The typically genial real estate developer Richard LeFrak [TRDataCustom] seemed downcast as he sat for an interview in his West 57th Street office early last month.

He rubbed his face and grumbled about the topic of conversation: his friend Donald Trump.

“Can we talk about my real estate now?” he asked. “The agreement was that we wouldn’t talk about Donald.”

For the record, there was no such agreement. But the billionaire’s eagerness to sidestep the topic of Trump, who has described LeFrak as one of his best friends, was clear.

And that was before Trump’s controversial response to the violence that broke out during a white nationalist rally in Charlottesville, Va. The president’s response has triggered widespread condemnation and a backlash that’s since ricocheted throughout political and business circles.

One week after his sit-down with The Real Deal, however, LeFrak broke his silence. He called his friend’s comments — which failed to fully condemn the white supremacists and neo-Nazis who descended on the college town — “inappropriate” and out of line with his own beliefs.

“It’s easy to say that I don’t approve of white supremacists,” he told TRD in a follow-up phone call. “It’s base and violent. I don’t approve of any of those things. You don’t have to be a hero to make that comment.”

While that statement might have been “easy,” it was one of the most overt public criticisms from a member of Trump’s inner circle and from the New York real estate community in general.

“Perhaps the context in which [the president’s] statements were made — especially at the press conference — caused people to be confused about him,” LeFrak said. “I would not even suggest that he is any one of those things. But I can see why people would react to those words very viscerally. He’s made some effort to clarify it, but not as far as he could have.”

LeFrak’s comments came as pressure was mounting. A string of CEOs from companies ranging from Merck to Under Armour had just stepped down from two of the president’s advisory boards, prompting Trump to preemptively disband the panels before more defections.

And while the infrastructure panel that Trump tapped LeFrak to co-head in January was also shuttered, LeFrak derided the public shaming that those who served on the boards faced.

“The part I didn’t like about it was that you looked bad if you said you wanted to stick it out,” he said. “The wave of opinion that forced people out is totally understandable, but I don’t want the president to fail or the country to fail. No one has asked me if I want to continue, but if the president called me and said come down here and talk infrastructure, of course I would.”

He added: “If people can offer something that can help the country, should they just make a sanctimonious political statement and give up their ability to help the country?”

He also noted that heads of public companies always face added pressure under controversial circumstances because they have shareholders breathing down their necks.

“[But] I’m sensitive to my customers as well,” LeFrak said. “My buildings are not occupied by Nazis and white supremacists.”

At a time when the 72-year-old could be sitting back and enjoying his golden years, his attention has been redirected. Instead of talking about his massive 40 million-square-foot real estate portfolio — not to mention his active development projects in New Jersey, Miami and Los Angeles — he’s receiving hundreds of calls a day from media about Trump.

He hinted at the challenges of that friendship last year when he told the New York Times that having Trump as a friend is “like being friends with a hurricane.” And that was when Trump still resided in his glass tower on Fifth Avenue.

Still, LeFrak has attempted to define his relationship with the president as more personal than professional.

“People tend to assume I must be involved in lots of policies,” he said during TRD’s Aug. 9 interview. “I’m not. They have a tendency to overestimate my involvement. I never engage [the president] on any topic other than infrastructure. I don’t engage him on health care, or North Korea.”

Trump, he said, still enjoys a little “real estate gossip.”

“Our conversations mostly aren’t different from what they were before — who’s selling condos, who’s doing well, who’s doing badly.”

As for whether he’s worried about Trump negatively impacting his brand, it’s not happening, he said.

“I won’t let it,” LeFrak said. “That’s the bottom line. I’m never going to deny my friendship with the president — I love his wife, his kids are nice, but a lot of things he does I don’t agree with. He’s not my brand; he doesn’t represent my business. I’m LeFrak.”

Rooted in rentals

In his day, no one built more apartments around New York than LeFrak’s father, Samuel, who competed with Trump’s father, Fred; Lew Rudin; and others.

“All the families go back decades,” said developer Bill Rudin, Lew’s son. “Every year at the Bank of New York’s annual Christmas lunch, my father and Richard’s would sit at the head of the table with the CEO of the bank. Richard and I were at the kids’ table.”

Related Companies CEO Stephen Ross said LeFrak “recognizes he was born on third base,” but noted that he “certainly knew how to get home.”

Forbes indeed pegs his net worth at over $6 billion.

