While Hudson Yards and Essex Crossing continue to inch forward in Manhattan, it’s the booming outer boroughs that will see many of the most ambitious real estate projects realized in the year ahead.

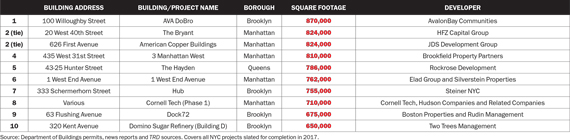

The two tallest residential buildings in all of Brooklyn are among 2017’s upcoming megaproject milestones. Collectively, the 10 largest ground-up real estate construction projects slated for completion in 2017 span more than 7 million square feet, according to an analysis by The Real Deal of Department of Buildings permits, news reports and sources. Of those 10, five are located in either Brooklyn or Queens.

The current market is more favorable to larger projects, helping them to reach the finish line, while many smaller ones — especially luxury residential developments — are facing delays and struggling to obtain construction loans, according to attorney Neil Shapiro, a partner at Herrick Feinstein [TRDataCustom].

“The market is restraining the non-A-plus developers from doing anything stupid because the financing will not be there for them,” he said. Shapiro added that “all large successful projects in the city possess the same three traits”: a top developer, a prime location and long-term patient capital. Therefore, a less experienced developer with a risky project may not get the opportunity to build — and, potentially, fail.

The largest project expected to come to completion this year is AVA DoBro, AvalonBay Communities’ 870,000-square-foot rental tower at 100 Willoughby Street in Downtown Brooklyn. The property is expected to open sometime in the first quarter of the year, according to a spokesperson for the Virginia-based real estate investment trust. The 826-unit building, formerly called Avalon Willoughby West, also holds AvalonBay Willoughby Square, which has its own address of 214 Duffield Street and opened its doors in June 2016. Apartments list for as much as about $11,500 per month.

The 58-story tower has more floors than any other residential or commercial property in Brooklyn. When it comes to height however, AVA DoBro, at 596 feet, ranks second to Douglas Steiner’s 610-foot Hub at 333 Schermerhorn Street, also in Downtown Brooklyn.

Hot outer-borough neighborhoods such as Williamsburg and Long Island City will also have a handful of new projects opening this year, with developers in those areas reaping the rewards of earlier trendsetters. “The initial risk of going into a new community has been taken care of, so what we’re seeing are add-ons,” Shapiro said.

The widespread development in Long Island City is representative of how such projects arise in select pockets throughout the city. Rockrose Development, for example, will put the finishing touches on its latest Long Island City rental tower. The Hayden, a 50-story, 974-unit development at 43-25 Hunter Street, will include a 195-unit affordable component. The affordable housing lottery was held in November 2016.

Real Capital Analytics’ Jim Costello noted that “for decades now, the city has been promoting Long Island City as an alternative to corporate relocations to New Jersey. They did get Citi to build there in the late 1980s, but not much else until the current cycle.”

Still, not everything is going down in the outer boroughs. The second and third largest projects scheduled for completion in 2017 fit the mold of Midtown Manhattan luxury. HFZ Capital Group’s condo-hotel the Bryant recently topped out at 34 stories and will open later this year. The 824,216-square-foot project, located at the southwest corner of the nine-acre Bryant Park, is British architect David Chipperfield’s first residential tower in New York City. Meanwhile, JDS Development Group is wrapping up construction on its two-tower project in Murray Hill. The American Copper Buildings will hold 761 rental apartments, 20 percent of them affordable. The SHoP Architects-designed structures at 626 First Avenue, rising 41 and 48 stories, will be connected by a three-story skybridge.

Manhattan’s Far West Side, bustling with ambitious plans from several top developers, also stands out as a premier development destination. While it is expected to take years for Hudson Yards to reach completion, the area will come more into focus this year thanks to the openings of several towers developed by Brookfield Property Partners, Related Companies, Oxford Properties Group and others.

In 2017, Brookfield will unveil two key components of its four-building Manhattan West complex. The 62-story, 810,000-square-foot rental tower at 3 Manhattan West, also known as 435 West 31st Street, will hold 844 rental apartments. The building topped out in April 2016, and the lottery for the 169 affordable apartments occurred in September. Tenants will officially begin moving in early this year.

There’s also the $200 million renovation of 5 Manhattan West, which is excluded from this list. The 1.7 million-square-foot office building’s repositioning will result in a new glass facade and a flurry of new retail tenants, including Whole Foods.

“For a lot of developers, repositioning an office building is a better move than building one from scratch,” said Meridian Capital Group’s David Schechtman. “They could shift entrances from front to back while a lobby is being worked on. Renovating one section at a time — floor by floor — allows for the money to keep flowing in.”

A number of 2017’s other top projects are also components of larger campuses: Building D in Two Trees’ Domino Sugar redevelopment in Williamsburg; the first phase of Cornell Tech’s new Roosevelt Island campus; Dock72 in the Brooklyn Navy Yard redevelopment; and 1 West End Avenue in the Riverside Center complex.

At the same time, some of the city’s seemingly invincible developers have put the brakes on projects, citing the absence of the 421a tax abatement. Others have had their launch dates delayed by at least a year. The Wolkoff Group’s controversial 1,000-unit residential redevelopment of former graffiti mecca 5 Pointz in Long Island City, for example, was long pegged as a 2017 project. But in December 2016, Jerry Wolkoff told TRD that it’s now poised to open in mid- to late 2018 instead.

There are also many other high-profile developments slated for the year ahead that, while noteworthy, weren’t big enough to make this list. Those projects include Zeckendorf Development’s 51-story condo tower at 520 Park Avenue; Gotham Organization and Brause Realty’s 38-story rental tower at 44-26 Purves Street in Long Island City; and 550 Vanderbilt Avenue, the first condo building at Greenland Forest City Partners’ Pacific Park megadevelopment. The bench for large-scale 2018 projects is vast, not only because of customary delays, but also because of the loss of 421a and other market factors. The New York State Legislature is expected to review a deal to revive 421a in 21017, but the outcome remains uncertain.

“There’s no question the loss of 421a significantly impaired rental development,” said Cushman & Wakefield’s James Nelson.