Manhattan’s elite residential brokers aren’t just going after the most expensive listings to stay on top. They’re also recalibrating their business models to include a wider range of clients in a rapidly changing market.

Manhattan’s elite residential brokers aren’t just going after the most expensive listings to stay on top. They’re also recalibrating their business models to include a wider range of clients in a rapidly changing market.

In some cases, agents have also jumped to new firms to stay ahead of the much-discussed softening in the luxury sector.

Overall, The Real Deal’s annual ranking of Manhattan’s residential agents found that the Top 75 brokers held a combined $12.5 billion in listings this year, compared to $12.2 billion last year. But that dollar volume represents a bigger jump than it seems at first blush because this year TRD excluded in-contract properties. Whether the higher dollar volume tally means more deals — or more languishing listings — varies depending on who you talk to.

As in years past, the ranking’s top 10 is full of familiar faces but also includes some brokers who didn’t even make the cut in 2015.

Some skyrocketed on the ranking because of the multi-million-dollar exclusives they hold in glossy new buildings, while others saw a precipitous fall because they moved to new firms and haven’t yet rebuilt their listing portfolios.

Of course, the ranking — which includes active listings compiled on May 24 from the listings portal On-Line Residential — isn’t the final verdict on broker prowess. As TRD annually notes, it does not include closed deals or buy-side clients. But it does provide a telling snapshot of the quantity and quality of listings being marketed by Manhattan’s top brokers.

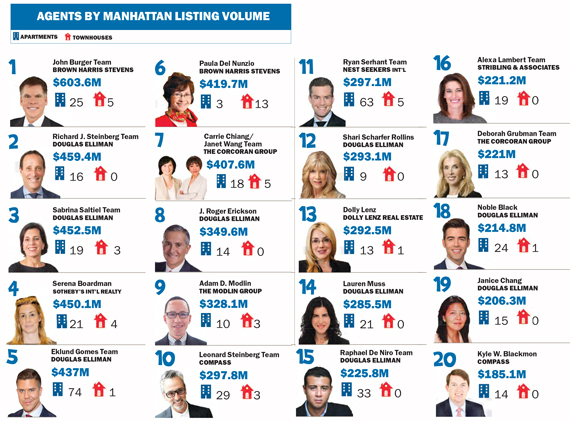

To that end, Brown Harris Stevens’ John Burger took the No. 1 spot with a massive $603.6 million in listings. He was followed by Douglas Elliman’s Richard Steinberg (with $459.4 million), Elliman’s Sabrina Saltiel (with $452.5 million), Sotheby’s International Realty’s Serena Boardman (with $450.1 million) and Elliman’s Fredrik Eklund and John Gomes (with $437 million).

Overall, the most elite agents muscled their way to the top by gaining more market share: As a group, the top 10 agents accounted for $4.2 billion in listings, compared to $3.8 billion last year.

Clocking in at No. 6 was BHS’ Paula Del Nunzio, a perennial top-performer, with $419.7 million in listings. She was followed by the longtime power-team of Corcoran Group’s Carrie Chiang and Janet Wang ($407.6 million). Rounding out the top 10 were Elliman’s J. Roger Erickson ($349.6 million), the Modlin Group’s Adam Modlin ($328.1 million) and Compass President Leonard Steinberg ($297.8 million).

Clocking in at No. 6 was BHS’ Paula Del Nunzio, a perennial top-performer, with $419.7 million in listings. She was followed by the longtime power-team of Corcoran Group’s Carrie Chiang and Janet Wang ($407.6 million). Rounding out the top 10 were Elliman’s J. Roger Erickson ($349.6 million), the Modlin Group’s Adam Modlin ($328.1 million) and Compass President Leonard Steinberg ($297.8 million).

The ordering at the top represents a significant reshuffling from last year, when Eklund and Gomes took the top spot and when other household names — Dolly Lenz (now No. 13) and Raphael De Niro (now No. 15) — were front and center. De Niro told TRD that his team sold off many of its listings earlier in the year. Lenz did not respond to requests for comment but has said in the past that she does not use OLR.

New blood at top

Two fresh faces at the top of the ranking, Richard Steinberg and Saltiel, were carried by their pricey listings at the über-luxury tower 432 Park Avenue.

