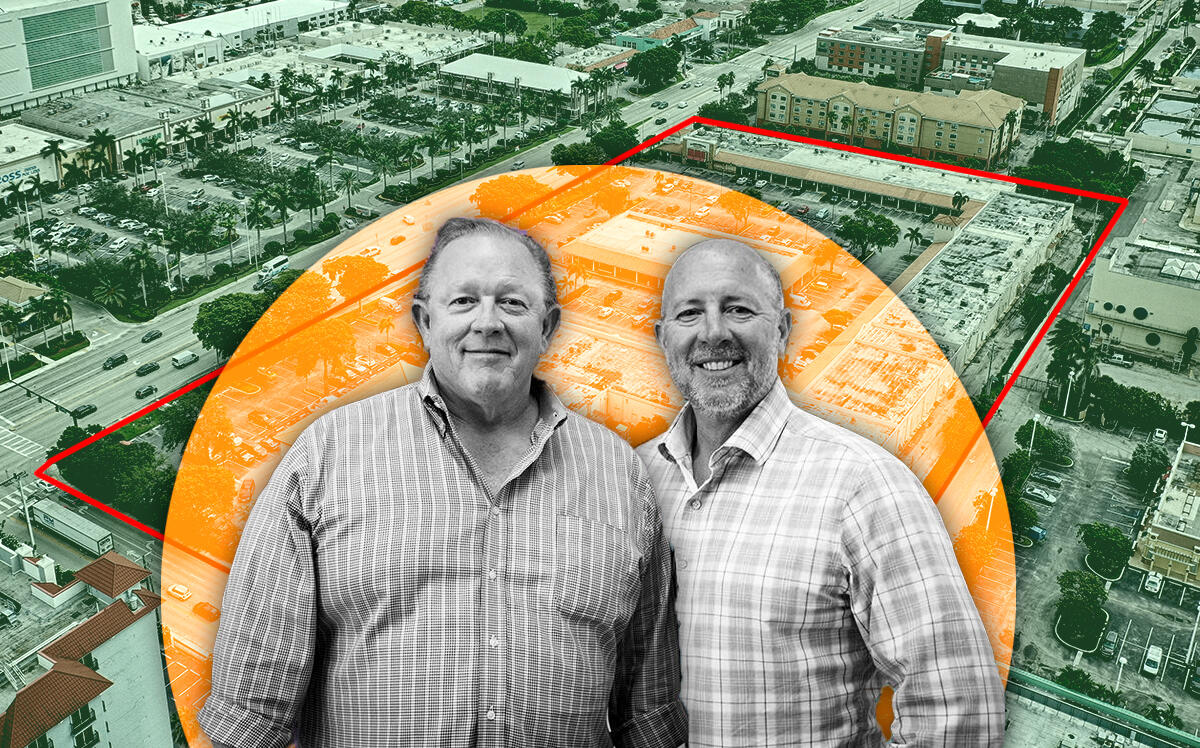

UPDATED, Oct. 25, 4:47 p.m.: Steven Hudson and Charles Ladd Jr. are not slowing down their Broward County retail shopping spree, as they scooped up the South Harbor Plaza in Fort Lauderdale for $40.5 million.

The real estate honchos, through their Chapter Two Investments, along with co-investors Las Olas Capital Advisors and Foreward Management, bought the retail-office property at 1300 Southeast 17th Street, according to a news release.

Las Olas Capital, based in Fort Lauderdale, and led by Paul Tanner, provided $18 million in equity financing through its Real Estate Fund III. Valley Bank provided a $20 million acquisition loan, according to the release.

The purchase closed in three deals from different seller entities, two led by Andrew Martin. The third seller is South Harbor Plaza Joint Venture.

The 91,634-square-foot Sunset Harbor spans 8.2 acres and has 750 feet of frontage along the 17th Street Causeway, according to the release. Martin developed it in 1982.

The plaza is 82 percent occupied, with tenants that include Mexican restaurant Carlos & Pepe’s, Clearsight Opticians, Carrabba’s Italian Grill and Stretch Zone.

Talks are ongoing with new tenants as well as existing tenants to extend their leases, Hudson said.

Hudson co-founded Fort Lauderdale-based Hudson Capital Group with his father, Harris “Whit” Hudson, in 1997, according to the firm’s website. Ladd leads Barron Real Estate, also based in Fort Lauderdale.

The duo’s Foreward Management will run Sunset Harbor.

This is Hudson and Ladd’s third retail purchase in South Florida this year. In June, they bought the Oakland Park Festival Centre at 3400-3580 North Andrews Avenue for $23.4 million, and the Primavera Plaza at 830 and 840 East Oakland Park Boulevard, also in Oakland Park, for $10 million.

They also partnered with Las Olas Capital on these purchases, as Las Olas’ Fund III had raised roughly $34 million for all three acquisitions, according to Hudson.

Their investment in retail is not surprising, as the South Florida market has shown signs of rebounding after last year’s lockdown.

Rents have surpassed pre-pandemic levels, as vacancy rates dropped. A Colliers third quarter report showed that Broward’s average asking rent reached $22.96 per square foot, up from a previous high of $22.83 a square foot in the fourth quarter of 2019.

Correction: An earlier version of this story misidentified the property and the funds raised by Las Olas Capital.