With a $74 million construction loan due in mid-August, two prominent real estate investment firms are locked in an acrimonious dispute over ownership of a partly completed mixed-use project in Doral.

In a lawsuit filed last month in Miami-Dade Circuit Court, a shell company controlled by Boston-based Congress Group alleges that it was illegally ousted from the partnership that owns the 25-acre multifamily and retail development on the northeast corner of Northwest 58th Street and Northwest 107th Avenue.

The complaint accuses an affiliate of Boca Raton-based Encore Capital Management Group, headed by Miami Worldcenter co-developer Art Falcone, of violating an operating agreement. It alleges the affiliate tried to sell its stake in the Doral project, known as Landmark South, to a third party while muscling out Congress Group.

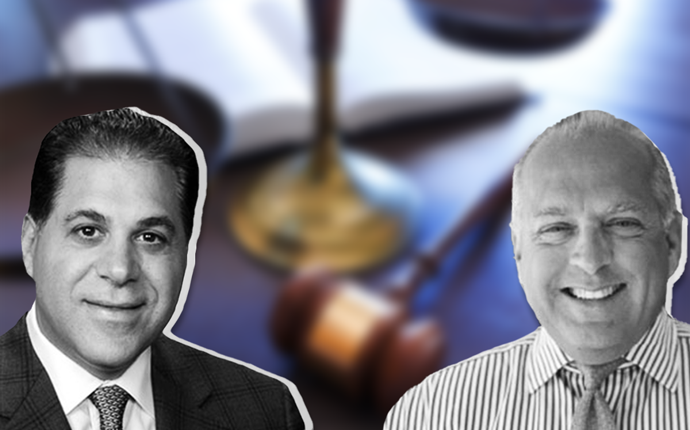

Dean Stratouly, founder and CEO of Congress Group, and the attorneys representing his firm, did not respond to requests for comment. Joe DiCristina, Encore’s president of multifamily investments, said Congress’ claims are unfounded and misdirected. He claimed that it was Stratouly’s firm that wanted to force Encore out of Landmark South.

“Congress was looking to refinance and take us out of our investment,” DiCristina said. “The terms and logistics of that fell apart and caused certain violations in our agreements.”

Still, DiCristina said, Encore looks “forward to resolving this amicably over the next month.”

In 2014, Encore and Congress teamed up to buy the development site for $30 million amid a hotbed of development in Doral. The property is directly next to Landmark at Doral by Lennar Homes, as well as close to other residential and mixed-use projects by Terra, Terranova Corp. and Century Homebuilders.

For Landmark South, the developers are planning two eight-story buildings with a combined 630 residential units, split between 420 rental apartments and 210 condos. Landmark South will also include 60,000 square feet of commercial space, a children’s park, tennis courts, a 5,000-square-foot gym and a parking garage with more than 1,000 spaces.

In 2016, Encore and Congress secured a $73 million construction loan for the project from Bank OZK, then known as Bank of the Ozarks. According to the lawsuit, the outstanding principal, $74.16 million, is due to be paid in full on August 16.

Congress claims that Stratouly managed the project and is responsible for having completed the first phase, which entailed two luxury apartment buildings with 418 units. Stratouly also worked out a deal to sell the commercial retail portion of the project to another developer. Construction of the second phase could commence within a few months, according to the lawsuit.

While in discussions on how to move forward with the second phase and whether or not to refinance the Bank OZK loan, Encore entered into an agreement to sell its interest to an unrelated third party without Congress’ consent, the lawsuit states. When Congress refused to accept “unreasonable terms and conditions” for a new operating agreement with the third party, Encore wrongfully removed Congress from the partnership, the complaint alleges.

“Encore is disappointed and its goal of cashing out of the project has been frustrated because the terms of its sale are unacceptable,” the lawsuit states. “In order to sell on those terms, Encore decided to create a pretextual subterfuge.”