillionaires looked to real-life property as a way to diversify. They purchased pricey homes across the country, particularly in cities like Miami – home to the FTX Arena – New York, and Los Angeles.

But that party came crashing down last week with the spectacular collapse of Sam Bankman-Fried’s FTX, the world’s second-largest cryptocurrency exchange. The fallout will be huge, with some estimates pegging the number of FTX creditors at 1 million. And then there’s the ripple effect many observers predict across the crypto space, with brokerages, other exchanges and crypto startups vulnerable to collapse.

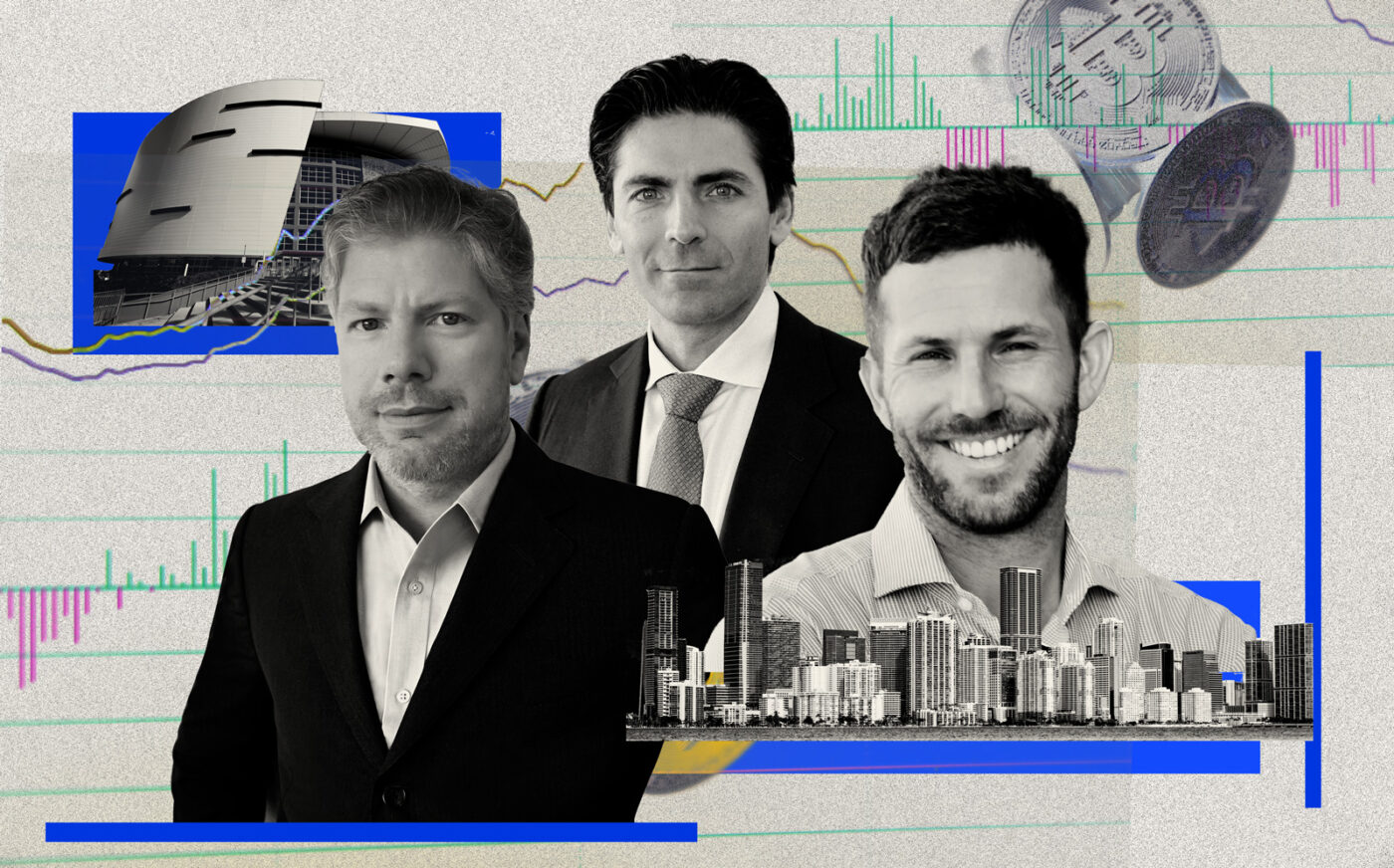

Crypto buyers were already pulling back on real estate spending, brokers said, and now dealmakers are experiencing a more dramatic slowdown since FTX filed for bankruptcy last week. Star broker Ryan Serhant called the collapse a “watershed moment” at The Real Deal’s Miami event.