“I’m not the Norwegian pension fund or the Qatar Investment Authority, and I can’t access as much capital as Blackstone or Starwood,” LeFrak said. “But I can build an apartment house. They can’t — or, if they think they can, they can’t do it as well as I can.”

LeFrak’s capital-intensive approach is classic build and hold. It’s a luxury few others can afford.

“The capital required to be in the business is tremendous, and a lot of it gets supplied by private equity or hedge funds that have a holding period and want their money back,” he said.

In contrast to some of his developer peers, and one developer-turned-White House resident, LeFrak is short on glitz.

Arguably the showiest member of his family was his wife’s poodle, Mikimoto on Fifth, who reigned for three years as America’s No. 1 show standard poodle. Tellingly, LeFrak’s rare brushes with stardom have come courtesy of Trump — first in 2009, when he served as a Miss Universe judge and then in 2010, when he was a judge on an episode of “The Apprentice.”

Careerwise, the two men went in opposite directions at the very beginning. Trump traded his father’s outer-borough multifamily portfolio for a shot at building some of Manhattan’s brassiest condo towers. LeFrak, meanwhile, stuck to the blueprint laid out by his dad, who proudly proclaimed his company served “the mass, not the class.”

“He had a very simple business philosophy,” LeFrak said of his father, who died in 2003. “He would say, ‘Give the people what they want at a price they can afford to pay, and you’ll do good business.’”

In LeFrak’s telling, his father’s shrewdness loomed large: “If there was a right side and a wrong side of Queens Boulevard, he would always be on the wrong side, because it was cheaper.”

Like his father, LeFrak focuses on rentals, steady earners that can be passed on from one generation to the next.

Today, as his contemporaries vie to build glitzy condo towers, for example, LeFrak is sitting on one of the most valuable sites, a plot at 40 West 57th Street right on Billionaires’ Row. There he and Vornado Realty Trust CEO Steve Roth razed three prewar buildings and are rumored to be eyeing a hotel project down the line.

LeFrak boldly told TRD last year that he sees condos as “the stupidest form of real estate investment that exists. Do you ever do something and start liquidating it right away?”

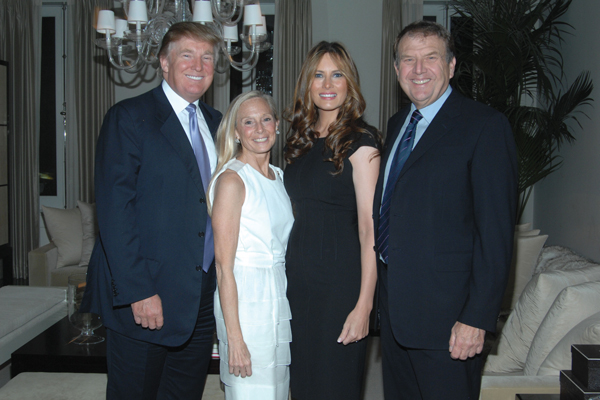

From left: Trump, Karen LeFrak, Melania Trump and Richard LeFrak at a New York City event in 2007

The firm’s massive 20-building complex in Queens — the famed LeFrak City — is home to a wildly diverse population of residents and currently has three-bedroom units listed for about $2,700 a month.

Yet LeFrak’s sons, Harry and Jamie, both managing directors at the LeFrak Organization, seem to be ramping up the wattage, hiring brand-name architects, including Arquitectonica, and pushing into new markets, including Beverly Hills and South Florida.

The company’s focus will, however, remain largely on rentals.

It’s biggest bet outside the New York area is the massive $4 billion mixed-use project in Miami called SoLe Mia. The project — which fittingly sits on a relatively cheap former Superfund site — is slated to bring 12 residential buildings with 4,390 units, more than 1 million square feet of commercial space, 37 acres of parks, two swimmable lagoons and 4,000-plus parking spaces to North Miami over several phases.

The firm broke ground on the first two residential buildings, which will have 400 units, this summer.

But LeFrak’s legacy will likely hinge on the firm’s $10 billion Newport site in Jersey City, which will ultimately house 9,000 apartments, 7 million square feet of office space and 2 million square feet of retail and hospitality.

His father paid a mere $50 million for the 600 derelict waterfront acres just over 30 years ago, and when complete, the new neighborhood will be six times the size of Battery Park City.

