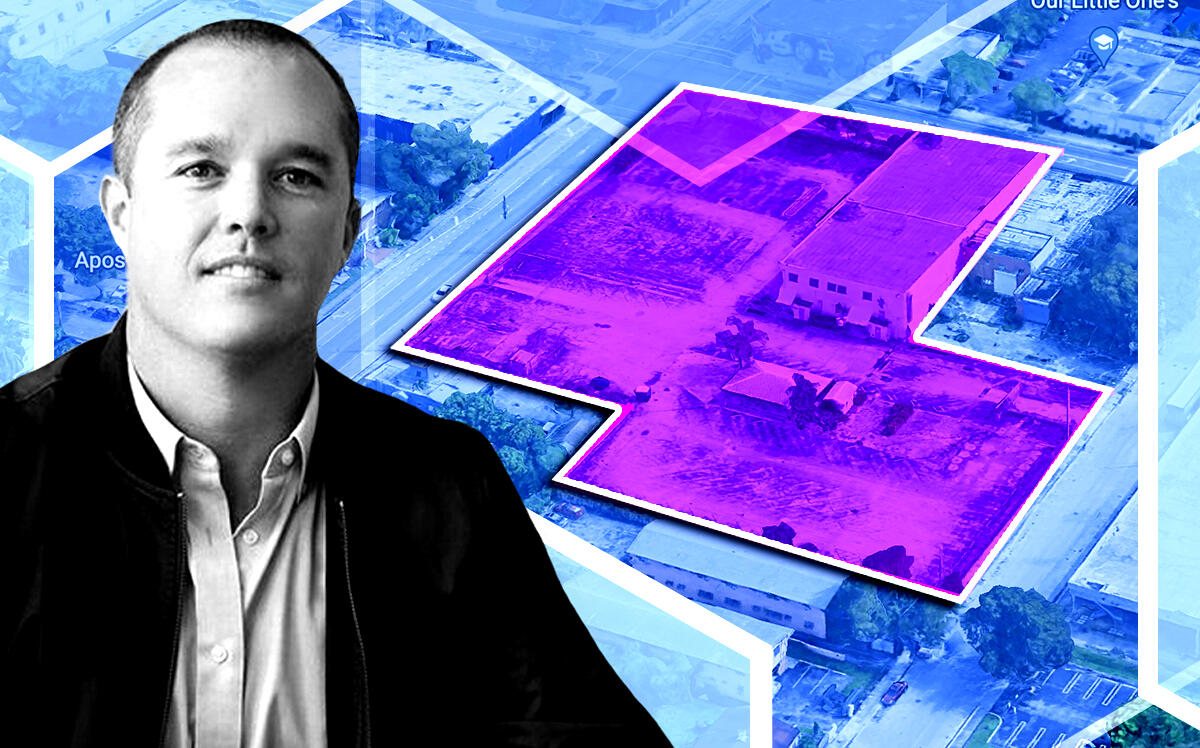

Investor Thomas Conway parted ways with an Opportunity Zone development site in Miami’s Little River where he had planned a mixed-income apartment project.

Conway, through one of his Qualcon Real Estate Fund affiliates, sold the 2.2-acre former Bellsouth telecommunications facility at 8038 Northeast Second Avenue and 165 Northeast 80th Terrace, records show. Three years ago, Qualcon paid $25 million for 1 million square feet of properties previously owned by defunct Bellsouth.

A Delaware entity with an address at 1111 Lincoln Road in Miami Beach paid $13.4 million for the Little River site, records show. Conway’s affiliate sold the properties, which includes a building completed in 1950, for nearly triple its 2019 purchase price of $4.5 million.

The site is in an Opportunity Zone, which allows investors to receive tax breaks on their capital gains for reinvesting in projects in underserved areas.

Alfredo Riascos with Gridline Properties represented Conway, and Tony Arellano with Dwntwn Realty Advisors represented the buyer in the off-market deal. Riascos and Arellano said they could not disclose the buyer’s identity due to a confidentiality agreement.

In July, the Miami City Commission approved Conway’s request to rezone 1.4 acres of the site to allow for a larger multifamily project, city records show.

“The upzoning allows for up to 150 units an acre, so about 330 residential units can be developed [on the entire site],” Riascos said. “The buyer acquired a site with tremendous development potential for multifamily.”

The zoning allows for a building of up to eight stories, but the height can be increased to 12 stories through city incentive bonuses, he said.

Arellano reached out to him about a year ago about representing a buyer interested in expanding its portfolio in Miami’s urban neighborhoods, Riascos said. “The seller never dictated he wanted to sell, but I approached him that I had a qualified prospect and would he consider it,” Riascos said. “The opportunity and the timing was right. We got to a point where the parties agreed on pricing and we were able to bring it to the finish line.”

Multifamily development in Miami’s Little River is gaining traction, so it made sense his client jumped on the chance to buy the former telecom property, Arellano said. “This is one of the largest aggregate land purchases in Little River,” he said. “Even with the headwinds in the economy, transactions like this are happening because there is an obvious opportunity.”

Last month, an investment group of Rock Soffer of Aventura-based Turnberry Associates, Guadi Castro of Miami-based Native Construction and Jose Vizcarrondo of Miami-based Cade Capital Partners, paid $5.8 million for a vacant site at 123 and 137 Northeast 79th Street. The trio plan to develop a market rate apartment project, but the partnership has not yet finalized its plans.