Qatari firm Al Rayyan Tourism Investment Company is set to close on a $188 million refinancing for the St. Regis Bal Harbour resort.

The loan comes a year after the Reuben Brothers acquired a $132 million mortgage that backed the oceanfront resort. The new commercial mortgage-backed securities loan values the hotel at $331 million, according to DBRS Morningstar.

Al Rayyan, or ARTIC, will pay its existing loan and will cash out $44.5 million of its equity, DBRS Morningstar reported. The loan is expected to close next week.

Read more

ARTIC paid $213 million for the hotel at 9703 Collins Avenue in 2014, in a deal that broke down to more than $1 million per room. The 27-story luxury condo-hotel includes 192 keys and 24 condo-hotel third-party owned units that are part of a rental management program. It was built in 2011.

The hotel is in the center tower of a three-tower development on 21 acres. ARTIC invested nearly $40 million into renovating the property since it acquired the hotel seven years ago, according to DBRS Morningstar.

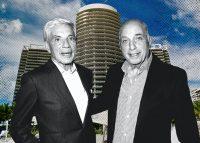

In November 2020, Reuben Brothers, the private equity and investment firm led by British billionaire brothers David and Simon Reuben, acquired the $132 million note from Mack Real Estate, which was issued in August 2018.

Confidence is returning to the hotel market in South Florida. As the DBRS Morningstar report notes, the St. Regis remained open throughout the pandemic, with high average daily rates and occupancy. The analysis states that any cost-cutting that benefited the hotel during the pandemic could be temporary, “as luxury travelers will again demand a high level of service.”

“Removing the impacts of the pandemic, DBRS Morningstar believes the property has the ability to capture upscale transient business and an affluent guest base throughout the fully extended loan term,” the report continued.

Elsewhere in South Florida, the Abu Dhabi Investment Authority recently closed on a $180 million refinancing of the Miami Beach Edition, an oceanfront hotel it acquired six years ago for $230 million. First Abu Dhabi Bank and the National Bank of Kuwait provided the financing.