Hindsight is a precious thing, but foresight may be easier on the bottom line.

Hindsight is a precious thing, but foresight may be easier on the bottom line.

In the wake of the 2008 financial crisis, it was easy to spot the red flags that were screaming of an impending market collapse.

But are those warning signs visible before every downturn?

This month, The Real Deal examined key metrics across the New York City real estate industry to ascertain whether the market may be at its peak — or if it’s approaching that point.

What we found were several trends pointing to a leveling off, if not yet an outright peak. Despite rising residential price on the whole, for example, there’s also been stagnant inventory growth, an increase in the rental market’s vacancy rate, a recent drop-off in the overall number of sales and a decline in the average asking price per square foot. Commercial deals, meanwhile, are growing, but not as quickly as they once did.

On the residential side, a drop in sales may actually be healthy, according to Jonathan Miller, president of real estate appraisal firm Miller Samuel.

“[Residential] sales activity from a year ago was bloated, because of the release of pent-up demand,” he said.

He characterized the market as being in a “high plateau” — more subtle than a peak, but still unsustainable given the number of buyers who can afford to purchase in Manhattan.

In fact, sales of properties $10 million and up have been sliding since April, according to market analytics site UrbanDigs. Founder Noah Rosenblatt attributed the drop to fluctuations in the stock markets.

“We’re just not as strong as we were four months ago,” said Rosenblatt, who told TRD he thinks the residential market peaked around May.

He said the metrics his firm tracks, like in-contract sales, indicate that it’s taking longer for properties to sell.

Inventory and days on market can also be extremely telling statistics, according to Teo Nicolais, who teaches a real estate and economics course at Harvard Extension School.

“The seeds of the bust are planted years before we actually see it,” he said. “The problem is, once we know we’re in the bust cycle, it’s like trying to stop an oil tanker.”

He cited research by real estate economist Glenn Mueller that outlines four distinct phases of a real estate cycle: recovery, characterized by declining vacancy and no new construction; expansion, with declining vacancy and new construction; hyper-supply, with increasing vacancy and new construction, and recession, with increasing vacancy and more completions.

“If you see a trend of declining occupancy, that’s when you know we’re headed for trouble,” said Nicolais, citing Mueller’s analysis.

In New York City, current market data points to the hyper-supply phase, given the ongoing construction boom and a citywide residential rental vacancy rate that jumped over the summer.

Gary Malin, president of rental brokerage Citi Habitats, said prices are currently out of sync with what renters can, or will, pay.

“The vacancy rate being higher at the end of the summer than the start tells you pricing is beyond the reach of tenants at this point,” he said. “Pricing everywhere is constrained. There’s only so high you can go.”

Read on for some of the metrics that economists and industry analysts are watching as they try to predict the peak.

Median Manhattan sales price flat

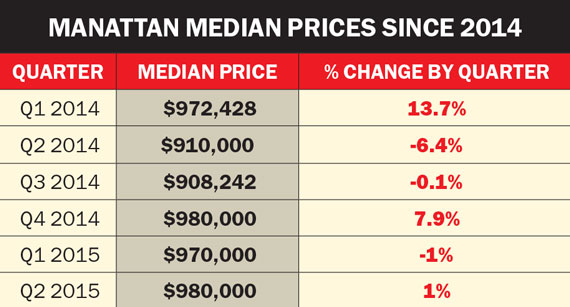

Although Manhattan’s average sales price hit a record $1.8 million during the second quarter, that stat can be skewed by a few outrageously pricey sales — recent ones include a $34 million penthouse at 158 Mercer Street and a $32.7 million penthouse at Macklowe Properties’ 737 Park Avenue. Median prices, though, are a more reliable gauge. And so far, they haven’t seen huge jumps, rising just 1 percent to $980,000 between 2015’s first and second quarters, after dropping 1 percent between the two quarters before that. That suggests that there is a decent amount of stability in the market when it comes to prices, though not much growth.

