HFZ Capital Group is looking to sell the historic Shore Club hotel in South Beach, as the company’s financial and legal issues continue to pile up, The Real Deal has learned.

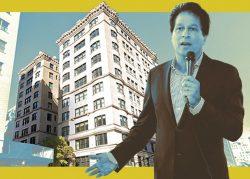

The New York-based firm, led by Ziel Feldman, tapped Newmark to sell the oceanfront hotel where it once planned a luxury condo and hotel development, according to sources.

HFZ, which has recently laid off and furloughed employees as it deals with lawsuits from lenders and subcontractors in New York, paid more than $175 million for the 18-story, 309-key hotel at 1901 Collins Avenue in 2013.

The company had planned to redevelop the hotel into a 67-unit luxury Fasano-branded condo, but canceled plans and returned buyers’ deposits due to the slow market in 2017. Management company Sbe has been operating the hotel since it acquired Morgans Hotel Group in 2016.

Read more

Newmark broker Adam Etra confirmed that the beachfront property is on the market. In a statement to TRD, a spokesperson for HFZ said the firm is considering selling the hotel or selecting a joint venture partner to reposition the property.

HFZ is also facing a lawsuit from Morgans Hotel Group, SBE and an affiliate for more than $935,000 in alleged unpaid bills. The suit was filed last week in Miami-Dade Circuit Court. (Sam Nazarian recently sold his remaining 50 percent stake in SBE to Accor.)

The Shore Club was built in 1939 and designed by Miami architect Albert Anis, and was redesigned by architect David Chipperfield in the early 2000s. Hotelier and Morgans Hotel Group founder Ian Schrager stepped in to manage the property in 2002, but it hasn’t been renovated since then, and has deteriorated. It’s been closed throughout the pandemic.

The hotel is one block north of the Raleigh Hotel, which a Michael Shvo-led partnership plans to redevelop.

The HFZ spokesperson called the Shore Club “one of the true trophy assets on the beach in Miami” and cited Florida’s “strong real estate market.” But the hotel market has struggled, and few properties have traded since the pandemic took hold in March.

Many borrowers are working with their lenders to extend forbearance agreements or seeking new sources of capital to survive, experts say. Valuations are also a question mark, as no one knows when the market will fully recover.

Before the pandemic, Virgin Hotels had created a proposal to pay $235 million for the Shore Club, with plans to invest another $100 million into transforming the property. But that deal fizzled out.

“There have been very few transactions in 2020. We’re all a little bit surprised there haven’t been more sort of given the nature of the moment. Liquidity is so important to sustaining your ability to get to the other side of this,” said Scott Berman, a principal at PricewaterhouseCoopers, who leads the hospitality and leisure practice for the firm. “The simple real estate mantra is you need a willing seller and a willing buyer. We’ve had few of each.”