New York real estate is thought of as a bloodsport.

But it is often lawyers, not swashbuckling developers, who engage in the actual scrapping.

The courtroom drama between lawyers representing developers, partners or brash lenders is made for TV. In Manhattan, “Suits” may come to mind. In Long Island, “My Cousin Vinny” may be more appropriate. And in New Jersey, it might feel more like “Better Call Saul.”

But real estate attorneys don’t just litigate disputes in courtrooms. They are involved in each facet of a deal. Every sale, every loan, every parcel of land tediously jigsawed together so developers can amass air rights to build their cantilever towers have gone through hours of legal review.

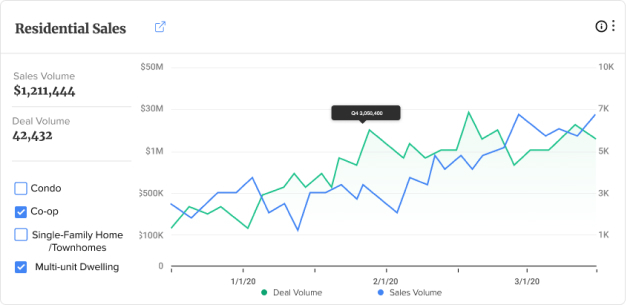

To put it all into context, The Real Deal ranked law firms by their dollar volume of closed sales in Manhattan, Queens and Brooklyn, between August 1 of last year and July 31 of this year. In total, TRD analyzed 41,000 commercial and residential sales in the Big Apple, totaling $89.4 billion.

Skadden Arps stood above the rest with $2.2 billion of sales, across 14 deals. Some among the top law firms had a few large transactions such as Sheppard Mullin Richter & Hampton, which had three deals, totaling $1.2 billion, while others made the list because of their high-volume residential-focused business.

The sweet spot

Today, real estate lawyers say they are spending a bulk of their time on workouts. To the layperson, the process sounds like a bad thing. It means a deal is broken, the borrower can no longer make payments and a lender cannot provide the debt. But those in the trenches say workouts show the market is finally moving out of its prolonged state of limbo. It usually involves lengthy exchanges where the lender asks the borrower to chip in more money or bring in a new partner to provide new funding.

Since the start of Covid, lenders were all too willing to extend loans on a short-term basis. A majority of the $700 billion worth of commercial real estate loans set to mature in 2023 were extended, according to the brokerage CBRE. That tide is starting to turn, attorneys told TRD.

Subscribe to TRD Data to unlock this content

“There’s a lot of lender fatigue right now,” said Janice Mac Avoy, co-head of Fried Frank’s real estate litigation practice. “Everyone’s been holding their breath for the past four years.”

For some lenders, the vibe is, “we’re done, we’re not talking anymore, we are just going to foreclose,” according to Mac Avoy.

Michael Lefkowitz, a leader of Rosenberg & Estis’ real estate transaction team, said his firm recently created a distressed asset division to assist borrowers and lenders in troubled situations.

“In our view, with the cut in interest rates, there will be more activity,” said Lefkowitz. “Borrowers and lenders are both becoming a little more realistic on asset value and realizing that they need to transact.”

Lefkowitz points to his work on a recent deal where his client sold an office building to a buyer who is seeking to turn a Class C office building on West 36th Street into a 16-story self-storage facility. He said the creative buyer “saved the day” for the seller who would have otherwise been left with a largely vacant office building.

Going to the mattresses

Lawyers are sometimes thought of as a high-cost necessity when it comes to real estate deals.

After all, developers are the ones who find the opportunities and source investors. Lenders extend the financing. Architects draw the design. Contractors pour the cement, put up the concrete beams, and install the shiny glass windows.

The lawyers are not dealmakers, builders or machers, but in down cycles, they can offer the Solomonic wisdom necessary to salvage a deal.

Jonathan Mechanic, chairman of Fried Frank’s Real Estate Department, said he is close to restructuring a deal in which he has a relationship with the borrower and the lender.

“They were about to go to the mattresses and the borrower called me and said you have a relationship with these guys. This is stupid. We ought to have a better result,” said Mechanic. “So I reached out to them. I tore my Achilles on Sunday, had surgery on Tuesday, and on Thursday I had a meeting with the lender and the borrower in my apartment as the trusted intermediary.”

Mechanic noted the firm had a number of huge deals, including advising Blackstone on its 1-million-square-foot lease at 345 Park Avenue and Citadel’s New York City headquarters at 350 Park Avenue.

Lawyers at smaller shops in New York are not spending their days counseling the world’s largest hedge funds and private equity titans on their new headquarters. Instead, they spend a large portion of their day on condo unit purchases. Romer Debbas, for instance, ranked third on TRD’s list this year with $1.6 billion in deals through 522 transactions.

The partners said higher mortgage rates have put a damper on transactions, but an increasing number of buyers turned to all-cash purchases. They noted that about two-thirds of their deals this year were done with cash.

The attorneys, like others, claim that much of its business on the commercial side is coming from deals in the Sunbelt states where it’s easier to build.

“There was an imbalance between mortgage rates and cap rates in New York City, which made other markets more attractive to multifamily and commercial investors,” said Michael Romer, a co-founder of the firm.

Mechanic of Fried Frank said they are also seeing a lot of business outside of New York City.

But Mechanic said their work with large corporations to expand their headquarters, including JPMorgan at 270 Park Avenue, is testament to the city. The biggest financial firms all want to be in NYC.

He also asserted, “New York City has come back faster than any other city in the U.S.”

Access the comprehensive data set supporting this ranking here. TRD Data puts the power of real data in your hands.