Blackstone had every reason to oppose the overhaul of New York state’s rent law in June.

The private equity giant and its Canadian partner Ivanhoé Cambridge had poured more than $5 billion into buying and upgrading Stuyvesant Town–Peter Cooper Village — making them the largest owner of rent-stabilized apartments in the city, with 11,000-plus units, since 2015.

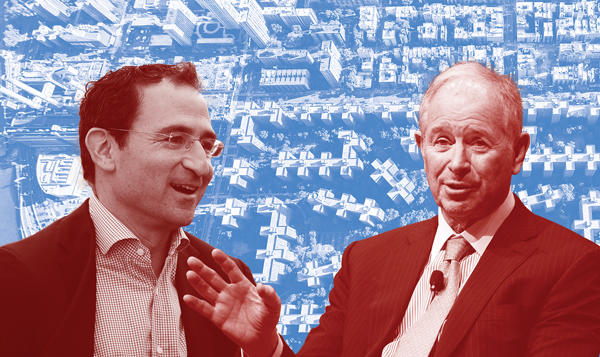

And at the start of this year, Blackstone was fresh off of what seemed like a big win in California, where the firm led by Steve Schwarzman and Jonathan Gray had spent nearly $6 million to fight against a statewide push for rent control (California lawmakers later approved such a law).

So with an army of in-house lobbyists, Blackstone made its case in Albany, and even orchestrated a closed-door meeting with tenant advocacy groups in New York City to try to reach a compromise.

But those efforts fell flat when Gov. Andrew Cuomo signed the Housing Stability and Tenant Protection Act of 2019 into law two months later. The bill cost the real estate industry billions overnight, according to several estimates.

Then in July, Blackstone halted major renovations at Stuy Town, and The Real Deal reported in September that the company would keep up to 50 units vacant — a move it reversed course on soon after. Blackstone initially declined to comment. But a source familiar with the matter said the firm was “evaluating capital investments and operations” and noted that “no final decisions have been made.”

The city quickly fired back three days later with a statement that it was assessing whether the “warehousing” of units and a freeze on most investment at the complex violates the covenants of a relatively small but key financing deal.

More than half of a $220 million loan from the city — on top of a much larger $2.5 billion deal with Wells Fargo — was provided as interest-free debt in exchange for keeping 5,000 units below market rate for 20 years.

“We take this very seriously and are conducting a thorough review in partnership with the state,” Juliet Pierre-Antoine, a spokesperson for the city’s Department of Housing Preservation and Development, told TRD. “The city will do whatever we can to maintain the availability of the housing stock and support hard-working New Yorkers in search of an affordable place to live.”

A good deal?

When Blackstone and Ivanhoé Cambridge teamed up to buy the embattled apartment complex along the East River, it was hailed as a landmark agreement and the capstone of Mayor Bill de Blasio’s affordable housing plan.

Prior to that, Stuy Town had been stuck under the control of special servicer CW Capital. The Fortress Investment Group subsidiary was appointed by a group of lenders after Tishman Speyer, the previous landlord, defaulted on its loans in 2010.

Tishman Speyer bought the complex for $5.4 billion — then the highest price ever paid for a U.S. residential property — two years before the financial crisis and was banking on rapidly deregulating and upgrading apartments to appeal to a ritzier tenant base.

In light of that, Blackstone’s deal with the city to maintain thousands of rent-stabilized apartments was seen a lifeline for tenants and a boon for politicians. The financing was structured so that the investment firm would have a balance of zero on the zero-interest-rate loan after the 20-year term and never pay a penny of the principal.

“We were not in control of the timeline or what CW Capital was necessarily going to do,” said former City Council member and longtime Stuy Town resident Dan Garodnick, who helped negotiate the terms of the city’s loan to Blackstone. “Being able to negotiate a deal that saved 5,000 units of affordable housing, where the alternative might have been zero — we thought it was important.”

But it soon emerged that the agreement wasn’t all it was cracked up to be.

The Independent Budget Office released a scathing report last year, estimating 1,800 of the affordable apartments wouldn’t have been deregulated through 2035 in the first place. The monumental changes to New York’s rent law then made that the case with all 5,000 units.

“No one knew rent regulations would change the way they did,” said Doug Turetsky, the IBO’s chief of staff.

After city and state authorities announced their Stuy Town review last month, Blackstone spokesperson Jennifer Friedman told TRD that the new rent law has caused the landlord to “make some difficult choices and scale back certain investments.” But she said the firm was actively “renovating and leasing all vacant units.”

Like many other New York landlords, Blackstone was no doubt responding to the sweeping changes in how renovation costs can be legally passed on to tenants through rent hikes, said real estate attorney Sherwin Belkin.

Others say the firm’s pause on its Stuy Town investments may have also been an attempt to get the attention of lawmakers and persuade them to intercede.

“It’s the subtext,” said Joshua Stein, another lawyer in the business. “It’s like: I’m going to hold my breath until I turn blue, and someone will come rescue me.”

Change of course

Stuy Town resident and housing activist Pete Harrison said Blackstone’s willingness to shelve apartments is evidence that the global private equity firm with $545 billion in assets under management was doing “just fine.”

“At the very least, they are slow-walking stuff, to give the perception of a capital strike and try to spook people,” Harrison added.

The Democratic Socialists of America member announced last month that he would challenge Rep. Carolyn Maloney with a run for Congress in New York’s 12th District and vowed to “take on the power of the big real estate developers.”

“Blackstone has a strict regulatory agreement that was negotiated in detail,” said Garodnick. “We’re going to hold them to it.”

Blackstone’s Friedman said the firm is in compliance with its agreement to maintain 5,000 affordable units at Stuy Town and continues to lease hundreds of apartments a month. “We are extremely proud of our record at Stuy Town,” she noted.

But the private equity firm has another key investment option at its disposal. While the interest-free loan saved Blackstone a few hundred million dollars, the most lucrative part of its 2015 deal with the city may be Stuy Town’s air rights — which the landlord has the city’s permission to sell.

Even after the sweeping changes to the state’s rent law, that deal is still looking good for Blackstone, according to several sources.

“I’m sure they’re working their associates 60 hours a week to squeeze out every last nickel, before and after the changes to the rent law,” said Brian Strout, a commercial broker at City Center Real Estate who specializes in air rights and land assemblages for development.

Now “there’s probably a little more focus on the air rights,” Strout added. “But I’m sure they weren’t forgetting them … because they’re Blackstone.”