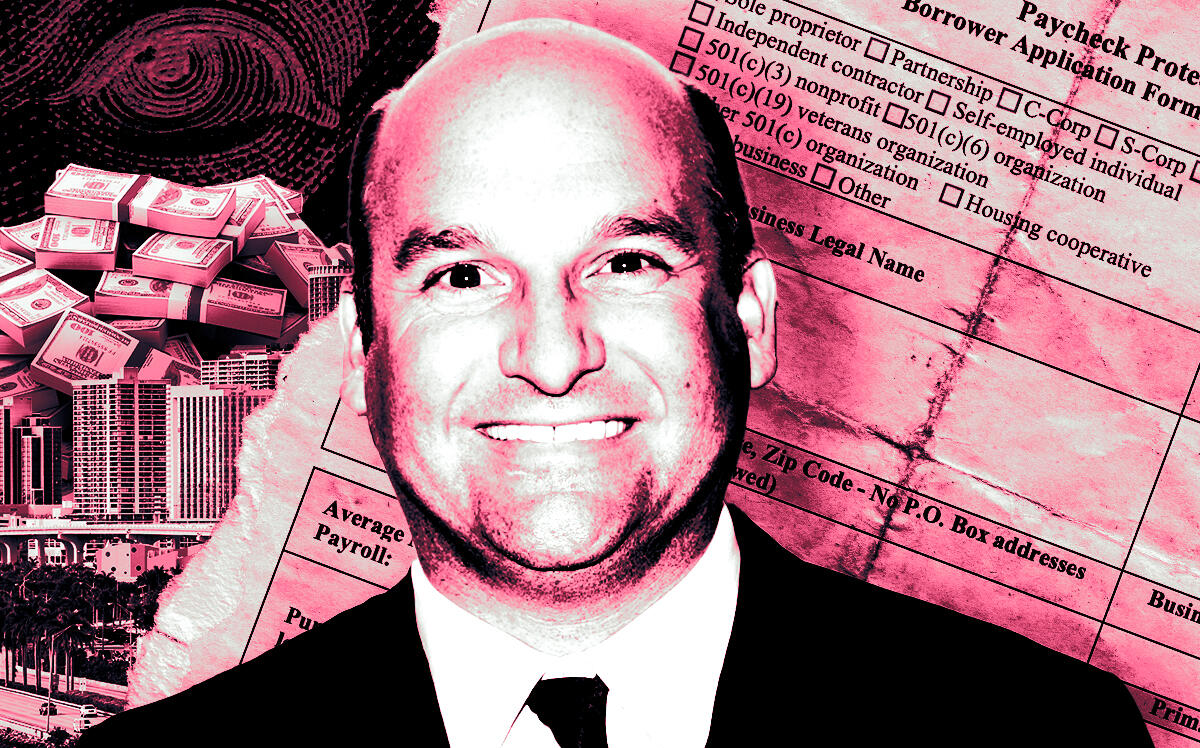

A Bal Harbour-based developer who was close pals with an infamous Ponzi schemer allegedly stole nearly $900,000 from the U.S. government’s Paycheck Protection Program, also known as PPP, according to a recent federal indictment.

Eric Sheppard, owner of WSG Development, is facing one felony count of wire fraud for allegedly submitting “false and fraudulent” applications to obtain Covid-19 financial assistance loans on behalf of six companies he managed in four states, including three based in Bal Harbour. During his 27-year career, Sheppard’s most significant project was his redevelopment of the historic Carillon Hotel at 6901 Collins Avenue into Canyon Ranch Hotel & Spa Miami Beach shortly before the 2008 real estate crash and global financial crisis.

In 2015, Z Capital bought the property for $21.6 million out of bankruptcy court and rebranded the project as the Carillon Resort & Spa after a management agreement with Canyon Ranch ended amid disputes between the condominium associations, the former property owner and Canyon Ranch. The Miami Beach property is now called the Carillon Miami Wellness resort.

According to his LinkedIn profile, Sheppard’s WSG is still doing business. His company is involved in the acquisition, development and construction of commercial and residential projects in 13 states, his LinkedIn states.

Since the Small Business Administration began handing out financial assistance funds two years ago to companies suffering business losses caused by Covid-19-related government shutdowns and restrictions, federal law enforcement agencies have been cracking down on a long procession of alleged scammers ripping off PPP loans. Companies are supposed to use the loans to keep employees on their payroll. If the funds were used for eligible payroll costs, payments on business mortgage interest payments, rent, or utilities, companies could seek loan forgiveness.

From March 2020, when Congress passed the first Covid-19 relief package, through March of this year, the Internal Revenue Service conducted 660 criminal investigations related to Covid-19 fraud totalling $1.8 billion in stolen funds, according to the IRS.

Since last year, Florida has led the nation in crimes involving Covid-19 relief fraud, according to the Miami Herald.

