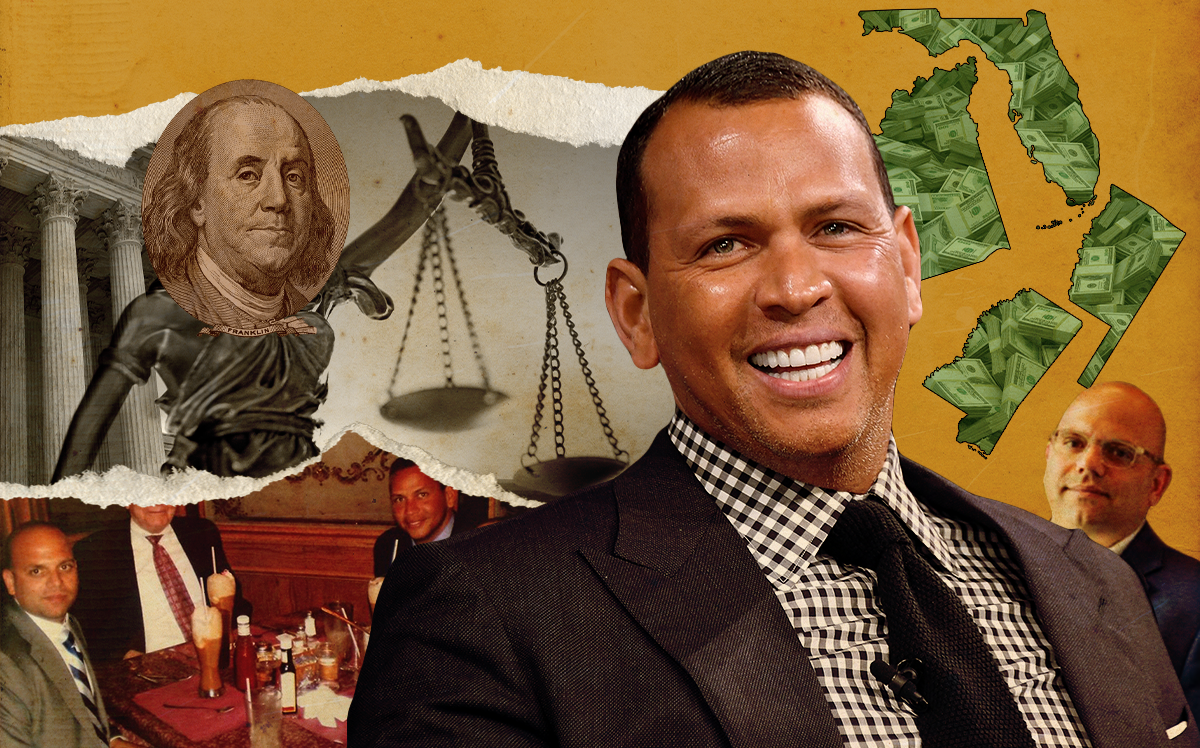

Former baseball slugger Alex Rodriguez has gotten 13 lawsuits dismissed that were filed by his former brother-in-law, Constantine Scurtis, over their unraveled real estate venture.

A Miami-Dade Circuit Court judge’s ruling to dismiss the suits means A-Rod is cleared of tens of millions of dollars in potential damages. Yet other litigation is still headed to court that could put Rodriguez on the hook for as much as $50 million.

Rodriguez and Scurtis’ former real estate partnership spanned more than 5,000 multifamily units purchased for $300 million in the early 2000s in Miami as well as in Texas, Mississippi, Indiana and Oklahoma, according to court filings. The properties largely were Class C apartments they planned to upgrade and hold long-term, but plans also included a vision to develop a 782-unit luxury condominium on their Edgewater assemblage they had dubbed “Promised Land,” Scurtis claimed in court.

Scurtis – whose sister Cynthia Scurtis is Rodriguez’s ex-wife – sued the ex-Yankee turned real estate mogul in 2014, saying the retired player cut him out of their partnership in 2008 — and his earnings. Rodriguez is a “liar” who first cheated on Cynthia Scurtis, and then, as a vendetta for the divorce, turned around to cheat his ex-brother-in-law, Scurtis alleged.

Rodriguez responded in court filings, saying Scurtis was caught dipping into their partnership’s funds to the tune of $1.4 million, and pushed back on other allegations.

In a countersuit filed in December, Rodriguez alleges that Scurtis’ 2014 lawsuit was a way to extort and harass Rodriguez, as well as wiggle out of refunding money Scurtis took.

Scurtis, who leads Texas-based multifamily investor Lynd’s acquisition arm, fired another set of 13 related lawsuits in January, on behalf of entities the duo had used to buy real estate.

Miami-Dade Circuit Judge Michael Hanzman shot down those 13 complaints last month, saying they came too late after a state law deadline to claim wrongdoing. Hanzman’s Aug. 24 judgment came on the heels of another ruling that struck eight of Scurtis’ 59 counts in his 2014 suit.

