Downtown Miami condo prices and rental rates are leveling out after two years of rapid appreciation, offering another sign of change afoot in the market as supply and demand shift, a new report obtained by The Real Deal reveals.

The Miami Downtown Development Authority’s Q2 2015 Residential Real Estate Market Update, written by Integra Realty Resources, shows a continuing trend toward a correction in the market, amid the ramifications of foreign currencies sliding against the dollar.

“IRR-Miami’s research suggests that the residential downtown development market cycle is firmly in the middle of the cycle,” the report said.

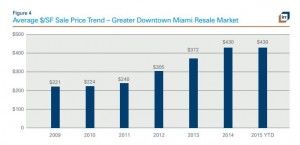

Average condo unit pricing has leveled off at $430 per square foot, following 22 percent and 16 percent annual increases in 2014 and 2013, respectively.

Average price per square foot sale price trend for Downtown Miami resale market

The report, which is based on January through March activity, and follows a first quarter report released in March, also shows that rental rates are stabilizing as new apartments are delivered. The flattening follows rent increases of 8 percent from 2013 to 2014, and 5 percent from 2012 to 2013.

“Conventional rental rates have remained level [year-to-date] in 2015, as new condo projects are being completed and listed within the rental inventory,” the report said. “Rental rate growth will be constrained in 2015-2017 as more condo projects are completed and delivered into the rental inventory.”

Among examples: buyers of BrickellHouse‘s 374 units have listed 45 percent of the units for rent, while buyers of 1100 Millicento‘s 382 units have listed 72 percent of the 171 closed units to date, according to the report.

Meanwhile, the buyer pool for new condo units is shrinking in downtown Miami, a market where the continued growth in real estate market “remains largely dependent on foreign capital participation,” the report notes.

“The decline in foreign currencies compared to the U.S. dollar over the past 18 months has narrowed the buyer pool,” the report said. “Several brokers have expressed concern regarding the closing ability of mid-level buyers that may not be fully denominated in U.S. currency. There have mean early reports of buyers seeking approval for the assignment of their contract to a third party.”

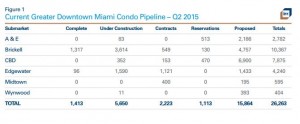

The entire Greater Downtown Miami market is currently being expanded by nearly 10,000 units, or 27 percent of the current market size.

Greater Downtown Miami condo pipeline

The report notes that only Nine at Mary Brickell was completed since the first quarter, and the first wave of projects in Edgewater, including Icon Bay, Bay House and Crimson, are expected to be delivered in the second quarter. The number of units in the reservations phase has dropped by 30 percent, according to the report, largely due to Ion at Edgewater’s cancellation and several projects moving into the contract phase.

Meanwhile, continued increases in land pricing and construction costs “are beginning to constrain irrational exuberance over the state of the market,” the report found. “Experienced developers in the market are approaching new deals with caution as current land pricing and construction costs are squeezing development margins substantially.”

Among the report’s other findings during the second quarter:

- Pre-sales velocity is slowing as many of the projects launched between 2011 and 2014 sell out, leaving scarce inventory behind.

- Brickell City Centre, a new luxury mixed-use development, reduced the required deposit structure from 50 percent to 35 percent, as TRD reported.

- Brickell remains in the top spot as the most active submarket, with Edgewater close behind. The Arts and Entertainment and Central Business District are the submarkets with the next highest current growth.