Investors and developers in Miami-Dade County have been pouring money into Opportunity Zones.

From April through September, property sales in those areas tallied $942 million, a 25 percent increase from the same time in 2017, according to The Real Deal’s analysis of records.

Enacted as part of the December 2017 tax overhaul plan, Opportunity Zones began catching the eye of savvy investors last summer, who were eager to get in on a program that provides incentives for new investment in low-income areas.

The program allows developers and property owners to defer and possibly forgo paying some of their capital gains taxes, or taxes resulting from the sale of certain assets. To reap the full tax benefit, those who invest in the more than 8,000 Opportunity Zones around the nation must hold the asset for at least 10 years.

In Miami, where land is scarce, the tax advantages could drive up property values significantly.

In the second and third quarter, North Miami Beach saw the biggest increase in sales in Opportunity Zones sites, shooting to $83 million from about $8 million the year before.

“They (investors) are out there raising money, they are buying properties, they are penciling the numbers out,” said Philip Rosen, chair of the real estate practice group at the law firm Becker. “We are starting to run, but the gun hasn’t fired.”

That’s because the government has not released all of its guidelines about the program. The lack of clarity on some key questions is delaying what experts say could be an even bigger rush of investment. The questions range from strictly tax questions, to what happens when an owner refinances an Opportunity Zone investment to can a developer still reap the benefits if the property is only partly in an Opportunity Zone.

The IRS and Treasury Department released more detailed regulations in October, but public hearings that had been set for earlier this month on those regulations were canceled when the partial government shutdown took effect.

Despite that, the program has been popular in Miami-Dade. Since May, there were at least 10 property sales of $10 million or above in Opportunity Zones, according to TRD’s research and analysis of county property records. Under the program, only properties that are new construction or are substantially rehabilitated qualify for the tax break.

“We are probably fielding 10 to 15 calls a week from prospective clients [about Opportunity Zones],” said Marc Feigelson, co-leader of the Miami accounting firm Kaufman Rossin’s real estate and construction industry advisory group.

In South Florida, Opportunity Zones span distressed areas such as Opa-locka, North Miami Beach and Carol City, along with places where major development is already taking place.

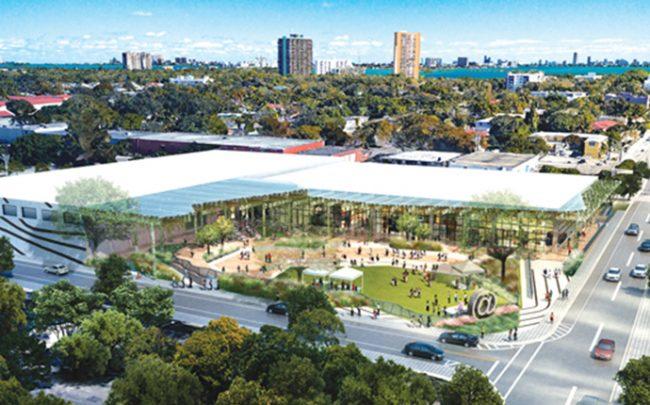

Several of the Opportunity Zone tracts encompass some of the wealthiest enclaves and megaprojects in Miami, such as Turnberry Associates’ Aventura Mall and the Magic City Innovation District, a planned $1 billion development in Little Haiti, led by Tony Cho and Bob Zangrillo.

The Magic City Innovation District

Opportunity Zones are designed to be in areas that have a poverty rate of at least 20 percent, but some of those areas also include pockets of wealth.

To receive the full tax benefit, property owners and developers would have to deploy their capital into Opportunity Zone projects by the end of this year. That has increased the demand for shovel-ready construction sites.

Opportunity Zone premium

Gerard Yetming of Colliers International South Florida happened to have the listing for an Opportunity Zone property in the heart of the so-called Arts & Entertainment District at 1765 North Miami Avenue. Yetming first listed the 30,000-square-foot vacant lot in 2016. He didn’t get any serious offers and pulled it from the market.

