The onslaught of retail bankruptcies and store closings in the past year has mall owners in a mad dash to fill hundreds of vacant spaces. The mall owner with the largest holdings nationwide, Simon Property Group (SPG), is no exception. During a 12-month span, dozens of struggling retailers at SPG properties have packed up and moved out, leaving about a million empty square feet in their wake.

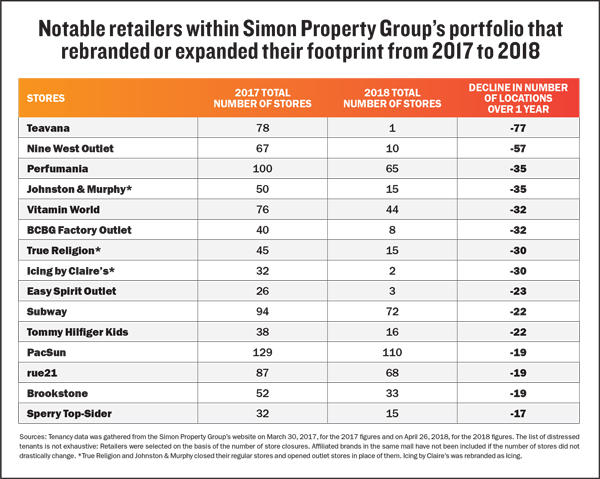

Take, for example, Nine West Outlet, which closed 57 out of 77 stores, and its subsidiary, Easy Spirit Outlet, which went from having 26 stores to just three, according to The Real Deal’s analysis of SPG tenants between March 30, 2017 and April 26, 2018. Fashion brand BCBG Factory Outlet moved out of 32 stores, leaving only eight open a year after the company filed for chapter 11. And Starbucks has shut down 77 out of 78 Teavana stores in SPG locations since the Seattle-based coffee company announced in early 2017 that it was closing all of its tea-selling locations.

As the largest retail owner in the country, the analysis of the change in SPG’s tenants serves as an example of what even the strongest performers are experiencing in the current environment.

A company spokesperson declined to comment on how SPG is reacting to the avalanche of vacancies, but it is clearly not alone in this predicament.

Taubman Centers, GGP, CBL and just about every REIT in the mall and shopping center business have been forced into a frenzied search for new tenants and new strategies to fill storefronts left empty by struggling retailers.

In an April 27 earnings call with Wall Street analysts, CBL’s CEO and president, Stephen Lebovitz, remarked on the rough road traveled thus far in 2018. “While our results for the first quarter were in line with our expectations and [Wall] Street estimates, I can assure you that we are not satisfied and are working diligently to improve our results,” he said. “First quarter was most significantly impacted by bankruptcies and store closures in late 2017 and additional bankruptcies in the first quarter.”

While REITs have devised redevelopment strategies to convert former big-box spaces occupied by Sears and the Bon-Ton department stores, among others, finding new occupants for the smaller shops is a bit trickier, said Matthew Mason, a managing director with Conway MacKenzie who leads the global management and financial consulting firm’s real estate division. “Those fairly small footprints in the 4,000-to 5,000-square-foot range are usually best for a clothing retailer or soft goods,” Mason said. “A lot of those users are struggling. There is still a lot of leasing velocity out there and store openings, but it is below the number of store closings.”

Even retailers that are not facing the threat of bankruptcy are downsizing, compounding the vacancy problem for mall landlords, said Garrick Brown, Cushman & Wakefield’s national retail research director. He noted that Ascena Retail Group — which owns the Ann Taylor, Dress Barn, Loft, Lane Bryant, Justice, Maurices and Catherines brands — is in the process of closing 200 stores and could close another 400 by the end of the year if the company is unable to renegotiate leases. Best Buy Mobile is closing all of its 250 mall locations; Signet Jewelers — parent of Zales, Kay Jewelers, Jared and other jewelry brands — is shutting down 200 stores; and athletic apparel retailer Foot Locker will close 110 stores, to name a few.

“There are some retailers that are in dire straits and on life support, but not every closure is about that,” Brown said. “Ten years ago, if you had a weak spot in your portfolio, there wasn’t as much urgency to get rid of it. You might renew the lease on a store with flat sales. Nowadays, if a store is losing money, you see retailers trying to get out of leases early.”

During the CBL earnings call, Lebovitz acknowledged that bankruptcies by Claire’s and Payless ShoeSource, as well as the closings announced by Ascena, would continue to hurt their performance in the immediate future. “We do still have some Ascena leases and some struggling retailers that we’ll work through,” Lebovitz said. “So we don’t expect to have positive spreads next quarter, but we’re hopeful that as the year progresses, we’ll see those trends improve.”

