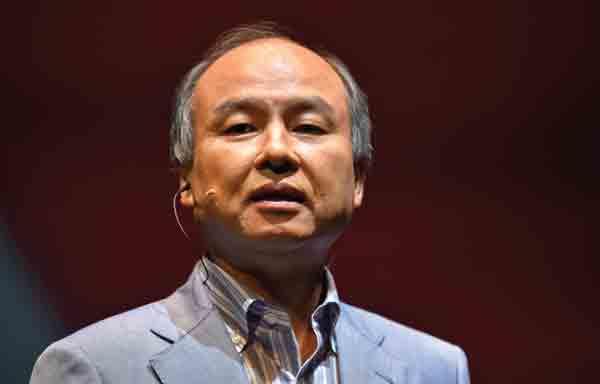

SoftBank, one of the world’s most active investors in real estate startups since Masayoshi Son founded the company nearly 40 years ago, is still plowing ahead full speed.

The telecommunications giant, which launched its $100 billion Vision Fund in late 2016, is looking to take the fund public and launch a second one of at least that size, the Wall Street Journal reported last month.

Son, 61, has been using the fund — backed by Saudi Arabia, Abu Dhabi and Apple, among others — to invest in industries ranging from dog walking to residential brokerages. And the Japanese billionaire’s “300-year vision” is fueling dozens of relatively young companies looking to shake up their respective fields, including WeWork, Compass and Katerra on the real estate side. SoftBank also acquired the old-school asset management firm Fortress Investment Group in December 2017 for $3.3 billion in an all-cash deal.

The Vision Fund’s $450 million investment in Compass the same month and additional $400 million funding with the Qatar Investment Authority last September were huge wins for the company, as it cemented its status as the most valuable residential brokerage in the U.S.

Son’s rise to kingmaker hasn’t been without some major setbacks, though. SoftBank lost nearly all of its value during the dot-com burst, and the company recently faced investor backlash over one of its biggest planned deals. Son had to dramatically scale back his billion-dollar bet on WeWork due to concerns from sovereign wealth backers in Saudi Arabia and Abu Dhabi.

Whether or not that tempers Son’s future investments remains to be seen, but here’s a closer look at some of the numbers behind SoftBank’s ascent.

SoftBank’s Otosan mascot

$63B

The amount Son has invested in companies that have caught his attention in recent years. The Vision Fund made 22 investments worth a combined $21 billion in 2017 and 43 more worth $31 billion in 2018, according to research firm Preqin. So far this year, it has done 27 funding rounds with a combined value of $11 billion.

$47

SoftBank’s stock price as of May 24. Its shares hit a high of $56.08 and a low of $31.08 within the past year. SoftBank had a market cap of about $101 billion as of late last month, and its stock price was roughly in line with that of Nippon Telegraph & Telephone — one of the company’s top competitors.

Adam Neumann

$14B

The difference between the Vision Fund’s potential and actual investments in WeWork. Though Son had planned to invest $16 billion in the co-working giant, it dialed that back to $2 billion in January following concerns from several key backers. The original planned investment would have given SoftBank a majority stake in WeWork.

99%

The amount of value SoftBank lost during the dot-com crash. The company was worth more than both Sony and Toyota, at about $17 billion, by 2000. But it was one of many victims of the bubble burst with its stock price falling from $1,865 in 2000 to just $14.53 in 2002. CNN reported that the slide caused Son to lose $70 billion in a single day.

1981

1981

The year Son founded SoftBank as a computer parts store when he was 24. The company went into the publishing business a year later, launching the monthly magazines Oh! PC and Oh! MZ. Since software in Japan is called “soft,” the literal meaning of the company’s name is “a bank of software.”

$23B

Son’s approximate net worth in late May 2019, per Forbes, which placed him at No. 43 on its latest global billionaires list and No. 2 on its list of the 50 richest people in Japan. He ranked No. 1 in his home country in 2018 but was replaced this year by Fast Retailing founder Tadashi Yanai.

3

The max number of years Son says he wants to spend raising his next fund. SoftBank’s founder, who’s been approaching both existing and new investors, told Bloomberg that he wants to raise a new $100 billion fund every two to three years to create successors to the first one.

800

The number of people SoftBank hopes to employ under its investment arm by 2021. Rajeev Misra, CEO of SoftBank Investment Advisers UK, said at a conference in April that he wants to double the number of employees in his division from 400 over the next 18 to 24 months.