Late last year, he relisted and got the full asking price of $6 million. Yetming said the Opportunity Zone designation heightened interest in the site, which is now under contract to a regional development group.

High-density zoning also helps the Arts & Entertainment District when it comes to Opportunity Zone investments, according to market pros. Yetming’s site allows a developer to potentially build a high-rise — up to 9.1 times the land square footage — in this case 273,000 square feet.

The Arts & Entertainment District has “an abundance of land and has high-density zoning, and there is not enough development in that zoning,” said Peter Mekras, managing director at Miami-based Aztec Group, a real estate investment and merchant banking firm.

Other brokers are trying to sell property in areas that may benefit from longer-term investments, such as in Little Haiti. Colliers International’s Mika Mattingly has a listing near the planned Magic City Innovation district at 260 Northeast 60th Street in Little Haiti for $2.7 million. The site has yet to sell, but Mattingly said she has been getting interest from buyers because of its Opportunity Zone designation.

Todd Rosenberg

Pebb Capital managing principal Todd Rosenberg said the Boca Raton-based firm has already invested in Opportunity Zone projects in South Florida and two sites in the Northeast. The projects are in what he calls “the fringe edge of gentrified areas. Places that have been gentrifying but ultimately that have been substantially improved,” he said. Rosenberg added that the investment firm would have considered developing in those areas even without the Opportunity Zone incentive.

That has been Avra Jain’s approach since she first heard about the program. The founder of the Miami development firm Vagabond Group and a former Wall Street bond trader, Jain had a number of existing Miami properties in Opportunity Zones.

For one, she set up a $2 million to $3 million Opportunity Zone fund. It was for a 95,000-square-foot flex warehouse development site at 1010 Northwest 72nd Street. Jain and others are setting up site-specific funds as way to be safe about the existing rules. They invest in a property with a close group of investors for a property they know will qualify, rather than risk setting up a big fund with multiple properties and designated zones.

Jain is still waiting for more guidance before moving forward with more projects.

The interest in shovel-ready Opportunity Zones sites has made at least one developer consider selling a site he has under construction, presumably at a premium.

Robert Suris, founder of the Estate Investments Group, is building a 200-unit multifamily complex, Soleste Bay Village in Palmetto Bay, that is in the beginning of construction.

If Suris sold the property before its completion date, that buyer could potentially gain the tax advantages for the Opportunity Zone project. Suris would not qualify to receive tax benefits.

Big buyers gear up

Unlike the smaller owners and developers who have acquired individual properties in Opportunity Zones in the last several months, institutional investors are holding back but gearing up.

Firms like Fundrise, EJF Capital, Youngwoo & Associates, and Normandy Real Estate Partners have all launched funds. Most have target raises of between $250 million and $500 million each for future Opportunity Zone investments nationwide.

Meanwhile, LeFrak CEO Richard LeFrak has partnered with Turnberry Associates to develop a $4 billion megaproject in North Miami, on the site of a notorious, now-shuttered landfill inside an Opportunity Zone. The project has been in the works for a number of years.

SoLe Mia rendering

Construction is underway but since parts of the project have not broken ground, LeFrak and Turnberry could potentially qualify for Opportunity Zone incentives.

In August, LeFrak told Bloomberg that some of the biggest returns could be found in building office space and relocating companies into the Opportunity Zones. LeFrak and Turnberry did not respond to requests for comment for this story.

So far, the largest sale in an Opportunity Zone in Miami has been the $60 million deal for the former Archbishop Curley Notre-Dame High School in Little Haiti. An heir to The Gap family fortune acquired the 15.5-acre property in November.

The project is going to be redeveloped into an elite private school called Avenues: World School, whose tuition at its New York City campus runs about $54,000 a year.

If the former school is demolished and a significant investment in the new school is made, the developer could qualify for Opportunity Zones tax incentives.