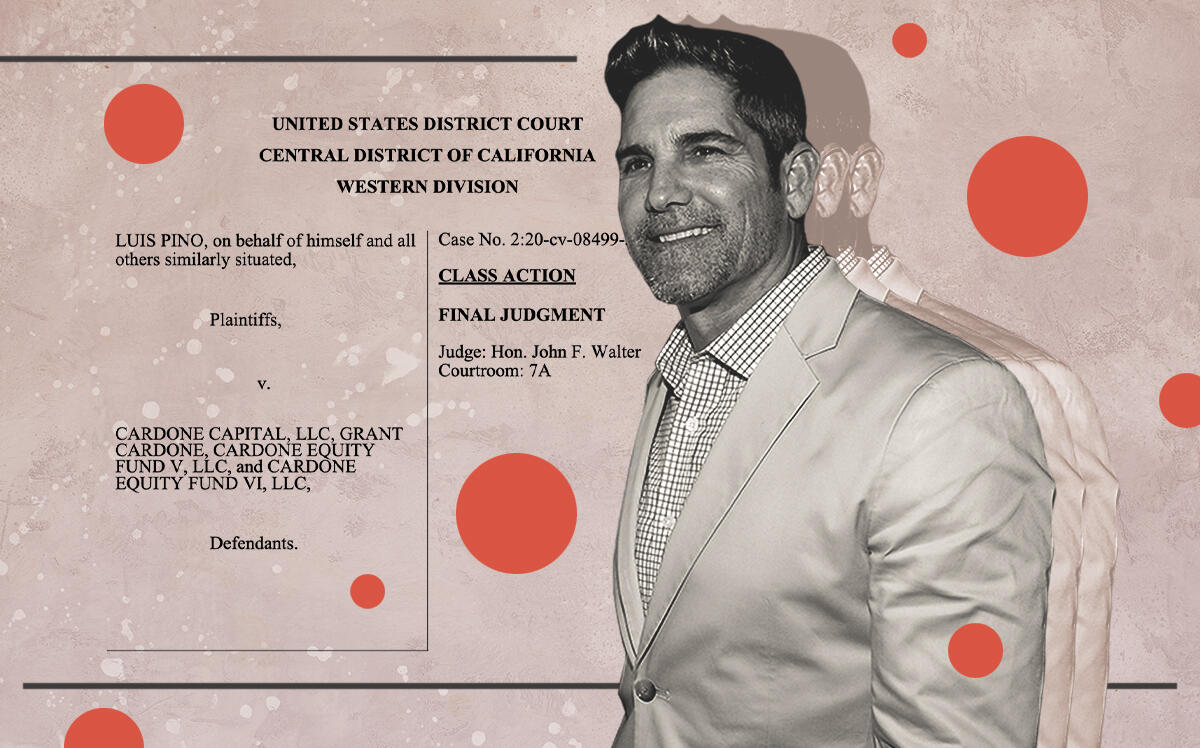

A legal offensive that attempted to use Grant Cardone’s outsized social media presence against him has failed.

U.S. District Judge John F. Walter last week dismissed a lawsuit filed by disgruntled investor Luis Pino in Los Angeles against the real estate crowdfunding guru and his Aventura-based company Cardone Capital.

In dismissing the case, Walter concluded that Pino failed to adequately allege that Cardone made material misstatements and omissions about a 15 percent annual rate of return on any investments made to Cardone Capital’s real estate funds; as well as the likelihood and amount of cash distributions for investors; and the acquisition and financing of properties purchased by the Cardone funds.

Cardone told The Real Deal that he blamed Pino’s lawyers for filing a weak case that had no merit.

“It is a shame that in our society, ambulance seeking, vampiric blood-drinking litigation attorneys attempt to threaten people like me who are trying to build businesses,” Cardone said. “The case was completely baseless. There was zero truth to the allegations.”

Pino’s lawyers, Krysta Kauble Pachman and Marc Seltzer, did not immediately respond to phone and email messages seeking comment.

Pino, an Inglewood, California resident who invested $10,000 in two Cardone funds in September 2019, alleged that Cardone Capital ignored warnings from a Securities and Exchange Commission enforcement lawyer. The lawyer’s warnings were to remove misleading claims about a monthly distribution investors would receive that amounted to about a 15 percent annual return on investment, according to the suit.

Pino’s complaint, which sought class action status on behalf of other Cardone Capital investors, alleged that Cardone pitched a wealthy lifestyle similar to his, if people put money into his real estate crowdfunding business.

The lawsuit cited a Sept. 17, 2019 Instagram video post in which Cardone said a $220,000 investment could net a $660,000 position in one of the funds, and could also earn about $12,000 to $15,000 in distributions to investors. Pino also claimed, among other allegations, that Cardone’s statements about the funds making monthly distributions were misleading because Cardone suspended payments in April and May 20, at the beginning of the Covid-19 pandemic.

Judge Walter concluded that documents provided to investors known as “Offering Circulars” clearly disclosed that “the timing and amount of distributions are the sole discretion of our manager,” and that the distributions resumed in June 2020. In fact, that month Pino received a distribution that was three times larger than the regular monthly distribution, to make up for the lack of disbursements in April and May of last year, the ruling states.

Walter also found that Pino failed to prove that Cardone misled investors into believing that he, and not them, would be responsible for making all debt service payments on any acquired properties. According to the judge’s ruling, the Offering Circulars make clear that Cardone and the investors would be jointly responsible for the debt, which he also disclosed in social media posts.

“Every single one of the claims was thrown out and completely dismissed,” Cardone said. “We created Cardone Capital to help the little guy, and we were validated. We have continued to buy about one billion dollars’ worth of real estate while this was going on.”

Attorneys specializing in securities litigation think he is an easy target because of his boisterous social media postings, Cardone added.

“They saw that I have a following on Youtube and Instagram, and that I have a big mouth,” he said. “I knew we wouldn’t lose because we didn’t do anything wrong.”