Kathryn Reinsmidt, CBL’s chief investment officer, told Wall Street analysts that occupancy has also been negatively impacted by the closure of 15 Teavana locations totaling 17,000 square feet and 36 Best Buy Mobile locations, totaling 50,000 square feet, set to close by the end of May.

“Our top priority from an operational point of view is to stabilize our results,” Reinsmidt said.

A sunnier perspective

Top executives for other major mall REITs were not as cautious about the retail outlook as professionals at CBL. In fact, some claim the fire alarms about rising vacancies are overblown.

During an April earnings call, Simon CEO David Simon said the 1 million square feet in vacancies created by retail bankruptcies represented a very small fraction of the 65 million square feet taken up by small shops in the company’s mall portfolio. “It’s not going to be material,” Simon said. “You can make up a number and do it yourself, and you will see that’s not material. Sixty-five million square feet is still 65 million square feet.”

Shoppers stroll through Denver’s Cherry Creek Shopping Center, which is owned by Taubman Centers. The mall will soon open the first Zara location in Colorado.

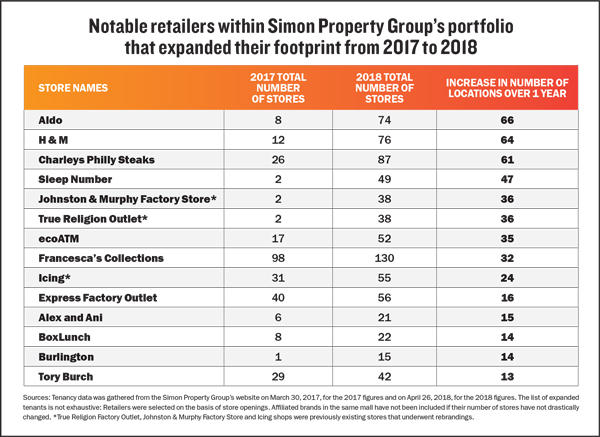

What’s more, Simon boasted a 3.3 percent increase in the average base minimum rent — to $53.54 a square foot — compared to last year, the company’s chief executive said. Among the retailers that have helped fill the gaps are shoe company Aldo, which went from eight stores at Simon malls in March 2017 to 74 stores as of April 26. Mattress retailer Sleep Number now has 49 locations in Simon-owned properties compared to just two last year. And Burlington Coat Factory — rebranded in January 2017 to just “Burlington” — expanded to 15 stores from one.

Simon also said retail sales momentum picked up in Q1 2018. “Reported retailer sales per square foot for our malls and premium outlets was $641 compared to $615 in the prior-year period, an increase of 4.2 percent,” he added.

Taubman Centers, another publicly traded REIT, had a flat occupancy rate remaining at 95 percent compared to the first quarter of 2017, according to its Q1 2018 report. Simon Leopold, Taubman’s chief financial officer, told Wall Street analysts during an April earnings call that 1.1 percent of the company’s tenants filed for bankruptcy in the first quarter of 2018.

Yet he said that doesn’t mean Taubman will be losing 1.1 percent of rent revenues or experiencing an equivalent drop in occupancy. He said that the 1.1 percent represents 18 Claire’s stores, totaling 2,400 square feet, and 14 Walking Store locations, also totaling 2,400 square feet. And while both companies have filed for bankruptcy, none of the stores in Taubman malls have closed yet. “And we don’t know that any of them will,” he added. “In terms of what it actually means for revenue and store closures, we feel a lot better about where we are this year versus last year.”

On the same earnings call, Taubman CEO Robert Taubman said the first quarter showed signs of a retail rebound, which bodes well for many of the traditional retailers occupying space in his company’s malls.

“Apparel, by far our largest category, which has lagged for a number of years, was up over 10 percent,” Taubman said. “Banana Republic, Abercrombie & Fitch, Sun, Uniqlo, the Gap, Eddie Bauer, Ralph Lauren and Aeropostale contributed notable rebound in unisex apparel. All in all, we’re delighted with our results this quarter.”

Trending retailers

Taubman said the REIT is targeting booming retailers like Zara, which is opening its first store in Colorado in a 37,000-square-foot space at Taubman’s Cherry Creek Shopping Center in Denver. Hermès and Warby Parker are also opening stores at Cherry Creek, and Louis Vuitton is doubling its footprint within the center, Taubman said.