“Many of the apartments there are very high-priced, so anybody that is working on that building is going to see a huge spike,” said Saltiel, who is also working with Erickson and Shari Scharfer Rollins at the building.

Meanwhile, Burger, who last held the top spot in 2013, has retained his traditional focus on resale properties, as has Boardman. The ever-media-shy Burger, who characteristically declined to comment, hit his sweet spot with 30 active listings ranging in price from $1.2 million to $70 million.

Eklund and Gomes, who are more active in new development, continued their strategy of emphasizing deal volume — a move that could give them an upper hand in today’s uncertain market. Although they slipped on the ranking, it should be noted that they had 43 in-contract listings last year so likely saw their numbers drop more significantly than others because of TRD’s new methodology.

They also said that combined with their “shadow listings” — properties at new condos that haven’t hit the market yet — they likely have more than $1 billion in actual inventory. And the duo accumulated 75 listings, more than any agent or team on TRD’s list.

“We have always wanted to be the guys who do a lot of volume,” Gomes told TRD, noting that some brokers simply land on the ranking because they have one $100-million-plus listing. “People often look to our very high-end listings, and give a lot of attention to the $25, $30, $50 million apartments, but the truth is we have very, very few of those.”

Eklund said that about three years ago, his 10-member team began targeting the below $5 million market, anticipating an oversaturation in pricier listings.

The breakdown of the team’s active listings reflect that strategy: 33 are priced less than $3 million, 15 range between $3 million and $5 million and nine are greater than $10 million.

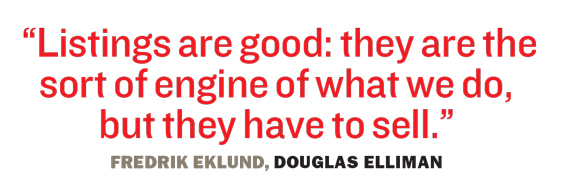

“Our strategy in 2016 is to transact,” said Eklund, who co-stars on Bravo’s “Million Dollar Listing New York.”

“To me, having a huge unsold inventory in the summer of 2016 is not ideal. That doesn’t do much for you,” he added. “Listings are good: They are the sort of engine of what we do, but they have to sell. They have to go into contract, and they have to close.”

The big switcharoo

As in years past, Manhattan’s ultra-competitive residential market has resulted in unabashed broker poaching.

Of this year’s Top 75 agents, 15 switched firms within the past two years, TRD found. But whereas a year or two ago defections by brokers and managers were inciting a spate of lawsuits by firms attempting to enforce non-compete agreements, the legal wrangling now seems to have largely played out.

While the rampant poaching hasn’t stopped, the results are less litigious.

Still, for brokers, deciding when to switch firms often involves cunning strategy based on how many listings they have and what their deal pipeline looks like. When an agent moves, listings typically stay at the old firm unless the seller signs an exclusive with the new brokerage. (Agents who leave listings behind are still paid when the property sells, but at a reduced commission split.)

Many — but not all — of the agents on this year’s rankng who moved saw a spike in business after switching firms.

Richard Steinberg, who did not make TRD’s ranking in 2014 or 2015, is one of them. In March 2015, he left Warburg Realty after 22 years because he wanted to work on new developments and do deals in Aspen and Florida, where he has homes.

“There was never a good time to leave,” said Steinberg, who admitted it took him several months to work up the courage to do it. “I had to factor in the loss of revenue — everyone does — and I wanted to do it before the summer, since the summer is usually slow and it would give me time to acclimate.”

Other agents saw a similar uptick in business after uprooting.

Lauren Muss, who jumped from Corcoran to Elliman in 2014, ranked No. 23 with $163.8 million in listings last year. This year, she shot up to No. 14 with $285.5 million. Muss said while the move made sense in the long run, the “transition was hard.” Her business took a hit during her first year at Elliman as she rebuilt her portfolio, but she’s now working on lucrative new development projects like 160 Leroy Street.

“It really takes a year to get back into the swing of things,” she said.