Inventory is level, but sales down

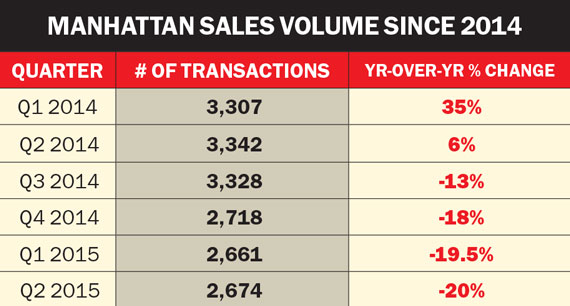

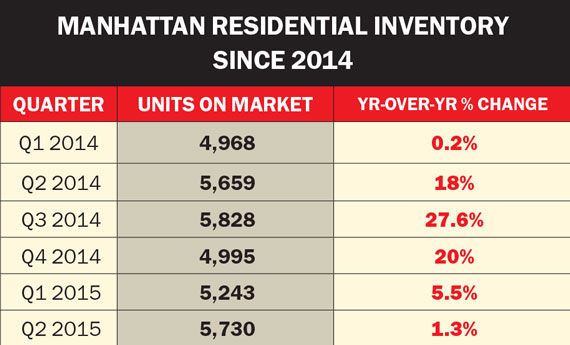

Residential inventory in Manhattan is notoriously tight and has been for a while. This year it’s also been stagnant. But in a concerning sign, overall Manhattan sales activity dropped 20 percent year-over-year during the second quarter to 2,674 transactions. What’s more, that came on the heels of a 19.5 percent year-over-year drop in 2015’s first quarter and an 18 percent year-over-year drop in 2014’s fourth quarter. Those figures are important since a drop in sales volume — which happened before the last crash — can foreshadow the market’s direction. Indeed, volume generally drops before prices do. Citywide, sales volume did a bit better, but still dropped 12 percent during each of this year’s first two quarters, compared with the same periods in 2014. The takeaway? If the numbers keep trending in this direction, the developers, brokers and sellers could face some sleepless nights in the near future.

In-contract sales down 22% in 2015

Since late spring, in-contract residential sales have dropped and properties are staying on the market longer, according to UrbanDigs. There were 2,553 pending deals in Manhattan on Sept. 21, down 22 percent year to date and down 18.6 percent year over year. The average number of days on market was 59, compared with only 43 on May 22. In short, that means buyers aren’t rushing to scoop up apartments with the same gusto as last year — a reality developers are no doubt watching. “The market didn’t crater. It didn’t collapse,” said Rosenblatt. “But demand is slowing. A little more risk entered the well.”

More rentals, but at higher prices

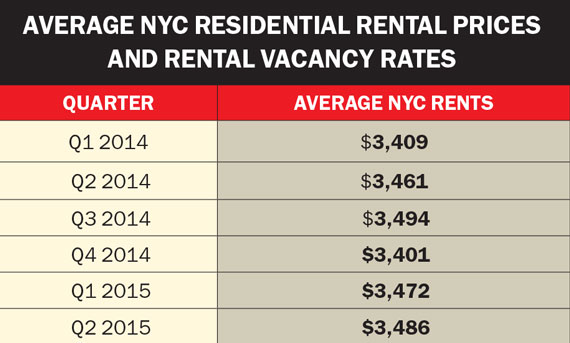

The citywide vacancy rate for residential rentals was 1.4 percent in August, according to Citi Habitats, up from 1.07 percent in May — a sign that tenants are being priced out. And while that vacancy rate may seem low, empty apartments don’t go unnoticed by landlords in a market predominantly comprised of rentals. One reason renters aren’t signing on the dotted line? The average monthly rental price citywide hit a record $3,507 in August, even higher than the $3,486 it achieved for 2015’s second quarter, according to the brokerage. “When you approach a 2 percent vacancy rate for Manhattan, that’s very high,” said Malin. “While landlords are sticking to their guns, tenants are reacting.”

Tourism growth hovers around 3%

Tourists have packed New York City’s streets in record numbers for years now. Indeed, a record 58 million visitors are expected to descend on New York City this year, up 3 percent from last year. But that’s a far cry from the 6.1 percent and 4.3 percent growth of 2010 and 2011, respectively. While Fifth Avenue retailers and hotel operators throughout NYC need not panic yet, they are no doubt watching those headcounts closely.

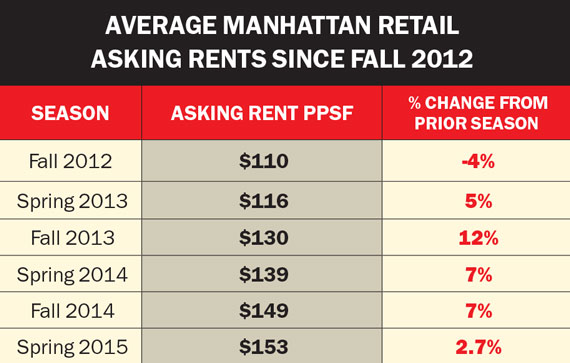

Fifth Avenue rent sees ‘modest’ growth

Average retail rental prices topped $3,683 per square foot on Fifth Avenue between 49th and 59th streets this spring, a “modest” 4 percent increase, according to a recent REBNY report. Overall, Manhattan retail asking prices are rising — but at a slower pace: The average asking price this spring was $153 per square foot, up just 2.7 percent compared with fall’s average asking price of $149 per square foot. The report suggests that slower growth is a good thing, counteracting an overinflated market. “The stable market conditions have led owners and prospective tenants to see the market with more clarity,” the report said.

