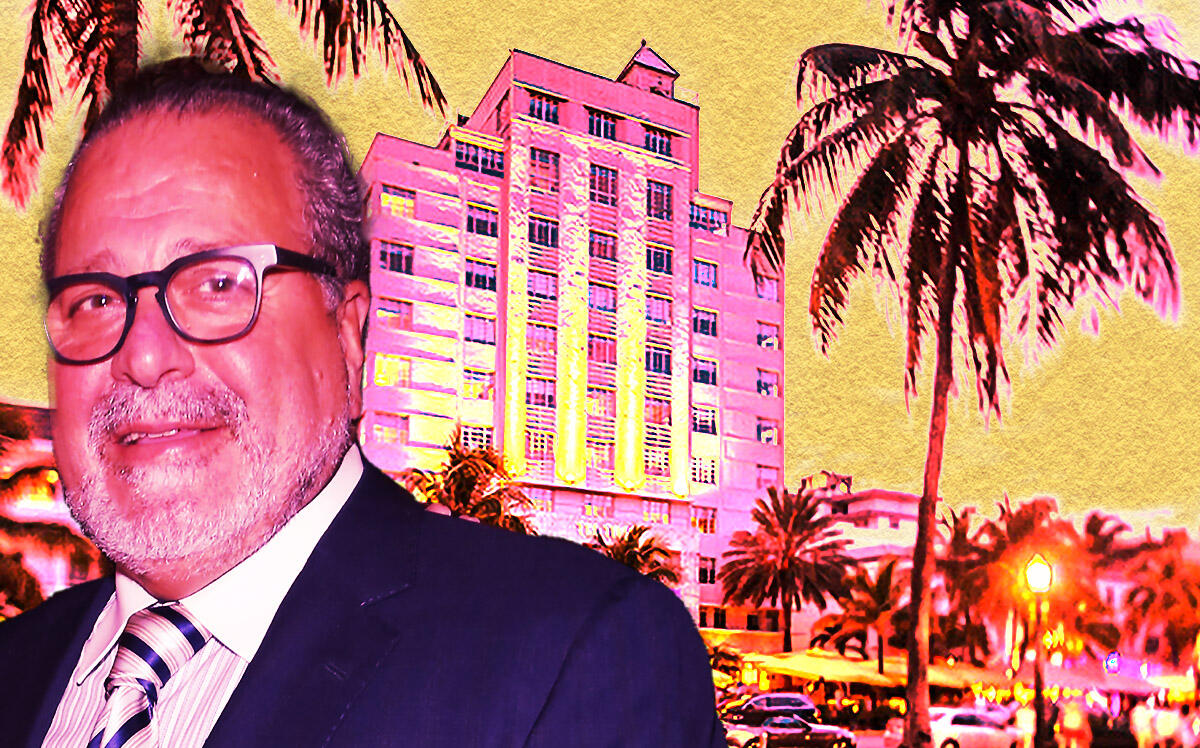

The lender for the Chetrit Group’s Tides South Beach hotel notched a win in its $45 million foreclosure case.

Safe Harbor Equity’s affiliate sued CG Tides and other companies linked to New York-based Chetrit Group over the long-shuttered Tides, a 45-key hotel at 1220 Ocean Drive in Miami Beach. The lender’s suit, filed in February 2021, alleged that Chetrit stole $2 million in insurance money tied to damages from Hurricane Irma, without the lender’s knowledge or consent, and allegedly defaulted on its loan.

This month, Miami-Dade Circuit Court Judge Judge Pedro Echarte Jr. granted the lender’s partial summary judgment. Following hearings in August and September, Echarte ruled that Chetrit did breach its mortgage agreement by transferring the insurance funds to its company bank account and the personal bank accounts of Joseph and Meyer Chetrit without their lender’s consent or knowledge.

The judge also ruled that the Chetrit entities breached their mortgage when they allowed their insurance coverage to lapse for months, and that they defaulted on the loan when they failed to pay it back by the extended maturity date of Dec. 20, 2020. Emails included as attachments to the filings revealed that the Chetrit ownership allowed insurance coverage to lapse at the start of hurricane season in 2020.

The loan is backed by the Art Deco hotel on Ocean Drive, as well as a mixed-use building fronting Collins Avenue that Chetrit redeveloped. Chetrit secured the $45 million loan in 2014 from Ocean Bank, which sold the debt to the Safe Harbor Equity entity in January 2021.

The judge wrote in his order that the filings show that “there is no genuine dispute as to any material fact regarding the occurrence of the foregoing defaults or the date on which default interest begins to accrue” according to the loan documents.

“We are grateful for the time that the court took to consider this matter, and we believe it came to the right result,” a spokesperson for Safe Harbor Equity wrote in a statement to The Real Deal.

Chetrit and its attorney, Dennis Richard of Richard and Richard law firm, did not respond to requests for comment.

Safe Harbor alleged that the insurance proceeds belonged to Ocean Bank, and by keeping the check without the bank’s approval, the Chetrit entities allegedly committed grant theft. Chetrit alleged that it notified Ocean Bank’s then-chief lending officer, Ralph Gonzalez-Jacobo, of the insurance check. Gonzalez-Jacobo died in late 2019, according to his obituary.

Chetrit has projects scattered across Miami Beach and Miami that have stalled at various stages. The firm owns the closed Miami Beach Resort, an oceanfront property at 4833 Collins Avenue, the under-construction Collins Park hotel redevelopment, and a development site along the Miami River where the firm planned to build a $1 billion project with 1,700 residential units, 330 hotel rooms, 266,000 square feet of retail and office space, and more than 2,000 parking spaces.

In May, Chetrit secured a $94 million construction loan for a planned waterfront luxury condo development in Pompano Beach. New York-based Madison Realty Capital provided the financing for Chetrit’s site at 2629 North Riverside Drive.

The family owned firm also recently completed a bulk purchase of condos at the aging Hollywood Beach Resort.

Last year, Chetrit sold a Miami Beach apartment hotel to its operator, Royal Stays Miami, for $42 million.