That wasn’t the case for Brenda Powers, who hopped from Sotheby’s to Compass to Town and back to Sotheby’s this spring. She and partner Elizabeth Sample ranked No. 39 this year with $117.3 million in listings, down from $144.5 million last year. But the slide could have been steeper: While she was bouncing around, Sample was solidly stationed at Sotheby’s.

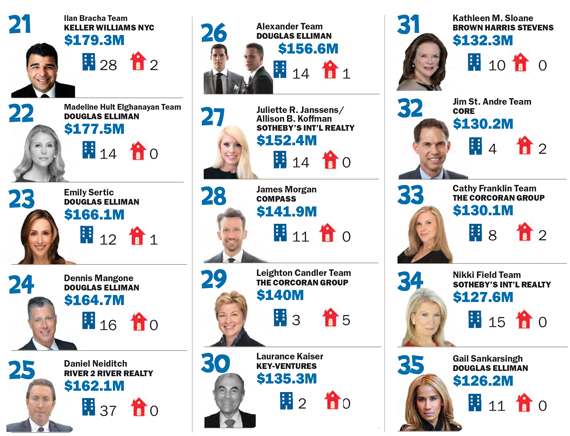

Meanwhile, James Morgan, who left Corcoran last year to join Compass, did not make the cut in 2014 or 2015 but this year snagged the No. 28 spot.

Of course, switching firms isn’t without risk.

Compass’ Kyle Blackmon, No. 24 in 2014, fell off last year’s list after leaving BHS, where he was one of the highest-grossing brokers. This year, Blackmon regained his footing and took the No. 20 spot, partly buoyed by a $29.5 million pad at 15 Central Park West, where he made his name in the late aughts.

And Cathy Taub, who moved to Sotheby’s this year from Stribling & Associates, fell off the list after taking the No. 51 spot last year.

And Cathy Taub, who moved to Sotheby’s this year from Stribling & Associates, fell off the list after taking the No. 51 spot last year.

Taub didn’t respond to requests for comment and Blackmon declined to comment. But others said it makes sense that it would take months to ramp up after switching firms. In fact, some agents intentionally wind down their business before taking the plunge so that they leave as little commission on the table as possible.

Stuart Siegel, president and CEO of Engel & Völkers NYC, said he sometimes compensates agents for a portion of that lost revenue.

That compensation can be in cold hard cash, in extra marketing dollars, in a bonus for reeling in a listing or take other forms.

To some extent, all this broker movement has had an impact on which firms rule the roost on the ranking.

As it did last year, Elliman — which has more brokers than any other firm in Manhattan — swept this year’s ranking with 29 agents who held $5.1 billion in listings. That was up from 26 agents and $4.1 billion last year.

Following Elliman was Corcoran (with 10 agents and $1.5 billion in listings), Sotheby’s (with nine agents and $1.3 billion), BHS (with seven agents and $1.5 billion) and Compass (with five agents and $785.6 million).

Buyers’ bonanza

While buyers’ brokers don’t necessarily get their due on TRD’s list, they may be getting it in the market — especially now that purchasers wield more leverage.

The buyers in the Manhattan residential market are changing, according to Sotheby’s Nikki Field, who for the last several years has focused heavily on international buyers, especially those from China.

Field — whose team dropped to No. 34 this year from No. 14 last year — said local buyers are increasingly finding Manhattan prices more palatable.

“What we’re seeing, clearly, is a leveling off of international interests but a ramp up of local interests. Therein lies our third-quarter market,” she said. “I’m taking my eyes off — well, maybe, one of my eyes off — the international buyer in order to finally deliver to our local buyer. It is their time.” Of course, that could change now with Britain’s vote late last month to part ways with the European Union.

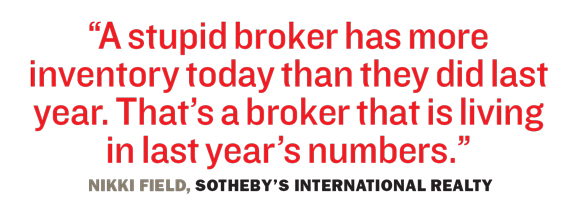

Field said she’d prefer to be lower on the ranking because it means more properties in contract. She said she’s pushing to get her inventory sold before September, when a high volume of new development is expected to hit the market.

