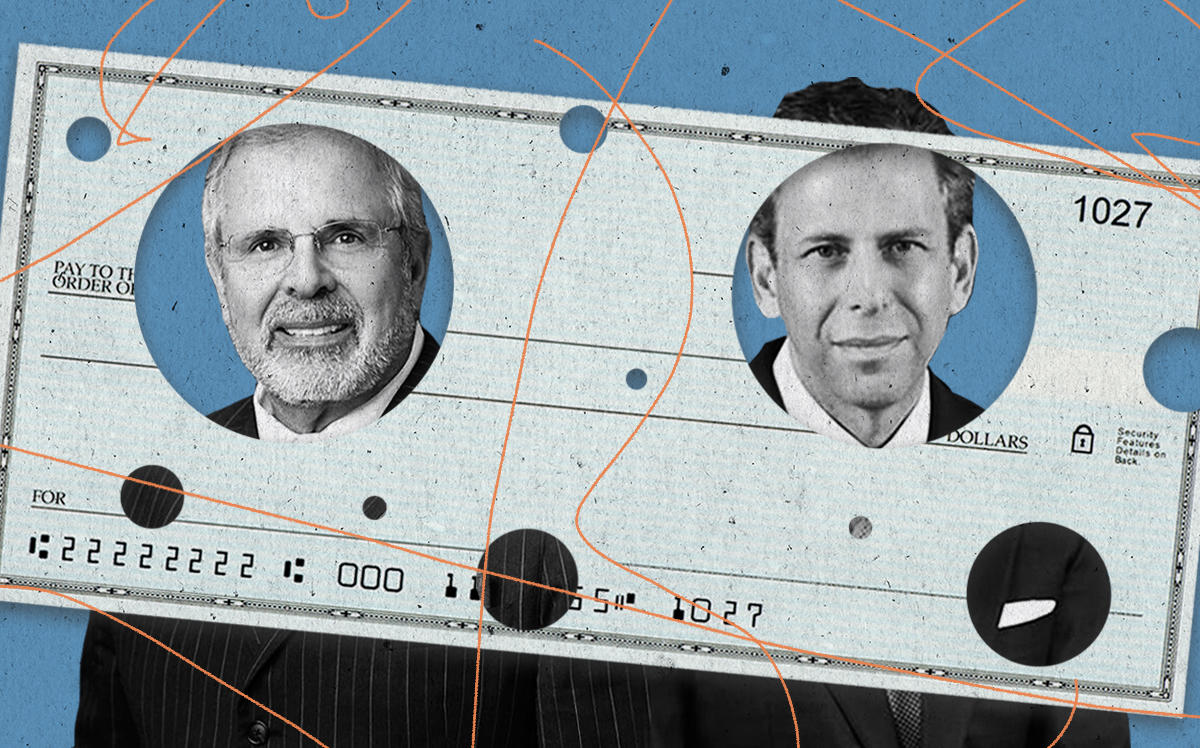

Developer Russell Galbut and investor Michael S. Liebowitz are rolling out the SPACs.

The two partners, who last year raised $115 million for their New Beginnings Acquisition Corp. blank check company, filed initial public offerings for two more companies, New Beginnings Acquisition Corp. II and New Beginnings Acquisition Corp. III, each targeting $100 million raises.

Liebowitz said the Miami Beach-based companies both plan to target travel, hospitality, leisure, financial technology, insurance technology, and proptech. Shares will be priced at $10 each.

“We decided to file two more SPACs because we think the market for SPACs is going to stay strong for a long time,” Liebowitz said. SPACs, or special purpose acquisition companies, have made a comeback across industries in recent months.

Galbut, co-founder and managing principal of Miami-based Crescent Heights, serves as chairman of New Beginnings. Liebowitz, managing director and executive vice president of Alliant Insurance Services, is director and CEO.

Read more

Their first blank check company, New Beginnings Acquisition Corp., recently announced a merger with Airspan Networks, a 5G network company. The merger is expected to close at the end of the third quarter and will be valued at $822 million.

Though they can’t be used to acquire individual properties, SPACs can acquire businesses with real estate assets. A number of proptech-focused blank check companies have launched over the past year and are hunting for deals.