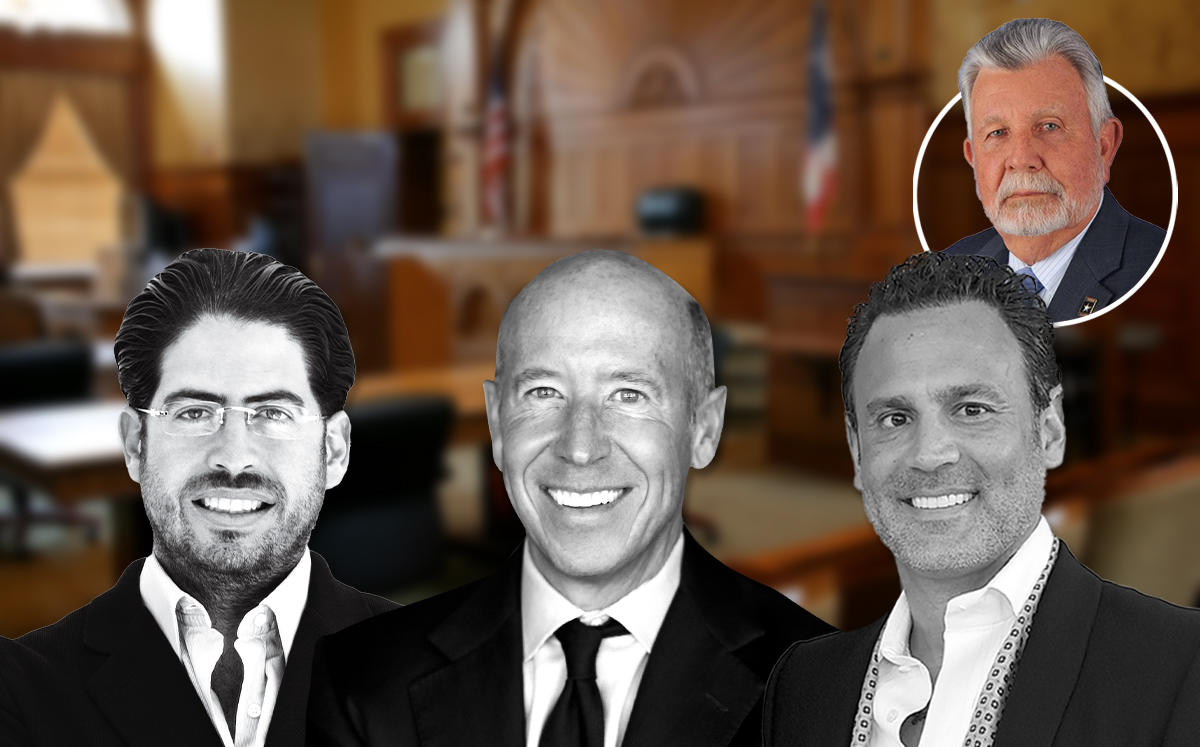

Affiliates of megamall developer Triple Five, along with Terra and Starwood Capital Group are crying foul over property tax bills from Miami-Dade County.

A number of developers and investment groups have recently filed lawsuits against Miami-Dade Property Appraiser Pedro J. Garcia for their tax appraisals for the 2019 tax year. Others include the owners of Aventura ParkSquare, the SunTrust office building on Brickell and the Delano South Beach.

The latest suits come as Miami-Dade issued preliminary taxable values for 2020 earlier this month, based on assessments and market conditions on Jan. 1. More such suits could arise, as businesses continue to lose money and commercial real estate values fall due to impacts of the coronavirus pandemic.

“A litigation showdown is looming between property owners and the government over property taxes,” said attorney Josh Migdal, a partner at the Miami law firm Mark Migdal & Hayden, who handles real estate cases.

“Property owners are faced with budget shortfalls due to decreased revenue,” Migdal added. “However, a decrease in tax revenue collection due to the virus will require the government to maximize its property tax collection to prevent its own budget shortfall.”

Florida is heavily reliant on property taxes since the state does not have a state income tax.

Overall, preliminary property tax values across Miami-Dade County rose in 2020 compared to the previous year. The estimated taxable value for Miami-Dade County properties totaled $324.36 million, up 5.1 percent from 2019, according to the property appraiser’s office.

The biggest increases were in West Miami (14.6 percent); Florida City (13.8 percent); Homestead (10.8 percent); Hialeah and North Miami (each up 10.4 percent). Much of the boost in appraised value is due to new construction, the property appraiser’s report shows.

Yet, the property appraiser’s office said falling prices for condos properties in Bal Harbour, North Bay Village, Key Biscayne and Aventura will have a negative impact on property taxes in 2020. It also says that coronavirus is starting to impact commercial real estate values.

“I will do everything within my authority to assist property owners who are struggling during these unprecedented times,” Garcia said in a statement. “As the real estate market changes during 2020, my office will consider these factors and make the necessary corrections permitted by law.”

The property appraiser’s office declined to comment on the recently filed suits. Among them, Triple Five, the Canadian developer, sued over the assessed value of its property in west Miami-Dade, where the group plans to build American Dream Miami mall.

The developer alleges the property appraiser gave an agricultural designation for 46.5 acres of its property, but denied the agriculture designation for two parcels totaling 38.32 acres. The properties were valued at $5.13 million and at $1.5 million, respectively, which the Triple Five alleges are “amounts in excess of their agricultural values.” The developer alleges the entire property should be classified as agricultural for the 2019 tax year, according to the complaint.

Developer Terra is also suing over a 11,865-square-foot parcel it owns at 2765 South Bayshore Drive in Coconut Grove. The company alleges the property is based on appraisal practices that are not “professionally accepted appraisal practices nor acceptable mass appraisal standards” in Miami-Dade County.

A company tied to Starwood Capital Group sued the property appraiser over a hotel it owns at 6700 Northwest 7th Street near Miami International Airport. The complaint alleges the $20 million assessment does not represent the value of Springhill Suites Miami Downtown/Medical Center because it exceeds the market value.

An affiliate of Integra Investments is suing the appraiser over Aventura ParkSquare, its mixed-use project in Aventura. The development group claims the property appraiser misappraised its property and it should not owe $106,629 in property taxes. The 1.2-million-square-foot project, at 2920 Northeast 207th Street, was completed in 2018. It includes a 131-unit luxury condo building, a 100,000-square-foot Class A office component, 55,000 square feet of ground-floor retail and restaurant space, and a hotel.

Alliance Re Holdings, the investment group that owns the SunTrust building at 777 Brickell Avenue is suing the property appraiser over its appraised value at the office tower. The group, led by Adolfo Geo Filho, who is tied to Brazilian construction company Construtora ARG, alleges it should not owe $2.2 million in property taxes. Alliance Re Holdings alleges the “Property Appraiser’s assessment of the property is arbitrarily based on appraisal practices.” The Filho-led group purchased the SunTrust building for $140 million in February 2015. Tenants include SunTrust, Truluck’s and Quest Workspaces.

The owner of the Delano South Beach is suing the property appraiser’s office over the hotel’s $172,905 tax bill. A company tied to SBE Entertainment Group, led by Sam Nazarian, also alleges the property assessment is arbitrarily based on appraisal practices that are not professionally accepted nor acceptable in Miami-Dade County.