Although all this cuts out a substantial chunk of Scurtis’ gripes, other allegations for roughly $50 million could be headed to trial, including allegations of Rodriguez committing civil racketeering.

Scurtis deferred comment to his attorney, Katherine Eskovitz, who said they are looking forward to continuing their battle at trial. The trial is expected to start once the mask mandate is lifted.

Rodriguez’s attorney, Alaina Fotiu-Wojtowicz, said via email that they have a “mountain of evidence contradicting” Scurtis’ accusations. Rodriguez’s countersuit is for hundreds of thousands of dollars, and Scurtis is exposed to millions more for litigation fees, she said.

“Rather than focusing on pleading and proving viable claims, Constantine Scurtis has spent seven years using this litigation to smear Mr. Rodriguez, chase irrelevant issues, and try his case in the press,” Fotiu-Wojtowicz added in her statement.

Scurtis previously had included references in his suit to a news story that alleged that Rodriguez was seen going into a hotel room with a stripper. In February, Hanzman ordered this scrubbed from the record, saying this was irrelevant and that the litigation “will not devolve into a soap opera.”

Quarrels

Rodriguez and Scurtis started their venture shortly after the baseball player married Cynthia Scurtis in 2002, according to Scurtis’ suit.

The well-heeled former Texas Rangers and New York Yankees player bankrolled the purchases, entitling him to 95 percent of profits.

Rodriguez already separately had ventured into real estate and other investments through his A-Rod Corp, founded in 1995, and also into development through his Newport Property Construction. And Rodriguez continues to invest in real estate. He is among the backers of Grand Station Apartments in downtown Miami.

According to Scurtis’ lawsuit, he was the brains of the venture, picking properties they bought, entitling him to 5 percent of profits and a 3 percent acquisition fee.

The partners used a different entity to buy each property, with Scurtis and Rodriguez as limited partners of the buyers, and Scurtis also controlling the general partners, which were ACREI, ACREI-II and ACREI-III, Scurtis claims in his suit.

They prospered so much so that even entrepreneur Warren Buffett allegedly was wowed. After they met with Buffett, he wrote to them commending their investments. “In fact, I can’t think of a more logical program than the one you are following,” Scurtis claims Buffett wrote.

Things went awry when Rodriguez and his ex-wife divorced in 2008, shortly after news of his alleged infidelity broke. Scurtis alleges that Rodriguez put up his “paramour’s” parents in a condo unit their venture owned.

“After Rodriguez’s wife discovered the truth about Rodriguez’s infidelity and filed for divorce, Rodriguez then turned on Scurtis and cheated him,” Scurtis alleges in his complaint.

First, a Rodriguez associate kicked out Scurtis from the office. And despite a text from Rodriguez about a follow-up meeting when they can work things out, the rendezvous never happened, according to Scurtis’ complaint. Then, Rodriguez and his associates allegedly transferred Scurtis’ interest in the three ACREI entities to a Rodriguez-controlled entity, and sold much of the real estate for less than market value during the Great Recession, behind Scurtis’ back. In some cases, properties allegedly were sold to Rodriguez affiliates.

Scurtis claims that this not only denied him the opportunity to reap profits, but also to buy out the real estate.

According to his suit, other alleged shams exposed Scurtis to significant financial risk. Rodriguez and his cronies made the portfolio look profitable to a lender by having their employees pay rent, even though they did not live in the apartments, Scurtis claimed in court. Staff members then were repaid with checks for purported professional or consulting fees.

In his countersuit, Rodriguez alleges that Scurtis was paid everything he was owed, and Scurtis is the one who owes money. When Scurtis’ withdrawal of nearly $1.4 million was discovered, the partnership decided to treat it like a loan that Scurtis would pay back from his fees on property deals. Scurtis still owed $800,000 when he first filed his suit, according to Rodriguez’s suit.

Furthermore, Rodriguez claims that Scurtis was not pushed out of his control over the ACREI entities, but voluntarily transferred the interest in 2005. Also, properties were not sold to Rodriguez affiliates, he added in his suit.

“Promised Land”

Exactly how much money is at stake for Rodriguez under the remaining claims is unclear.

A report by a Scurtis-hired expert alleges Scurtis could have been out a hefty amount, although Rodriguez’s attorneys have pushed back on the way calculations were made.

If the partnership had pursued its plan to hold the real estate long-term, but sold the “Promised Land” lots in Edgewater, then Scurtis suffered $23 million in damages, according to his expert’s analysis. If the venture had held the real estate, improved it and developed the Edgewater project with additional investors, then it is closer to $209 million.

Property records show one of the lots part of the “Promised Land” assemblage was sold to the Melo Group for $993,900 in 2009. On it, Melo plans to start construction in 2022 on its roughly 800-unit Aria Reserve, where half of its units have presold so far.