Even though his company loosened the time frame in which buyers can put money down on a new condo at Brickell City Centre, doesn’t mean he’s forsaken 50 percent deposits on units, Swire Properties President Stephen Owens told an audience in Coral Gables Friday morning.

“I think the 50 deposit model is likely to stay in place,” Owens said. “It is unique to Miami.”

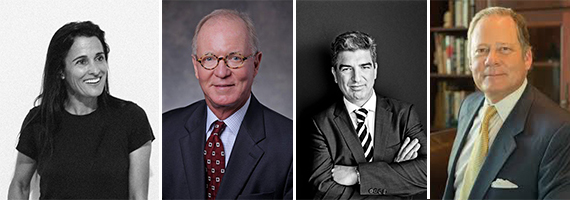

At the Coral Gables Chamber of Commerce’s 8th Annual Commercial Real Estate Outlook breakfast panel at the Westin Colonnade Coral Gables, Owens joined developer and Vagabond Hotel owner Avra Jain, Allen Morris Chairman and CEO W. Allen Morris and Carlos Rosso, the Related Group’s condo division president, in a discussion about the current state of Miami’s real estate market.

In March, when Swire announced it had topped off Reach, the first residential tower at Brickell City Centre, and sales had begun on the second condominium, Rise, the company also stated that it had modified its deposit structure. Buyers would pay 20 percent at signing with a second deposit of 15 percent due 120 days after executing a contract. Another 15 percent would be due before closing.

The modification was necessary due to foreign investors from South America taking more time to shop other competing projects and the rising sales price of preconstruction condos, Owens said. “There’s no question sales have slowed down,” Owens said. “The market is at half the pace it was a year ago. Buyers are being more discerning. Those are indicators of a healthy market.”

Rosso and Morris echoed Owens. “We are trying to space out those down payments as much as possible,” Rosso said, adding that he tells potential buyers sales prices are not coming down. “We tell them it is going to cost more if you wait.”

Morris said maintaining the 50 percent deposit model will prevent the rush of speculators that fueled the last bust that led to the economic recession. “It’s good for the market, the developers, the banks and the buyers,” Morris said. “The buyer knows the project is going to get built, the developer knows he has the leverage for a construction loan and the bank knows there is a huge amount of equity in a project.”