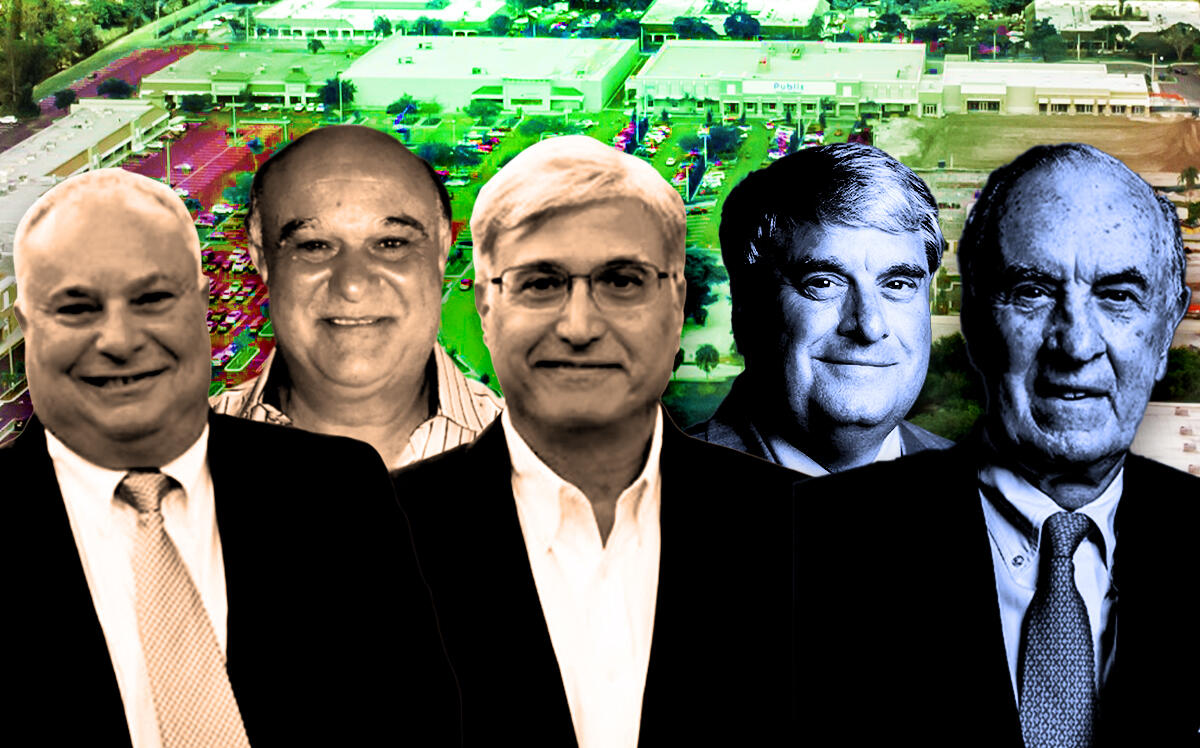

Jacksonville-based Sleiman Enterprises bought the Publix-anchored Delray Square shopping plaza for $48 million, marking continued appetite for retail centers with grocers.

Records show an affiliate of The Keith Corporation, based in Charlotte, North Carolina, sold the 162,412-square-foot, multi-building property at 14620 South Military Trail, as well as at 4751 and 4789 West Atlantic Avenue in Delray Beach. The buyer is Delray Square Land Trust, with Property Management Support as trustee, which ties to Sleiman Enterprises.

The buyer borrowed $32.5 million from The Guardian Life Insurance Company of America for the purchase.

(Source: ISRAM Realty Group)

Delray Square, built in 1976 on 16 acres, was redeveloped in 2019, with improvements including roof renovation, LED lighting in the parking lot, facade overhaul and several new buildings, according to a Sleiman Enterprises news release. Publix relocated to one of the newly constructed buildings, in a 45,600-square-foot space.

Hobby Lobby is moving into the building with the renovated roof this year, the release states.

Delray Square is 96 percent leased. Other tenants include Walgreens, Chipotle and Chick-fil-A.

The Keith Corporation, led by Graeme and Greg Keith, bought the plaza out of foreclosure in 2014 for $7.7 million, records show. As part of the renovation, The Keith Corporation also demolished a movie theater.

Founded in 1989, The Keith Corporation has developed more than 400 commercial real estate projects spanning over 44 million square feet and worth $3.6 billion, according to its website. It has projects throughout the U.S., as well as in Australia, Canada, Mexico and the United Kingdom. It also has brokerage, acquisition and property management divisions.

Family owned Sleiman Enterprises traces its roots to 1955 when husband-and-wife Eli and Josephine Sleiman started buying investment properties in and near Jacksonville, which eventually led them to develop 7-Elevens, according to the company’s website. As the firm grew, it increasingly focused on projects anchored by marquee tenants such as Publix, Bed Bath & Beyond, Target and BJ’s Wholesale Clubs, with its portfolio spanning the Southeast U.S.

Sleiman Enterprises is led by Principals Toney, Joe and Eli Sleiman.

The deal comes as the South Florida retail market is seeing vacancies drop and rents creep up.

The Palm Beach County vacancy dropped to 4.9 percent in the fourth quarter of last year, from 5.2 percent in the same quarter of 2020, according to a Colliers report. Year-over-year, the average asking rent reached $27 a square foot, up from $23.44 a square foot.

Although the market took a hit during the pandemic lockdown and continued growth of e-commerce, grocer-anchored plazas remained in demand. In December, Union Investment bought the Publix-anchored, fully leased Fountains of Boynton shopping center for $79.5 million.