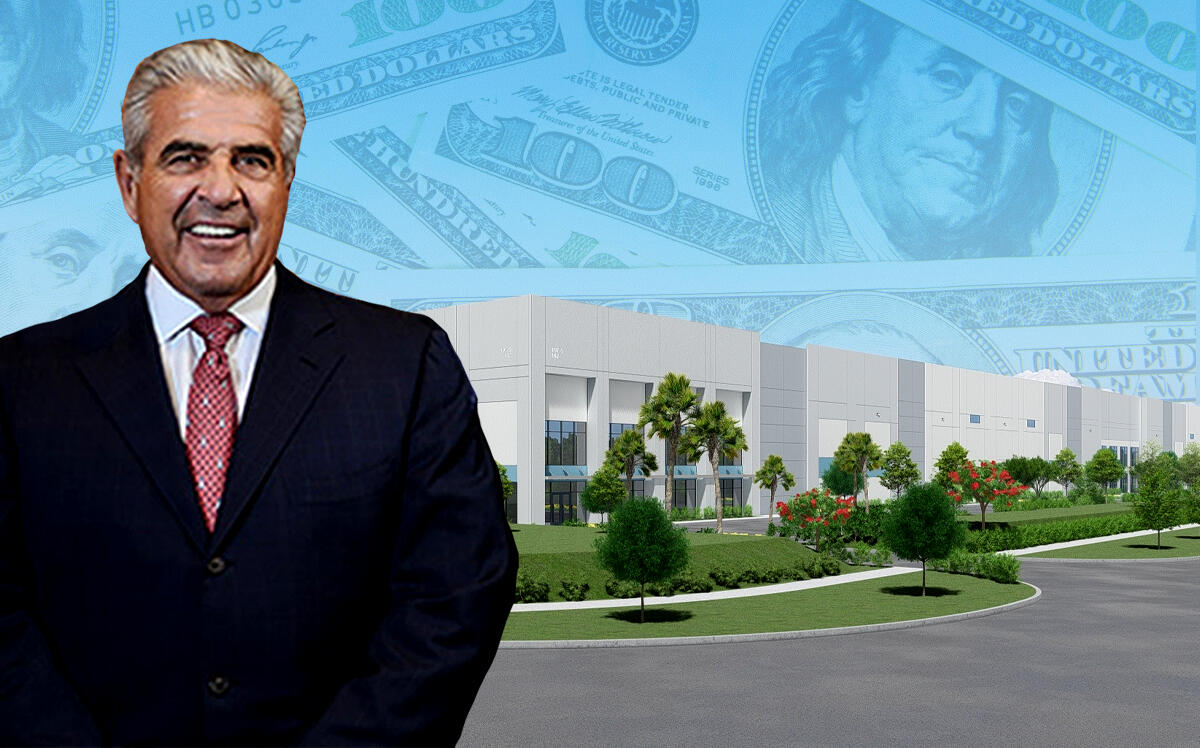

A joint venture between Easton Group and LBA Logistics dropped $29.4 million for an industrial development site in Hialeah, marking the partners’ latest project in Miami-Dade County.

The partnership bought a 26.4-acre vacant property used as a truck yard at 4220 West 91st Place in Hialeah, according to a press release. Easton Group and LBA paid about $1.1 million an acre.

The seller, DMG Properties LLLP managed by Naples attorney Kevin Carmichael, paid $920,000 for the land in 2001, according to records.

Easton Group, led by founder and CEO Ed Easton, submitted plans to the city of Hialeah to build a pair of spec warehouses totaling 462,954 square feet, the release states. Each building will have 36-foot clearance heights, and the entire site will have 124 stalls for trailers and 407 parking spaces. The joint venture plans to start construction near the end of this year, according to the release.

Easton Group associate Dalton Easton said in a statement that the joint venture controls more than 40 acres in the Hialeah submarket, including 16.8 acres in Hialeah Gardens where the two companies are building a 266,760-square-foot warehouse project.

The joint venture is also building a warehouse in Doral.

In May, the partnership scored a $24 million loan to build the Hialeah Gardens project. Also last year, Easton Group and LBA Logistics landed $12 million in construction financing for its spec warehouse project in Doral.

Easton Group is a Doral-based, family run commercial real estate development and investment firm founded in 1974, according to the company’s website. LBA Logistics is an Irvine, California-based real estate investment firm focused on industrial assets, according to the company’s website.

Miami-Dade’s industrial market doesn’t show any signs of slowing down after experiencing a record year in 2021, according to a recent JLL report. Leasing activity was fueled by high demand from e-commerce, consumer goods and distribution tenants. The vacancy rate hit 2.6 percent in the most recent quarter, a new record for Miami-Dade, the report states.

The market also had a net absorption of 2.6 million square feet in the fourth quarter, bringing the total net absorption to 7.8 million square feet for all of 2021 in Miami-Dade, crushing a previous high of 4.3 million square feet in 2015, according to JLL.

Ed Easton said in a statement that the industrial market is going through one of the busiest cycles of his nearly 50-year career. “Demand is as strong as I have ever seen it,” he said. “With vacancies dropping and rents climbing, I do not see this upward trend slowing any time in the near future.”