“A stupid broker has more inventory today than they did last year,” said Field. “That’s an unsuccessful broker. That’s a broker that is living in last year’s numbers.”

Other brokers say that the appetite for luxury is alive and well.

Del Nunzio said brokers who say the high-end market is soft aren’t the ones doing deals. She said foreign buyers are still interested in New York prices, which are lower than those in London and Hong Kong. “Not to say it’s a bargain, but that helps the blow of having to pay a number that’s high,” she said.

Elliman’s Saltiel agreed. Buyers sign, she said, if they perceive value.

The fact that many units at 432 Park are complete has bolstered confidence among buyers, who aren’t being asked to buy off floor plans. “In an uncertain market —where people who bought a few years ago are selling at a loss — people like to come and see it, feel it,” Saltiel said.

And despite claims that the new development market is overbuilt — particularly on the high end — agents can still benefit from landing those plum assignments.

Coming in at No. 11 with $297.1 million in listings, Nest Seekers International’s Ryan Serhant said that his book of business is bigger thanks to condos he’s worked on for years that are finally hitting the market. He’s also expanded his team to a massive 40 agents, up from 20 last year.

Like his MDLNY co-star Eklund, Serhant is doing brisk business on the lower end of the market. In addition, he said he has more listings in Brooklyn and in previously untapped areas of Manhattan, including around Hudson Yards.

Serhant, who in May landed a solo TV show on Bravo, said there’s been a “changing of the guard a bit” in terms of agents working on new development projects. Even though his TV gig has boosted his name recognition, he said developers are generally looking for fresh blood and approaches.

“There are developers and clients I’m working with now,” Serhant said, “who, three years ago, I wouldn’t have been in the same room with.”

Less slack now

Amid uncertainty in the market — and competition for listings — agents on the Top 75 are doubling down on two key strategies: rejecting overpriced listings and diversifying into lower price points.

BHS’ Kathy Sloane — whose core business has historically centered on tony Upper East Side co-ops — said about 10 months ago, she shifted her focus to the market between $2 million and $5 million.

“If anything well-priced is in that range, it’s simply gone,” said Sloane, who ranked No. 31, with listings ranging from a $2.2 million two-bedroom on the Upper East Side to an $86 million duplex at the Sherry-Netherland. (The price at the Sherry-Netherland was dropped to $78 million after TRD’s data collection.)

Certainly, agents whose bread and butter has been low- to middle-market deals are in a strong position given the market shift.

Compass’s Julia Hoagland, who ranked No. 63, said her team does 60 moderately sized transactions a year, compared to other teams that do fewer (but pricier) deals.

“It happens to be that we’re used to diversifying, so we can pivot really quickly when necessary,” she said.

Compass’s Steinberg, who has a $65 million condo listing in Midtown East, said he’ll take on listings with “crazy prices” only if the property is extremely unique. If a property is “absolutely exquisite,” he said, “sometimes we’ll say, ‘It’s so special that maybe someone will pay that price,’ and we’ll take it on.”

In addition, while brokers have always been cognizant about dumping too many new development units on the market at one time, they are extra wary these days.

Gomes and Eklund said that at many projects — such as the 80-unit 1 Seaport, which is being developed by Fortis Property Group, and the 82-unit Steiner East Village, being developed by Steiner NYC — they purposely release only five or six units at a time.

“Everyone is so sensitive to how many days any given property is on the market,” Gomes said.

The numbers show that it is indeed taking longer to sell high-priced listings.

Properties listed at $4 million or more had an average marketing time of 311 days as of mid-June, according to Olshan Realty. That’s up from 181 in 2014 and 243 in 2015.

No. 38-ranked Jed Garfield, owner of Leslie J. Garfield & Co., acknowledged that his high-end listings are lingering longer than they have in the past.

“The sub-$10 million market — which is your average, wealthy, successful New Yorker — that market is still fine,” he said. “Once you get north of $10 million, it’s really dead.”

Still, Garfield contended that those mega listings are still great to have. “If you sell them, great. But they also become calling cards,” he said.

— Research by Yoryi DeLaRosa and Adam Pincus