It’s unclear what will happen to buyers who used FTX to purchase pre-construction condos with cryptocurrency.

“Crypto-rich, cash-poor buyers are probably in a little bit of trouble executing their contracts, especially if they are overleveraged,” said Erik Mendelson, a broker specializing in crypto transactions at Miami Real Estate Agency.

Read more

When Kevin Maloney’s Property Markets Group looked to appeal to crypto buyers, they tapped FTX to convert buyers’ funds to dollars, as many developers can’t or won’t directly accept cryptocurrency because their lenders or investors don’t allow it.

FTX collapse

— Dan Toomey (@dhtoomey) November 16, 2022

Ryan Shear, managing partner of PMG in Miami, said at the time that its arrangement with FTX would “bring increased security for our cryptocurrency payment processes offered to buyers.”

Currently have no funds being processed by FTX.

The partnership, announced a year ago, was fruitful for both parties: FTX took a cut of each transaction involving crypto at E11even Hotel & Residences Miami and the Waldorf Astoria Residences Miami, both under-construction condo towers.

It’s unclear how many buyers used FTX to pay their deposits, though PMG and E11even Partners reportedly sold half of the 461 units at the second E11even tower to crypto buyers. Through a spokesperson, PMG said that it and its buyers “currently have no funds being processed by FTX.” All deposits are in escrow.

In Miami’s urban core, Diesel Wynwood and Cipriani Residences are among the projects with FTX partnerships. This summer, FTX even partnered with the developer of a single-family home community in western Broward County called AKAI Estates in Southwest Ranches. A spokesperson for the developer said that “no crypto transactions” ever took place at the project.

Maybe they’re not looking at that $15 million home anymore, maybe they’re looking at that $5 million home.

Mendelson and others called PMG’s move a “marketing ploy” since it and other developers aren’t accepting crypto directly. But if some of those buyers are unable to make additional deposits to ultimately close on their units — because they lost too much crypto or they simply don’t have enough liquid funds — they could be forced to walk away from the money they’ve already put down.

“Who are they going to send their payment to?” said Madison Roberts, an agent with Oppenheim Realty. “Developers aren’t going to accept Bitcoin.”

Fortune International Realty’s Stephan Burke, who with his wife and partner, Carol Cassis, have been involved in a number of crypto-related deals, expect their buyers to ultimately close on their units at Mast Capital’s Cipriani Residences, a planned luxury condo tower in Brickell.

“These people have deep crypto pockets,” said Burke. “They could continue the scheduled deposits easily to crypto or they could use cash.”

Mendelson cautioned that the “FTX contagion” is ongoing. Liquid Global, a crypto exchange owned by FTX, halted all withdrawals on Monday. On Wednesday, the lending arm of Genesis, a crypto brokerage, suspended new loans and redemptions following a huge increase in withdrawal requests.

“Fortunately, my buyers are OG bitcoiners,” Mendelson said. “If you’re not custodying your own digital assets in cold storage, if you don’t have the access to your coins directly, it’s a liability. It’s a risk.”

He cited the adage, “not your keys, not your coins.”

Still, he acknowledged his clients are adjusting their budgets.

“Maybe they’re not looking at that $15 million home anymore, maybe they’re looking at that $5 million home,” he said.

The mysterious crypto investor who spent the then-equivalent of $22.5 million on a penthouse in Surfside last year is now looking to cash out, even if that means they will lose money. It’s been listed for as much as $28 million, but in November it returned to the market for $19.9 million.

Aaron Kirman, a top luxury broker in Los Angeles, received three calls over the past week from sellers in the $15 million to $45 million range who were “in a jam” due to the crypto meltdown, he said during an Instagram live Tuesday with TRD’s Hiten Samtani.

As developers distance themselves from FTX and the crypto buyer pool, brokers who have been working in the space for years say that longtime holders of crypto will eventually make their way back into the real estate market.

“Whenever markets are unstable [buyers] get emotional and scared,” Roberts said.

Crypto real estate deal volume has slowed down since the spring, but the “extreme instability” caused by FTX’s downfall will be “bad for everybody,” she added. The price of Bitcoin is down about 65 percent since late March.

“No one is buying [real estate] right now,” Roberts said. “And nor would I want them to.”