“Financially healthy retailers are actively seeking new space,” he said. “These brands are being highly selective about the real estate decision and are only looking at opportunities in the best markets in great assets like ours.”

Cushman’s Brown said some clothing retailers are simply swapping out one brand for another when leases are expiring. “The Gap is finding that their activewear is doing great and their off-price clothing is doing great, so they are ramping up Old Navy,” Brown said. “Meanwhile, they are closing Gap and Banana Republic stores with lackluster sales.”

Mason of Conway MacKenzie concurred. “Old Navy is picking up the slack for The Gap and Banana Republic. Landlords are pursuing more of that value-oriented apparel retailer,” he said.

At least two brands in SPG’s stable of tenants also did swaps to target value-oriented shoppers. True Religion’s stores rebranded as True Religion Outlet, and Johnston & Murphy became the Johnston & Murphy Factory Store.

And there’s still high demand for H&M and Forever 21 stores, as well as discount department stores like Burlington, Marshalls and T.J. Maxx, Mason said. “The thing about discount retailers is that the customer has to go there to see what they have,” he said. “It is an internet-proof business.”

Even as apparel retailers are showing signs of recovery, mall landlords are shoring up their business by branching out with tenants that would typically be located in open-air shopping plazas, from yoga studios to financial-services companies to cosmetology schools, Mason said.

“A lot of malls will start competing with the grocery store power center for these type of tenants,” he said. “We’ve done a couple of deals with swim schools taking space in a mall. From a landlord perspective, it attracts the exact demographic you want: parents with their children. They tend to stay in the mall longer, go to a restaurant and pick up some retail items.”

Brown said he is seeing landlords pursue successful online-only retailers that are expanding into the physical realm, like eyewear maker Warby Parker. “They are adding about 65 stores,” Brown said. “By the end of the year, they will have 100 locations. Warby Parker is in a hot growth mode and is going into Class A malls and Class A retail streets.”

Online retailers are realizing that having a physical location helps drive e-commerce, he said. “The store is like an ambassador for the brand,” Brown said. “In Warby Parker’s case, its e-commerce sales have shot up 30 to 50 percent by having brick-and-mortar stores where new customers are introduced to the brand. Suddenly, they go home and are checking out Warby Parker online.”

Other online retailers implementing brick-and-mortar strategies, Brown said, include Adore Me, an internet-based lingerie company that plans to open between 200 to 300 stores in the next five years; No Boundaries, a men’s fashion line recently acquired by Walmart, which is opening 20 stores; and the formerly web-only activewear maker Fabletics, which has opened 30 stores and plans to add 10 more by the end of the year.

Lebovitz said during CBL’s earnings call that his company is pursuing online retailers, but he did not say which ones have been approached. “We’re seeing retailers, e-tailers, online-only, that are looking at opening up physical locations, and we’re talking to a number of them, and I know our peers are as well,” Lebovitz said.

He added that CBL did roughly 200,000 square feet more in leasing deals in the first quarter this year compared to last year. “We are making headway,” Lebovitz said. “We’ve got a lot of new leasing activity with different kinds of retailers throughout the portfolio. Seventy percent is nonapparel, and we are seeing real traction in our efforts to diversify away from apparel and bring in new uses.”

But landing new tenants has come at a steep price for CBL. On the earnings call, Reinsmidt said, the company signed roughly 707,000 square feet of new and renewal mall shop leases at an average gross rent decline of 13.6 percent. To help struggling retailers and those reorganizing through bankruptcy, CBL is negotiating rent reductions to try to avoid closing stores. “Rents on new leases for stabilized malls were relatively flat, and renewal leases were signed at an average of 15 percent lower than the expiring rent,” Reinsmidt said. “As we stated last quarter, we expect renewal spreads to remain negative for the next several quarters.”

Cushman’s Brown said publicly traded REITs, which usually own the most Class A and Class B malls, can withstand the wave of retail bankruptcies. “Most already had waiting lists of tenants,” he said. “Even when you get to Class B malls, they may have a space empty for a couple of months, but they have a steady stream of tenants looking for space.”

However, Class C malls are on life support, Brown said. “[They] have seen an exodus of a good share of national credit tenants,” he said. “It takes them a bit longer to backfill a vacancy.”

Brown expects vacancies caused by bankruptcies or stores with low sales volume to have a major impact on the ability of mall owners to keep their own doors open. “In the new reality, a metro area like Los Angeles that has 20 malls will likely only need a dozen,” Brown said. “The ones that will go away are the weakest of the weak.”