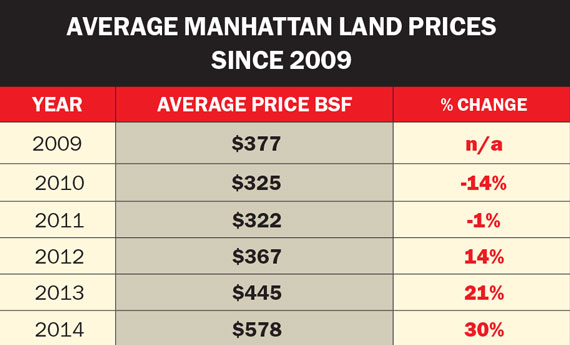

Already high land prices still soaring

After falling to $322 per buildable foot in 2011 in the aftermath of the financial crisis, Manhattan land prices have been on a vertical climb. Last year’s average price per foot of $578 was up 30 percent from the prior year, according to Cushman & Wakefield. And many developers have paid far more than that at prime Manhattan sites. Those stratospheric prices may be the current condo boom’s undoing. Unable to pencil out affordable units, developers are instead building super expensive ones. But that strategy comes with big financial risks, as the air can get pretty thin up there, especially if the buyer pool dries up.

Growth of commercial deals slowing

The number of commercial sales is still rising, but the pace of growth has dropped sharply. Transaction volume jumped a stunning 55 percent to 3,245 deals, between 2012’s third quarter and 2013’s second quarter, according to Cushman & Wakefield figures. But that figured slowed to 17 percent during the next year and to only 4 percent between last year and 2015’s second quarter, the most re- cent available number. Whether that growth continues to drop is the big question.

Wages stay relatively stagnant

You’ve got to have a paycheck to rent or buy real estate, but wage growth in New York City has been flat annually since 2013. The average weekly salary stood at $1,123 in December, roughly $58,396 a year, federal Bureau of Labor Statistics data show.

Hotels are popping up left and right

The number of New York hotel rooms has been growing rapidly, jumping to nearly 113,000 in 2015 from around 93,000 in 2009, according to hotel data tracker STR. Despite concerns about a glut, the city is on its way to having a record number of hotel rooms. There are 73 new hotels expected by 2016, including luxury spots like the forthcoming Four Seasons Hotel at the base of Silverstein Properties’ 30 Park Place condominium tower. If the number of tourists doesn’t keep pace, hotel owners may have empty beds on their hands.

Sales of $10M+ see steady decline

After some ups and downs in 2014, the number of in-con- tract luxury sales has been dropping steadily since June, according to UrbanDigs. There were 55 pending sales (for properties $10 million and up) on Sept. 23, compared with 103 in April. “The higher end of the market had an amazing 2014, and it’s come down to Earth,” Rosenblatt said. “Prices got too ahead of themselves. They were due to deflate a little.” The current level of in-contract sales on the higher-end, he said, is more in line with where it should be.

Price per foot in luxury buildings slides

In luxury buildings, the average price per square foot as of the middle of last month — $2,692 — is 15 percent higher than it was two years ago, according to CityRealty’s index of top buildings, which includes both resales and new devel- opment closings. But that price is down 5.2 percent from a year ago, 15.2 percent from six months ago and 11.2 percent from three months ago.

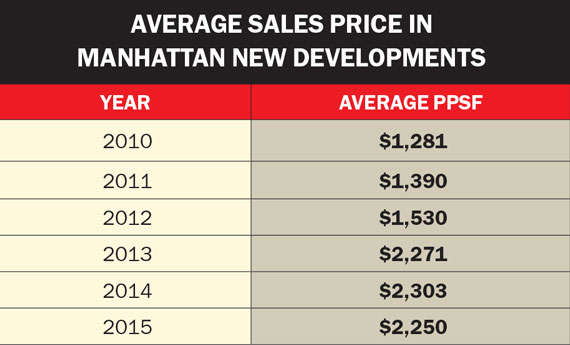

New condos see price-per-foot drop

Nearly 6,200 new condos are set to hit the market in 2016, up from roughly 5,000 in 2015, according to data from the Corcoran Sunshine Marketing Group. But during the first half of this year, the average sales price for in-contract condos dropped to $2,250 per square foot from $2,303 — a notable shift in a market where prices have been rising. So are developers negotiating more? It seems so, but time will tell whether that trend sticks.TRD