Sheppard’s entities received the allegedly ill-gotten loans between April 2020 and March 2021 through intermediaries that are not identified in the indictment, the document shows. The indictment also doesn’t explain if the six companies were involved in real estate development.

In a joint statement, Sheppard’s criminal defense lawyers Jon Sale and Jonathan Etra said their client properly utilized the PPP loans for their intended purpose of paying his construction workers and buying construction materials to build a new 60,000-square-foot store leased to a national retailer that was “successfully completed” in 2020. The store is in a Florida shopping center Sheppard developed and that maintained “full operations for other struggling tenants,” the statement said.

Sale and Etra did not disclose the shopping center’s name, nor the city it is in.

“In the uncertain times at the height of the Covid pandemic, when other companies were shutting down, Mr. Sheppard, a leading developer and job creator who has contributed greatly to his community, acted legally and lawfully to keep a multimillion-dollar construction project open and underway, despite the significant challenges of Covid, and construction laborers and workers got paid,” the statement said.

Sheppard remains free on a $200,000 bond, and his arraignment in Miami federal court is set for next Friday, court records show. If convicted, he faces a maximum 20-year prison sentence.

Sheppard’s latest legal trouble comes nearly a decade since he settled a federal lawsuit against WSG and Sheppard that alleged he used his development firm to divert nearly $40 million to Capitol Investments USA, a wholesale grocery distribution company owned and managed by Nevin Shapiro.

In 2010, Shapiro pleaded guilty to one count of securities fraud and one count of money laundering in one of the biggest fraud cases in South Florida history. Shapiro, who was sentenced to 20 years in prison and ordered to pay about $83 million in restitution, allegedly used Capitol Investments as a front to run a $930 million Ponzi scheme. In 2020, as part of a federal mandate to prevent medically at-risk inmates from contracting Covid-19, Shapiro was transferred to home confinement, where he is being monitored and is serving the remainder of his prison term, Yahoo! Sports reported.

Federal prosecutors accused Shapiro of using his ill-gotten gains to finance his lavish lifestyle, including $26,000 monthly mortgage payments for a $6 million waterfront estate in Miami Beach and $400,000 for floor-seat tickets to Miami Heat games, according to published reports. During his incarceration, Shapiro, who was a bigtime University of Miami sports booster, also gave interviews to sports news outlets in which he admitted to giving money, cars, yacht trips and jewelry, among other prohibited gifts, to football recruits, players and coaches.

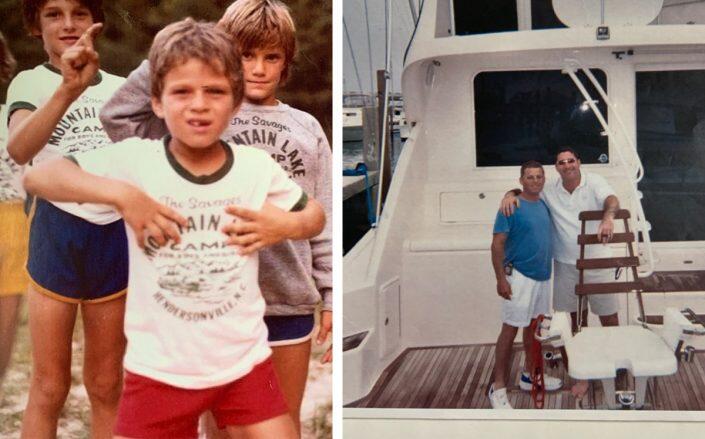

Shapiro and Sheppard were childhood friends who grew up in Miami Beach, published reports show. The Real Deal also obtained photos of the pair as kids attending summer camp and on a youth soccer team, as well as a photo of the former chums courtside at a Miami Heat game and on a boat.

Eric Sheppard (R) and Nevin Shapiro (L) were childhood friends who did business together as adults.

After Shapiro went to prison, Capitol Investments’ bankruptcy trustee went after Sheppard and other individuals who allegedly received illicit payments from Shapiro, in an effort to claw back investors’ funds. In the 2011 lawsuit, the trustee alleged Sheppard provided loans to Capitol with no formal documentation. In exchange, Shapiro would pay Sheppard directly, instead of paying WSG, which resulted in Sheppard receiving hundreds of thousands of dollars in fees at criminally usurious interest rates, the lawsuit alleged.

In 2012, even though Sheppard maintained he was also a Shapiro victim, he agreed to pay back $700,000 to settle the lawsuit. Shapiro was ordered to pay $1.3 million in restitution to WSG, court records show.

By then, Sheppard had lost large chunks of his South Florida real estate holdings. In 2009, Lehman Bros. Holdings, an affiliate of the bankrupt Lehman Brothers bank, took control of a majority of the units at the Canyon Ranch property through a $301.2 million deed in lieu of foreclosure. In 2010, Lehman Bros. Holdings also foreclosed on a neighboring hotel property and a development site in West Palm Beach that were both owned by WSG. Sheppard had defaulted on more than $200 million in Lehman Brothers loans, according to published reports.