The South Florida housing and rental markets are prospering amid an influx of out-of-state buyers and renters — but much of the local workforce is taking a hit from escalating prices.

Among them are some in the health care and education fields, as well as firefighters, whose wages are lagging the skyrocketing housing costs, according to a newly released Florida Realtors report.

The study examined how much more these workers need to earn to afford buying or renting in several metropolitan areas in Florida, including the southern region, consisting of Miami-Dade, Broward and Palm Beach counties.

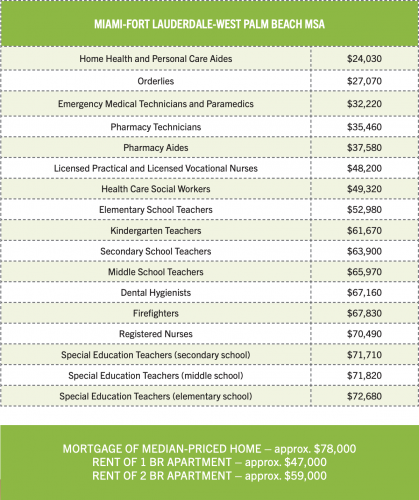

Chart via Florida Realtors

The median priced house in South Florida requires roughly $78,000 in annual income, and a one-bedroom apartment calls for roughly $47,000 in annual income, according to the report. The study was premised on homebuyers and renters spending no more than 30 percent of their earnings on housing costs, the federally deemed maximum before a household is considered cost burdened.

Home health care and personal care aides are the most priced out of the 17 occupations examined, as they would need to earn more than three times their median annual salary of $24,030 to purchase a home, and nearly double their salary to rent a one-bedroom unit, according to the report.

Licensed practical and vocational nurses, whose median income is $48,200, also are priced out of homebuying, while registered nurses, whose median income is $70,490, are better positioned, but still fall short, according to the report.

Florida Realtors also examined the gap for first responders, showing EMTs and paramedics’ median annual salary of $32,220 is well below the amount required to purchase or rent a home. Firefighters fare slightly better, but face a roughly $10,000 gap in buying a home. Still, their median salary of $67,830 is more than what is needed to rent a one-bedroom unit, and also is above the $59,000 median annual income needed to rent a two-bedroom apartment, according to the report.

As for teachers, how far off they are from achieving the American dream of homeownership depends on the type of educators. Elementary school teachers earn a median salary of $52,980. Kindergarten and middle school teachers fare slightly better, earning a median salary of $61,670 and $65,970, respectively, according to the report. Special education teachers, who earn in the low $70,000s, are in a better position to buy a home.

South Florida home prices continued their upward trajectory in the fourth quarter of 2021. In mainland Miami near Biscayne Bay, the median single-family house price jumped 17 percent to $560,000, year-over-year, according to Douglas Elliman reports. The median price in Fort Lauderdale rose 12 percent to $572,500; and in West Palm Beach, it climbed 16 percent to $419,000.

In the meantime, rents also have escalated, with Miami posting a 38 percent increase in 2021, the highest nationwide, according to a Zumper report. Much of the squeeze for locals is caused by the influx of newcomers, creating more competition for units. The transplants often are keeping their higher paying out-of-state jobs, and are better positioned to afford the increasing rents.

The Florida Realtors report shows the rest of the state also is faced with skyrocketing housing costs and lagging incomes.

In December, the median sale price of a house in Florida was $373,990, up 21 percent from December 2020, and up 58.2 percent from five years ago. Yet, the report cites Census data showing that median income was $59,227 in 2019, up less than 5 percent from the previous year.

The report was issued as the Florida Legislature is considering the Florida Hometown Hero Housing Program bill. It would provide no-interest loans to help workers on the frontline of fighting the Covid-19 pandemic with down payments and closing costs. The bill targets households whose earnings do not exceed 150 percent of the state or local median income.