For real estate players seeking financing — and who isn’t? — a word of advice: Don’t look back.

The number of loans issued by the top 20 lenders in New York City over the past year plummeted by almost 50 percent, an analysis by The Real Deal found. The cutback was concentrated in large loans, and the top two lenders, JP Morgan Chase and Wells Fargo, handed out 60 percent less money than they did in the previous year.

The retreat came as dealmaking was stymied by steep borrowing costs and, in some sectors, sinking property values. Lenders and property owners are in many cases trying to tread water until the Federal Reserve starts lowering interest rates, which it is expected to do in September.

“The last 24 months have been pretty dead. High rates have kept people out of the market to finance and refinance,” said Stuart Boesky of multifamily lender Pembrook Capital. “There has been — and there will be more — a lot of workouts.”

While lenders are still looking for alternatives to foreclosure, borrowers are increasingly chipping in equity to seal agreements.

“The deals that are out there that you want to lend on are deals that are essentially looking for recapitalization,” Boesky said. “Generally, they require the owner to put in more equity to recapitalize. Those are the deals that are getting done.”

To assess the industry’s biggest lenders in New York City real estate, TRD examined mortgages recorded in city records from July 2023 to June 2024 compared with the year before. The dollar volume of new loans dropped to $45 billion from $67 billion, according to the data. The drop was five times larger than the previous year’s $4.5 billion dip.

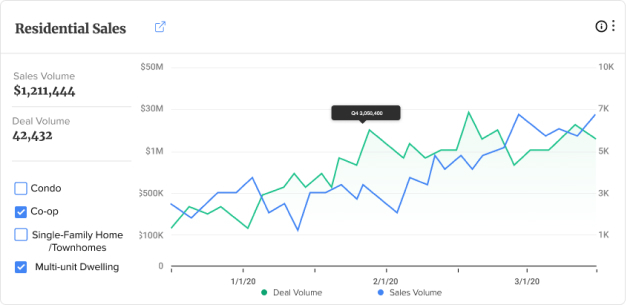

Subscribe to TRD Data to unlock this content

The rankings only include documents classified as mortgages — not those recorded as “agreements” — in city property records.

Individual rankings changed as some lenders pulled back and others stepped up. Eight of the top 20 lenders did not appear on last year’s list. Among them was Webster Bank, which captured the ninth spot with $680 million in loans.

JPMorgan stayed No. 1 in deals and dollar volume, with $2.1 billion issued on 1,711 loans. That’s down from $5 billion the previous year. Wells Fargo kept its second-place spot, issuing $1.4 billion in new loans, down from $3.6 billion year-over-year.

The largest lending deal of the year was by Merchants Capital, an agency lender for Freddie Mac, which provided $320 million to finance renovations at the New York City Housing Authority’s Edenwald Houses in The Bronx.

The private wealth division of Deutsche Bank provided a $300 million inventory loan for Harry Macklowe’s office-to-residential conversion at 1 Wall Street in the Financial District that was part of a $665 million refinance deal.

While lending between $50 million and $100 million stayed fairly steady, the number of nine-figure loans dropped sharply. Deals over $100 million fell by half, from 60 to 31. Multifamily deals accounted for the largest sector of the market by far in terms of dollar amount, with almost $11 billion in new loans, followed by $5 billion in condominium deals.

Unlike in the office sector, the slowdown in multifamily lending was driven by capital markets, not a drop in value or oversupply. Markets are expected to start moving as soon as rates start to drop. The Federal Reserve has signaled that rate cuts will begin in September.

That should open the floodgates for borrowers who have been locked out of the market since 2022.

“Sometime in 2025 we’ll hit an inflection point and rates will go to the point where there will be a tremendous amount of pent-up demand for debt and there will be a lot of transactions,” Boesky said.

Access the comprehensive data set supporting this ranking here. TRD Data puts the power of real data in your hands.