UPDATED, Dec. 2, 9:25 a.m.: British billionaire brothers David and Simon Reuben are picking up the senior loan behind the St. Regis Bal Harbour resort, as the hotel market continues to struggle.

Their private equity and investment firm, Reuben Brothers, acquired the $132 million mortgage from Mack Real Estate, according to a spokesperson for Reuben Brothers.

Tarek El Sayed, CEO of Al Rayyan Tourism Investment Company

Qatari firm Al Rayyan Tourism Investment Company owns the 27-story oceanfront luxury condo-hotel, which has 192 keys and 24 condo-hotel units. ARTIC paid $213 million for the St. Regis, at 9703 Collins Avenue, in 2014. That deal that broke down to more than $1 million per room.

The loan from Mack Real Estate, issued in August 2018, has a four-year term with a one-year extension option.

Cushman & Wakefield’s Adam Spies, Jared Kelso, Dan O’Brien and Steve Michaels represented Mack Real Estate in this latest note sale.

It comes as hotels across the country have been struggling to stay afloat, with many agreements between borrowers and their lenders having expired.

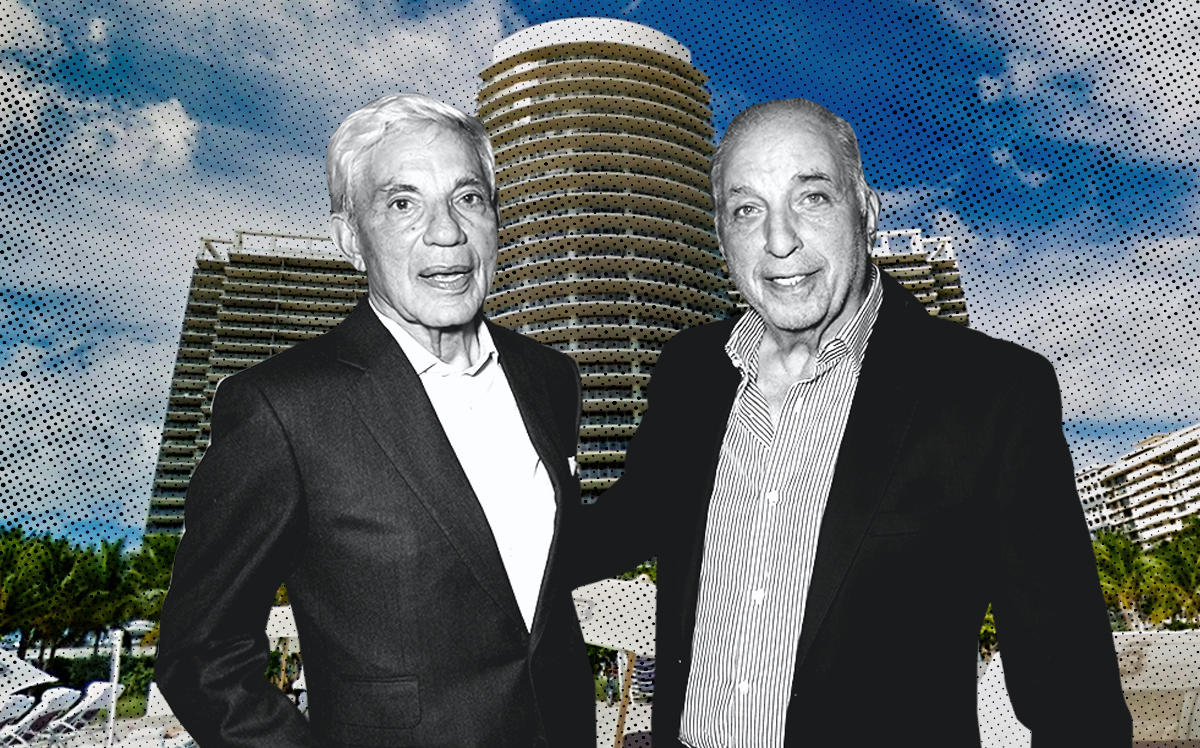

Reuben Brothers has seen opportunity in that sector, aggressively investing in luxury hotels in New York, South Florida and Europe throughout the pandemic. Through its private equity firm, the Reuben family, reportedly the second-wealthiest family in the United Kingdom, recently acquired a minority stake in Jeffrey Soffer’s JW Marriott Miami Turnberry Resort & Spa in Aventura.

The investors are also partnering with Soffer’s Fontainebleau Development on other investments as well. In Los Angeles, the British investors provided Michael Rosenfeld’s Woodridge Capital with $275 million in senior mezzanine debt for the Century Plaza megaproject.