The latest building, dubbed the Ellipse, the 17th tower the firm has erected there, opened this summer with 381 apartments.

So far, the project has been a smashing success.

“Richard doesn’t have to take risks to make money,” Ross said. “In New Jersey, it’s like having free land.”

LeFrak takes great pride in Newport and the sheer scale of it.

“Do you know who owns Hudson Yards?” he asked, referring to the amalgam of developers, private equity firms and pension funds with stakes in the massive Related-led, mixed-use project.

“Do you know who owns the New Jersey waterfront? Me.”

Zero-impact game

Having the White House on speed dial would in almost all other cases be a major asset. But while LeFrak’s firm fires on all cylinders, his connection to Trump is starting — at least from a PR standpoint — to seem more like a liability.

In addition to unwanted attention on his political and personal views, some have sounded the alarm on what they see as cronyism.

Among them is a nonprofit group that sued Trump in July claiming that his infrastructure panel, co-led by LeFrak and Roth, had been illegally convened without proper public disclosures.

The suit accused Trump of “outsourcing policy making to private individuals who are unfettered by conflict-of-interest rules.”

The implication was that the duo could bend the president’s ear on policy issues without disclosing their own vested interest.

A week before the president shut down the panel, LeFrak dismissed those accusations as political posturing, citing personal loyalty and patriotism as his reasons for serving.

“I have no skin in the game,” he said. “[But] I don’t feel there are any ethical issues. If there’s someone better out there to do it, God bless them. If the whole thing gets caught up in politics, I’ll say, ‘Oh well, I had an experience,’ and I’ll go back and hang my head between my knees.”

LeFrak and Roth board Air Force One at Andrews Air Force Base in Maryland

LeFrak also rejected the notion that he was self-dealing by being on the panel. “It takes time; it takes money; it takes me away from my own business to engage in these things,” he said.

In the real estate world, sources say there’s likely to be zero impact on his family’s sterling, scandal-free reputation.

“It is as strong as ever,” said Kathryn Wylde, president of the Partnership for New York City, which represents the city’s business community. “He resurrected the Northern New Jersey coast and continues to lead its redevelopment. He grew up with President Trump, and it is understood that their relationship is a personal and family connection, not a political one.”

Others agreed: “The connection is friendship,” said Ken Fisher, scion of another great New York real-estate fortune, Fisher Brothers, and longtime LeFrak friend. “They’re very close, and Richard is someone who brings so much experience to the table.”

Meanwhile, David Birdsell, dean of Baruch College’s School of International and Public Affairs, said the heads of privately held real estate firms aren’t under the same pressure as public companies, or large retailers, when controversy erupts.

“Even for the most dedicated Donald Trump loathers, that connection might be too much of a leap,” he said. “That’s too in the weeds for most folks.”

But while emphasizing the potential upside of a $1 trillion infrastructure boon that was being pushed by the White House, LeFrak continued to distance himself from messier non-real estate matters, such as alleged Russian meddling in the election.

“I have no more facts than anyone else does,” said LeFrak. “I wasn’t in the room with [Paul] Manafort, [Michael] Flynn. How the hell do I know what was going on? But knowing Donald, I don’t think he’d do anything blatantly inappropriate.”

LeFrak’s direct line to the president became clear in the wake of Charlottesville, when the Times reported that the developer (along with Roth and many others) had urged Trump to sack Steve Bannon, his incendiary chief strategist, who was booted shortly thereafter.

“I did see him for dinner,” LeFrak said, referring to a visit to Trump’s Bedminster, New Jersey, estate last month. “Anything I had to say to him was private. That’s between me and Mr. Trump. But I’ve made no secret that I’m far more moderate than Mr. Bannon.”

In addition, LeFrak has a lot to gain from other key policy issues on Trump’s desk, including the inheritance tax and property tax incentives like the 1031 exchange, which allows investors to avoid capital gains levies when selling buildings if they reinvest in another property.

LeFrak recently tapped the 1031 program when he traded a Queens building for the $125 million, 252-key Dumont Hotel on East 34th Street, where his firm is planning a residential conversion.

“These things have very powerful impacts on our business,” LeFrak said.

But he responded with a “no comment” when asked whether tax reform talk might crop up during 18 holes with the president.

And asked whether he’s lost friends because of his support for Trump, LeFrak said he had, but noted that most have stuck by him.

“Some said, ‘How could you serve a man like that? How could you be friends with a man like that?’”